Retail Traders Sell While Whales Wait

Retail Bitcoin investors have sent approximately 6,000 BTC—worth around $625 million—to Binance this month, signalling a wave of profit-taking among smaller holders. However, data from on-chain analytics platform CryptoQuant, published on 31 January, suggests that whale investors remain cautious, holding off on major sales despite Bitcoin’s ongoing bull run.

While retail traders appear to believe the market has peaked for now, whales—who are traditionally considered the “smart money” in crypto markets—are showing minimal signs of selling.

According to CryptoQuant contributor Darkfost, this divergence in behaviour between small-scale holders and whales is a classic market pattern.

“We often hear about a contradiction in the behaviour of investors categorised as whales and retail,” he wrote in a market update. “This is exactly what is happening now when analysing data from Binance in the short term.”

Whale Selling Remains Modest

Despite the increasing flow of retail BTC to Binance, whale inflows remain significantly lower. CryptoQuant’s data shows that whales have only moved around 1,000 BTC ($104 million) to the exchange in January—indicating only minor profit-taking.

“This is a perfect example of the contrasting behaviours between whales and retail traders, and it is often considered a better choice to follow whales rather than retail investors,” Darkfost added.

Market analysts suggest that whales, with their long-term outlook and deeper market insight, are likely positioning themselves for further gains rather than cashing out early.

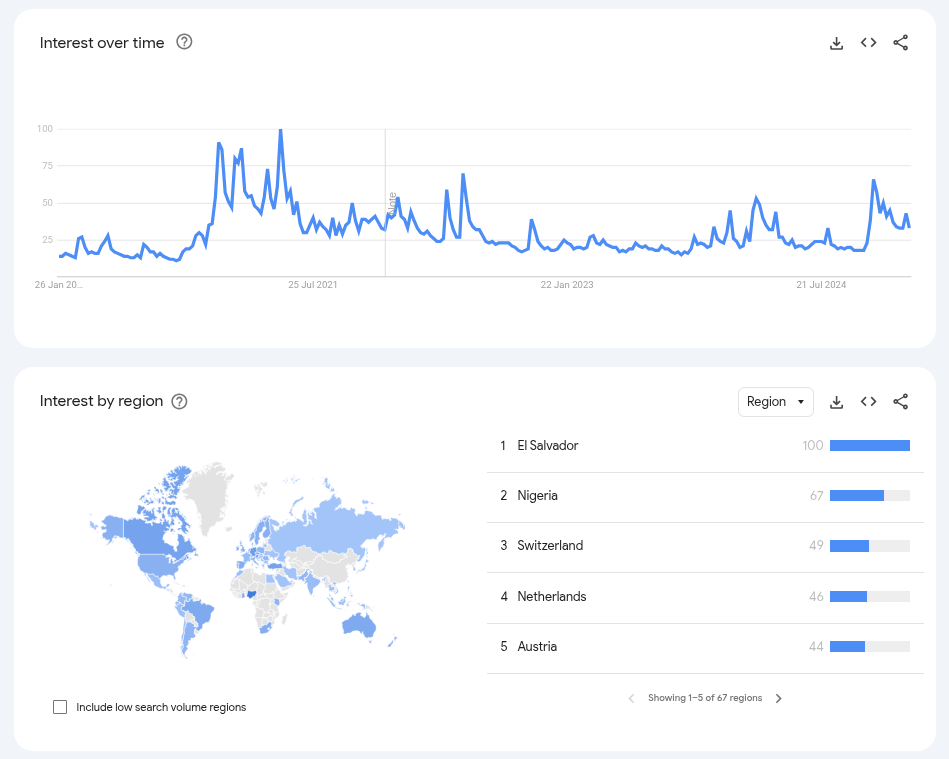

Retail Interest Resets Ahead of Next Rally

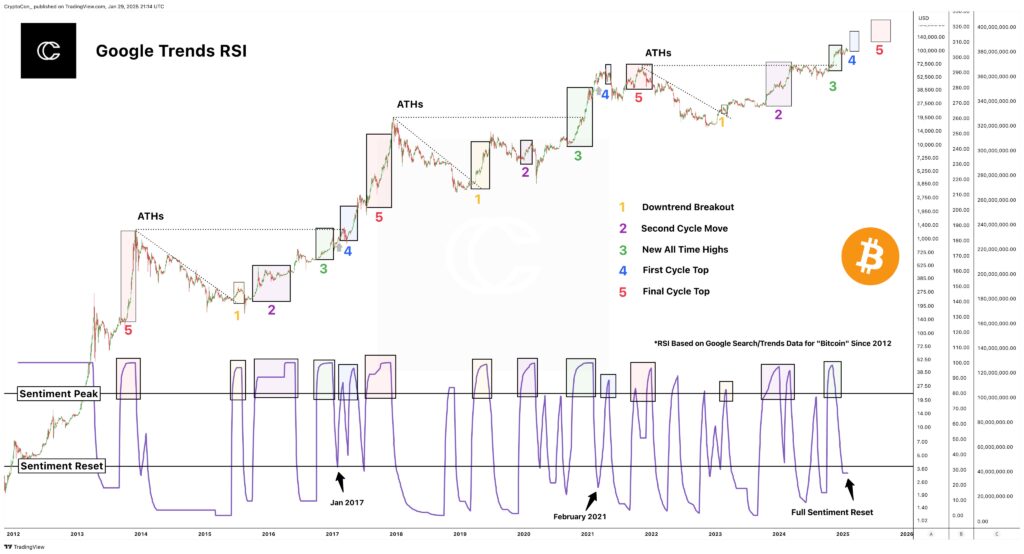

Despite strong BTC price movements, retail enthusiasm appears to have temporarily cooled, according to Google Trends data. CryptoCon, a well-known market analyst, has identified five key phases of Bitcoin’s retail interest cycle, noting that the latest reset suggests the market is now transitioning into its next phase.

“Using the RSI of Google Trends Data for Bitcoin searches, we can see when people start to get interested and use that to determine where we are in the cycle,” CryptoCon explained in a post on X (formerly Twitter) on 30 January.

The data suggests that retail interest rises sharply during price surges, but then fades before Bitcoin reaches major cycle highs. According to CryptoCon, the market has just completed Phase 3—marking an all-time high (ATH) move—and is now preparing for Phase 4, the ‘First Cycle Top’.

How High Could Bitcoin Go?

With analysts expecting more upside before a macro top, speculation on Bitcoin’s peak price for this cycle is heating up. Many forecasts suggest BTC could surpass $150,000 before the current rally ends.

As history has shown, retail investors often sell too early, while whales wait for higher valuations. If the pattern holds, those who remain patient could see further significant gains before the true market top is reached.

Leave a Reply