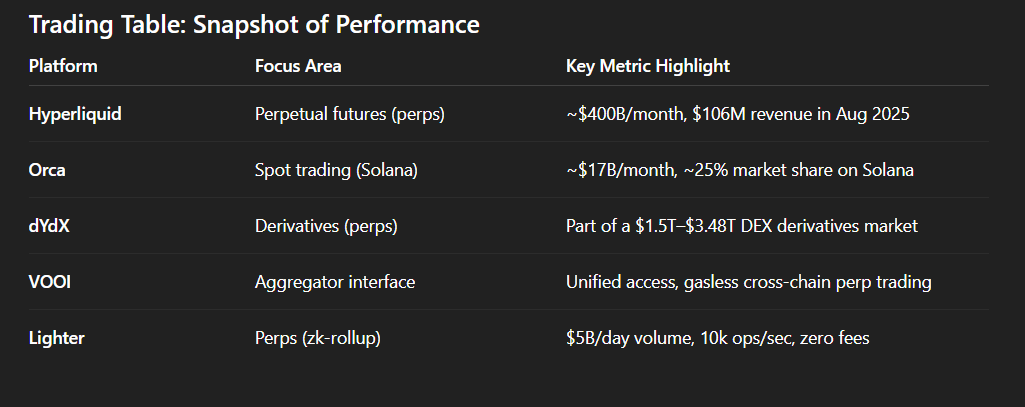

As decentralized finance (DeFi) gains momentum, decentralized exchanges (DEXs) continue to drive innovation in trading. Among the standout platforms this year are Hyperliquid, Orca, dYdX, VOOI, and Lighter—each offering unique advantages in liquidity, speed, user experience, and cross-chain access.

Hyperliquid:

Hyperliquid has emerged as the undisputed leader in decentralized perpetual futures:

- Market share & volume: Controls approximately 75–80% of the perp DEX market. In July 2025 alone, it processed an all-time-high $319 billion in trading volume—up 47% from June—and captured 35% of all blockchain revenue.

- Scale & growth: In Q1 2025, total protocol revenue for Hyperliquid exceeded $65 million over 30 days, dwarfing competing platforms.

- Ecosystem impact: Monthly perp volume reached $487 billion, helping DEX trading volumes hit the $1 trillion milestone for the first time.

- User base & infrastructure: Boasts over 466,000 users, 100,000 orders per second capacity, 0.2-second latency, and 99.99% uptime.

Orca:

A perennial favorite on Solana, Orca excels in spot trading:

- Robust volumes: Averaged daily volume near $560 million in Q2 2025, holding 22.1% of Solana’s spot DEX share.

- Platform growth: Coverage ranges between $715 million to $935 million in 24-hour volume; weekly totals near $6–$7 billion, and monthly aggregate around $17–19 billion.

- Market dynamics: Continues to share Solana’s expanding ecosystem, where weekly DEX volume recently exceeded $22 billion, with Orca playing a key role.

dYdX: Veteran of Derivatives Trading

Renowned for its derivatives focus, dYdX remains a strong contender:

- Perpetual dominance: Although precise volume metrics weren’t in our recent findings, user sentiment data reinforces dYdX’s stature among the top perp DEXs alongside Hyperliquid and Drift.

- Infrastructure shift: Its migration from Ethereum to a Cosmos-based chain has unlocked better scalability, lower costs, and a fully decentralized order book.

VOOI:

VOOI brings innovation in accessibility and aggregation:

- Volume traction: Since launching in May 2024, VOOI has handled $8.4 billion in cumulative perp trading volume.

- V2 Enhancements: Its V2 mainnet (July 2025) eliminated the need for wallets, bridges, and gas fees by utilizing chain abstraction technology from OneBalance.

- Growth metrics: Early data indicates 60,000+ active traders across 200+ markets.

- User adoption & features: V2 drove 30,000+ sign-ups in five days, captured ~1% mindshare, and integrated new markets like perps from KiloEx.

Lighter:

Lighter is rapidly carving out a place in the perp DEX space:

- Volume snapshots: Achieved $5 billion daily trading volume by September 2025, making it the second-largest perp DEX after Hyperliquid.

- Fast-growing metrics: Maintains daily volumes between $1–$2 billion, with a cumulative total of ~$2.4 billion. Reports also cite $2 billion+ daily volume, $184 million TVL, and $184 million open interest.

- Architecture & incentives: Built as a zk-rollup, Lighter combines 10,000 trades/sec matching speed and 5ms finality. Its zero-fee, Robinhood-style model is driving rapid adoption, though it invites scrutiny over wash trading potential due to volume-to-open-interest ratios.

Conclusion

The decentralized exchange landscape in 2025 reflects a clear shift in user priorities — speed, liquidity depth, and accessibility are now as important as decentralization itself. Hyperliquid has set the standard in perpetual futures with unmatched liquidity, while Orca dominates the Solana ecosystem through efficient spot trading. dYdX continues to be the go-to venue for professional derivatives traders, and VOOI is reshaping how users interact with perps through cross-chain aggregation. Meanwhile, Lighter has disrupted the market with its explosive growth and cutting-edge zk-rollup technology.

Together, these five platforms highlight the rapid evolution of DeFi trading: from legacy leaders to innovative newcomers, the competition is pushing the boundaries of what decentralized infrastructure can deliver. For traders, the result is unprecedented choice, better execution, and greater control, signaling that the future of crypto trading is firmly rooted in decentralized platforms.

Leave a Reply