CryptoQuant CEO Dismisses Bear Market Concerns

Bitcoin’s bull market remains intact even if the cryptocurrency experiences a sharp decline to $77,000 in 2025, according to CryptoQuant CEO Ki Young Ju. In a series of posts on X (formerly Twitter) on 19 February, Ki reassured investors that a 30% drop from Bitcoin’s all-time high (ATH) would not necessarily indicate a bearish reversal but would instead align with historical market patterns.

Bitcoin Remains in a Bull Cycle Despite Price Fluctuations

Over the past month, Bitcoin has struggled to maintain momentum after approaching the $100,000 mark, leading to concerns about a potential market correction. However, Ki maintains that the broader trend remains positive and that investors should not fear a prolonged bear market.

“I don’t think we’ll enter a bear market this year,” he stated, citing key cost bases among various investor groups.

“We’re still in a bull cycle. The price would eventually go up, but the range seems broad. I personally think that the bull cycle could continue even with a -30% dip from ATH (e.g., 110K → 77K), as seen in past cycles.”

A decline to $77,000 would still keep Bitcoin’s value above its previous cycle’s all-time high, providing traders with a strong level of psychological and technical support. Many market participants view this as a crucial indicator that Bitcoin’s long-term bullish trend remains intact.

Key Price Levels for Bitcoin Investors

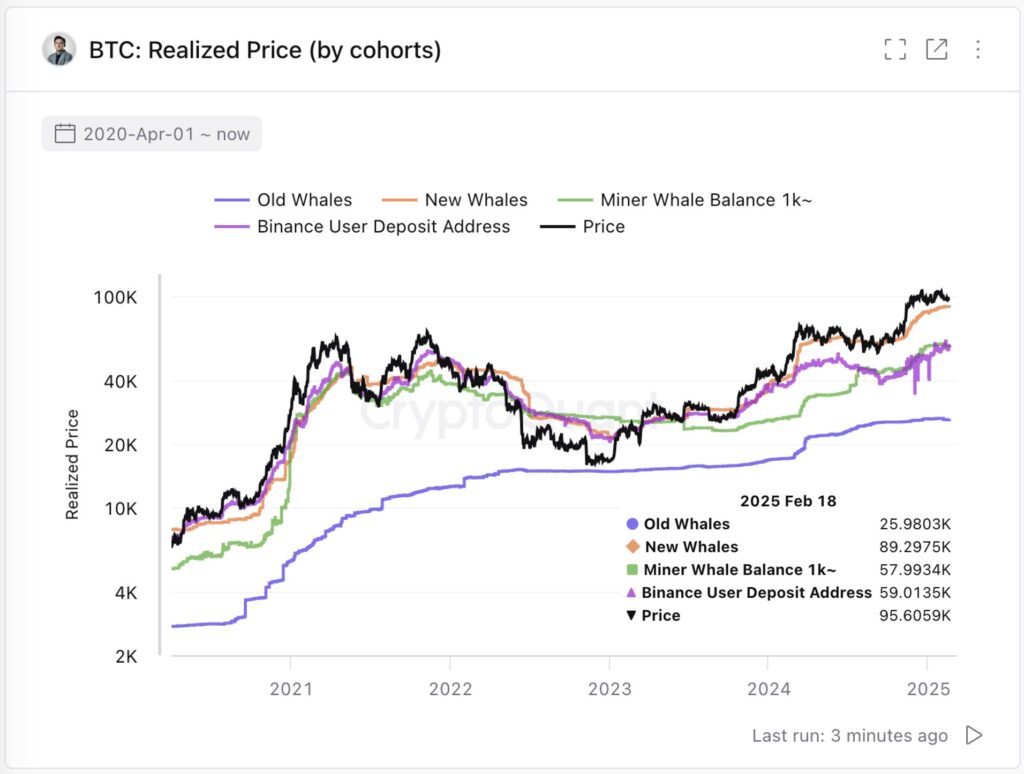

CryptoQuant’s analysis highlights several important cost bases that could play a significant role in Bitcoin’s price movements.

- $89,000 – This is the break-even price for US spot Bitcoin exchange-traded fund (ETF) investors, who have been accumulating Bitcoin since November 2024. This level has acted as support in recent months.

- $59,000 – Binance traders hold an aggregate break-even price around this level, making it a potential zone of increased buying interest in the event of a larger correction.

- $57,000 – Bitcoin mining companies would fall into unprofitability if Bitcoin dropped below this level. Historically, bear markets have been confirmed when Bitcoin has fallen beneath the miner cost basis, as seen in downturns during May 2022, March 2020, and November 2018.

Ki’s insights suggest that as long as Bitcoin remains above these key levels, its long-term bull market is unlikely to be derailed.

Further Price Gains Expected Post-Halving

CryptoQuant’s broader analysis suggests that Bitcoin has yet to reach its full potential in the current market cycle. Analyst Timo Oinonen recently described Bitcoin’s post-halving rally as “unfinished,” pointing out that BTC/USD has only gained about 60% since the April 2024 halving event.

Historically, Bitcoin halvings have triggered extended bull runs, and Oinonen expects this cycle to follow a similar trajectory.

“Despite the continuing halving cycle, I’d expect to see a ‘sell in May’ effect, a sideways summer, and elevated price levels by the last quarter,” he stated.

Oinonen noted that positive fourth-quarter price movements have been a recurring pattern in Bitcoin’s history, with notable uptrends occurring in 2013, 2016, 2017, 2020, 2021, 2023, and 2024.

“While short-term corrections are possible, a deeper and more prolonged market downturn could be multiple months or even a year away,” he concluded, reinforcing optimism for Bitcoin’s continued growth in 2025.

Market Outlook Remains Bullish

Despite concerns about a potential pullback, analysts remain confident that Bitcoin’s long-term trajectory remains upward. As institutional investors continue to enter the market, key support levels such as $77,000 and $89,000 could serve as strong foundations for further price appreciation.

With historical patterns suggesting a strong end to the year, traders and investors may find opportunities to accumulate Bitcoin during periods of temporary weakness, positioning themselves for potential gains in the coming months.

Leave a Reply