A major cryptocurrency investor has shifted billions from Bitcoin into Ethereum, signalling renewed institutional confidence in the world’s second-largest digital asset. The move comes as Ethereum continues to outperform Bitcoin, fuelling speculation of a fresh altcoin season.

Whale Sells Billions in Bitcoin for Ethereum

A Bitcoin whale, estimated to be worth over $11 billion, recently sold 22,769 Bitcoin valued at $2.59 billion. The funds were rotated into 472,920 spot Ether worth $2.2 billion, alongside a $577 million Ether perpetual long position on decentralised exchange Hyperliquid.

According to blockchain intelligence platform Lookonchain, the investor later closed $450 million of that long position at an average Ether price of $4,735, securing $33 million in profit. On Monday, the whale further purchased $108 million worth of spot Ether. Lookonchain noted the investor still holds 40,212 Ether longs valued at $184 million, with an unrealised profit exceeding $11 million.

Ethereum Outperforms as Bitcoin Declines

Ethereum has risen nearly 25% in the past month, while Bitcoin slipped 5.3% during the same period, TradingView data shows. Analysts say this divergence is largely driven by whale activity, with capital moving from Bitcoin into Ethereum.

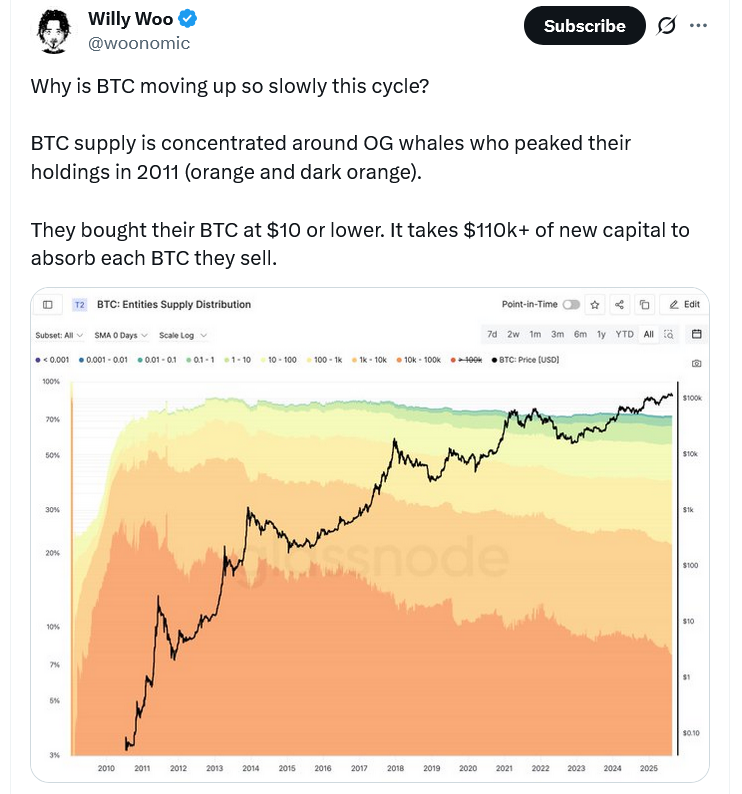

Last week, Bitcoin dropped 2.2% in less than ten minutes, falling from $114,666 to $112,546 before bottoming at $112,174. Market analyst Willy Woo suggested these whale rotations were a primary reason for the sudden decline.

Analysts Predict Ether Could Reach $5,200

Gracy Chen, CEO of cryptocurrency exchange Bitget, believes Ethereum’s strong momentum could push its price towards $5,200 in the coming weeks. She noted that Bitcoin may remain in a consolidation phase between $110,000 and $120,000, while Ethereum shows clearer upward potential.

“Ethereum’s rally past $4,300 reflects robust demand across its ecosystem and signals the possible onset of an altcoin season,” Chen said. “On-chain data shows whales reallocating funds from Bitcoin into Ethereum, accelerating ETH’s momentum.”

Powell’s Comments Boost Market Sentiment

Chen also cited Federal Reserve Chair Jerome Powell’s recent comments at the Jackson Hole symposium as a catalyst for renewed risk appetite in the crypto market. Powell suggested that US interest-rate cuts may resume in September, a dovish signal that has historically benefitted high-risk assets such as cryptocurrencies.

Traders Track Whale Movements for Market Signals

Whale behaviour is closely monitored by traders as it often shapes short-term market direction. The recent shift into Ethereum highlights growing institutional interest, raising expectations of further gains if the current trend continues.

With capital flowing away from Bitcoin’s sideways movement, Ethereum could be on the cusp of a breakout, setting the stage for a potential new all-time high.

Leave a Reply