1inch has unveiled a new system for direct swaps between Solana and Ethereum Virtual Machine (EVM) chains, promising a safer, faster and more reliable alternative to traditional blockchain bridges. The move marks a milestone in decentralised finance (DeFi) by tackling long-standing problems of interoperability, liquidity fragmentation and security risks.

A New Approach to Crosschain Transfers

For years, crosschain movement has been the weak link in DeFi. Bridges and off-chain messaging protocols have repeatedly been exploited, exposing users to hacks and operational failures. Many traders have turned back to centralised exchanges to move assets between networks, undermining the promise of permissionless finance.

With its new feature, 1inch allows users to swap tokens directly between Solana and EVM chains through its DApp, wallet and Fusion+ API, removing bridges from the process. The design ensures that swaps are cryptographically verified, protecting users from both bridge vulnerabilities and maximal extractable value (MEV) attacks that can drain profits from on-chain traders.

Intent-Based Aggregation Model

The upgrade builds on 1inch’s “intent” model, first introduced in 2022. Instead of committing to a rigid swap path, users set the outcome they want: a minimum return, time window and conditions. Professional traders, called resolvers, then compete to execute the swap, using both on-chain and off-chain liquidity sources.

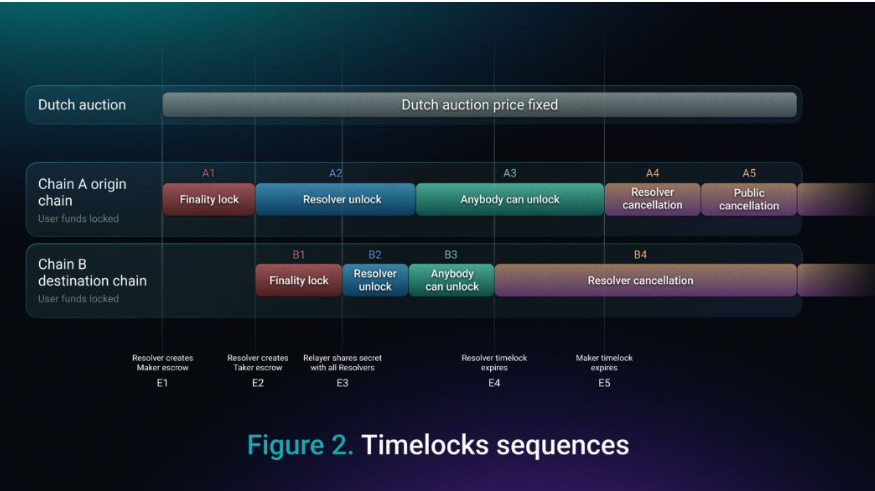

This process uses a Dutch auction mechanism, where acceptable prices decay over time to encourage efficient fills. The system automatically accounts for gas costs and market liquidity, reducing slippage and improving execution quality. Crucially, by removing trades from the public mempool and enforcing predefined rules, the model inherently limits opportunities for front-running or sandwich attacks.

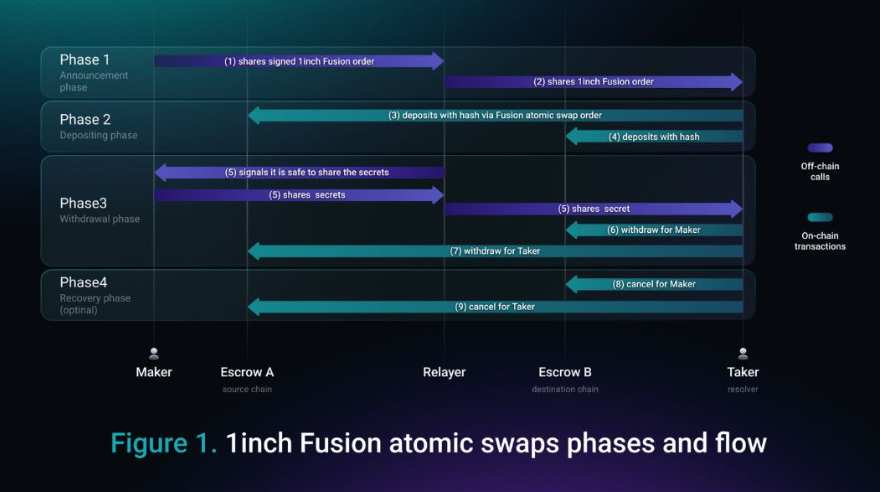

Atomic, Bridge-Free Settlement

With the Fusion+ upgrade introduced in late 2024, this intent system now extends across chains. Crosschain swaps are executed through atomic logic, meaning they either complete in full or fail entirely. If a condition is not met or a time limit expires, both sides of the swap are cancelled and funds return to the original wallets.

This reduces reliance on custodial middlemen and avoids the vulnerabilities common to bridge-based systems. For the user, the process feels similar to a standard swap: selecting a token on Solana and one on an EVM chain, then confirming the trade intent. The requirement is to keep the swap tab open until the transaction is verified across both networks.

Why It Matters for Users and Developers

Crosschain swaps are often when traders feel most exposed, but 1inch’s approach is designed to make chain boundaries nearly invisible. Everyday users benefit from stronger safeguards, while developers can integrate direct Solana–EVM swaps into their products through the Fusion+ API.

This launch strengthens 1inch’s broader offering, which already includes aggregation for best-rate routing, a self-custodial wallet, portfolio tools and even a crypto debit card. By embedding MEV protection and offering bridge-free settlement as a default rather than an add-on, the company argues it is setting a higher standard for interoperability.

Adoption and Roadmap

According to 1inch, its platform has already handled about $700 billion in trading volume across 200 million swaps by nearly 25 million users. This established base could accelerate adoption of its crosschain solution and bring more liquidity into Solana’s ecosystem.

The roadmap includes expanding interoperability with additional networks, increasing resolver participation and refining the user experience, particularly in transaction verification and failure handling. The long-term vision is chain-agnostic finance, where users can trade, invest and build without needing to consider which blockchain underpins their activity.

By uniting Solana liquidity with EVM networks through atomic swaps and MEV-aware execution, 1inch aims to make decentralised finance safer, simpler and more competitive with centralised alternatives.

Leave a Reply