BTC Price Drops to $85,000 Before Analysts Predict Rebound to $93,500

Bitcoin (BTC) has reached its lowest level in over three months, falling to $85,341 on February 26 as market pressures and suspected manipulation continue to weigh on its price. However, analysts remain optimistic, forecasting a potential recovery in the coming weeks.

Market Manipulation and Liquidation Fears

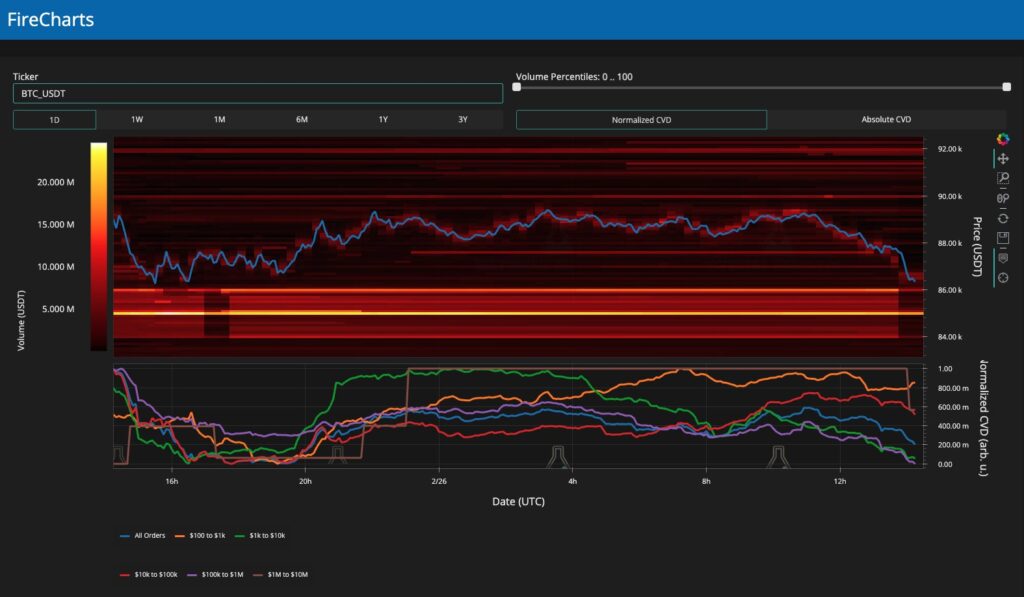

The decline, confirmed by data from TradingView, has raised concerns among traders, with some pointing to manipulation as a key factor behind the dip. Trading resource Material Indicators highlighted unusual order book activity on Binance, where bid liquidity appeared to vanish just before Bitcoin’s latest drop.

“This is about as clear of an illustration of what manipulation looks like you are going to find,” the platform noted in a post on X.

Further adding to the market instability, large amounts of Bitcoin from the Bybit hack continue to circulate, increasing sell-side pressure. This movement, combined with whale activity on exchanges, has contributed to Bitcoin’s struggle to maintain support levels.

Analysts See Signs of Stabilisation

Despite the sharp downturn, some analysts believe the worst may be over. Crypto trader and analyst Michaël van de Poppe suggested that Bitcoin may have already found its bottom, stating that the price needed to reclaim liquidity below $85,000 before stabilising.

“I mentioned before that this is the area for Bitcoin to hold on. Take liquidity beneath $85K, then basically everything is taken,” he wrote on X.

Van de Poppe also pointed to Bitcoin’s relative strength index (RSI), which has hit its lowest level since August 2024. At the time of writing, Bitcoin’s daily RSI stood at 28.6, while its four-hour RSI was even lower at 25.9—both indicating an “oversold” condition, which often precedes a price rebound.

Potential Rebound to $93,500

Meanwhile, popular trader and analyst Rekt Capital has identified $93,500 as the key level Bitcoin needs to reclaim in the short term. He believes this could happen within weeks, or possibly as early as the end of this week.

“If this deviation is to end up as a downside wick, then price could revisit ~$93,500 by the end of the week,” he explained.

Rekt Capital compared the current price movement to patterns seen after Bitcoin’s block subsidy halving in April last year. He suggested that Bitcoin could undergo a post-breakdown relief rally, similar to past cycles.

“Each of these scenarios points to a revisit of $93,500 at some point, with the revisit occurring as early as the end of this week or over the next 2-3 weeks,” he added.

Looking Ahead

While Bitcoin’s recent price drop has alarmed some investors, many analysts remain confident that the decline is temporary. With RSI indicators signalling an oversold market and historical trends suggesting a rebound, the coming weeks could see Bitcoin attempting to reclaim higher levels. However, concerns over market manipulation and liquidity fluctuations may continue to influence short-term volatility.

Leave a Reply