Bitcoin’s market is facing a test of resilience as profits fall to a two-month low, yet investors continue to buy in large volumes. On-chain data reveals that nearly $1 billion worth of Bitcoin was accumulated in just 24 hours, suggesting strong confidence in the long-term outlook despite ongoing volatility.

Profits Slide to a Two-Month Low

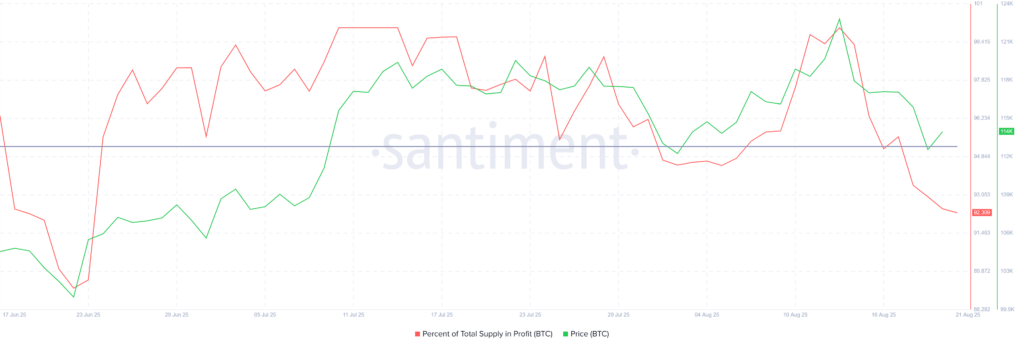

Over the past week, BTC profitability has dropped sharply. The price retreat has pushed many addresses out of profit, cutting down realised gains. Analysts note that when 95% of supply is in profit, markets often reach a top, followed by corrections as investors lock in earnings.

This latest downturn appears to fit that pattern. Profit-taking has weighed on sentiment in the short term, and traders betting on further price surges have been caught off guard. However, this is not the whole story of the current market landscape.

$1 Billion in Bitcoin Withdrawn from Exchanges

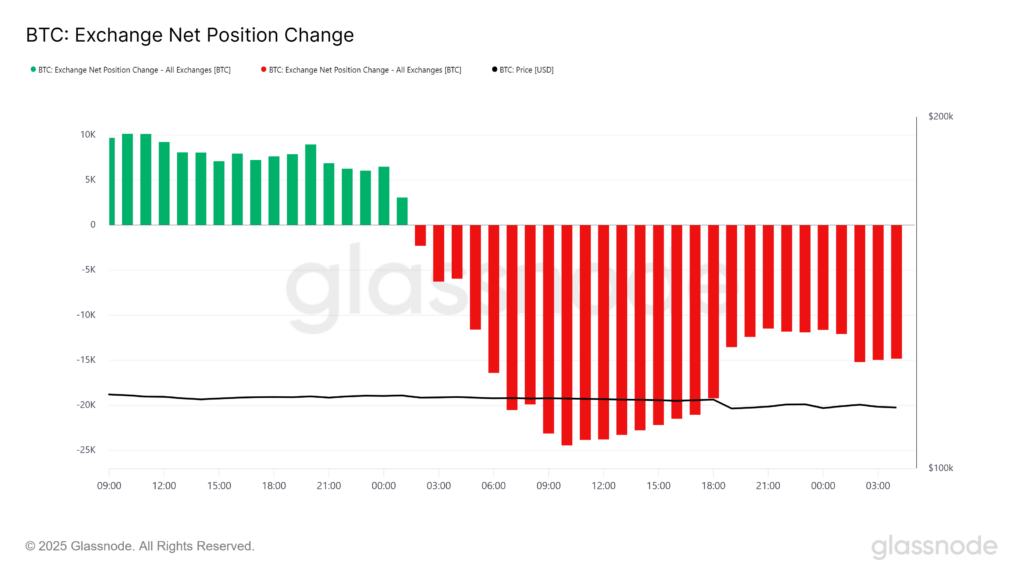

Despite the dip in profitability, investors have shown remarkable resilience. In the last 24 hours alone, over 11,890 BTC were withdrawn from exchanges, equating to nearly $1 billion at current prices.

Large outflows from exchanges typically signal accumulation rather than panic. Investors moving Bitcoin off trading platforms into private wallets generally reflect a long-term holding strategy, suggesting they expect a recovery.

This shift indicates that previously active sellers are now returning as buyers. It also highlights growing conviction that the current weakness may be temporary and that Bitcoin’s long-term value remains intact.

Support Holds at $112,500

At the time of writing, BTC is trading at $112,425, hovering just above the crucial $112,500 support level. This price zone has acted as a strong buffer since early August, preventing deeper losses.

Currently, Bitcoin’s price action shows consolidation rather than a steep breakdown. As long as this support holds, the market may avoid sharper corrections and instead enter a period of sideways trading.

If momentum picks up, BTC could climb towards $115,000, where the next resistance level lies. Breaking above it would mark a return of strength and could attract further buying.

Risks and Outlook Ahead

The coming days will be critical. If accumulation continues at the current pace, Bitcoin may see a relief bounce and regain stability above $115,000. However, if outflows slow and selling pressure resumes, the market could test $110,000, its lowest point in nearly two months.

For now, the data shows investors are willing to absorb volatility and use the weakness as a chance to buy. The clash between falling profits and heavy accumulation underlines the market’s mixed sentiment.

While short-term uncertainty remains, long-term confidence appears to be growing. Bitcoin’s resilience, even in a period of reduced profitability, highlights why it continues to hold investor interest as both a store of value and a speculative asset.

Leave a Reply