Active Addresses Hit Three-Month High Amid Market Correction

Bitcoin’s on-chain activity is witnessing a significant uptick, suggesting that the cryptocurrency market may be approaching a turning point following its recent correction. The number of active Bitcoin addresses surged to over 912,300 on 28 February, marking the highest level since 16 December 2024, according to data from Glassnode.

During the last occurrence of such heightened activity, Bitcoin was trading around $105,000. This renewed surge in active addresses may indicate a “capitulation moment,” potentially paving the way for a market reversal.

Capitulation and Market Bottom Indicators

According to crypto intelligence firm IntoTheBlock, spikes in on-chain activity have historically coincided with market peaks and bottoms. The firm highlighted in a post on X that these surges are often driven by panic selling from distressed investors and opportunistic buying from traders seeking to capitalise on lower prices.

“While no single metric guarantees a price reversal, this surge suggests the market could be at a crucial turning point,” IntoTheBlock stated.

In financial markets, capitulation refers to a scenario where a significant number of investors exit their positions in panic, leading to sharp price declines. This often precedes the formation of a market bottom before a new uptrend begins.

Key Support Levels and Market Stability

Bitcoin’s ability to hold above the $80,500 level could serve as a crucial stabilising factor for the market, according to Stella Zlatareva, dispatch editor at digital asset investment platform Nexo.

“Options data indicates that BTC’s ability to reclaim $80,500 will be a key factor in near-term momentum. A breakout above this level could pave the way for further upside, while a failure to establish it as support may lead to further testing on the downside,” Zlatareva noted.

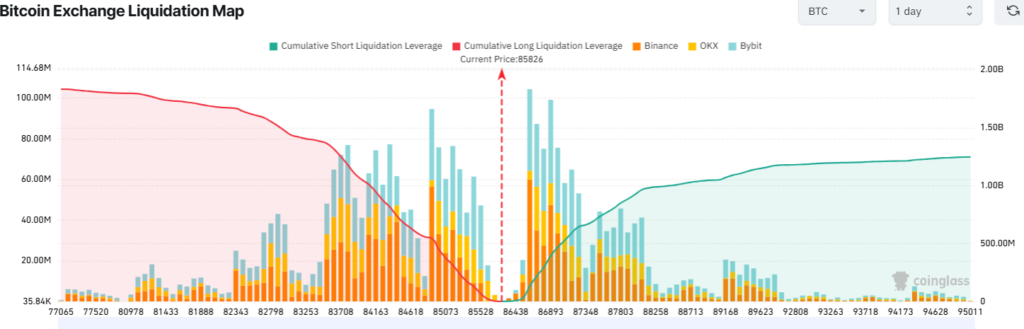

Should Bitcoin’s price drop below $84,000, it could trigger significant liquidations. Data from CoinGlass suggests that a correction under this level would lead to over $1 billion in leveraged long positions being liquidated across all exchanges.

Bitcoin Nearing Oversold Territory

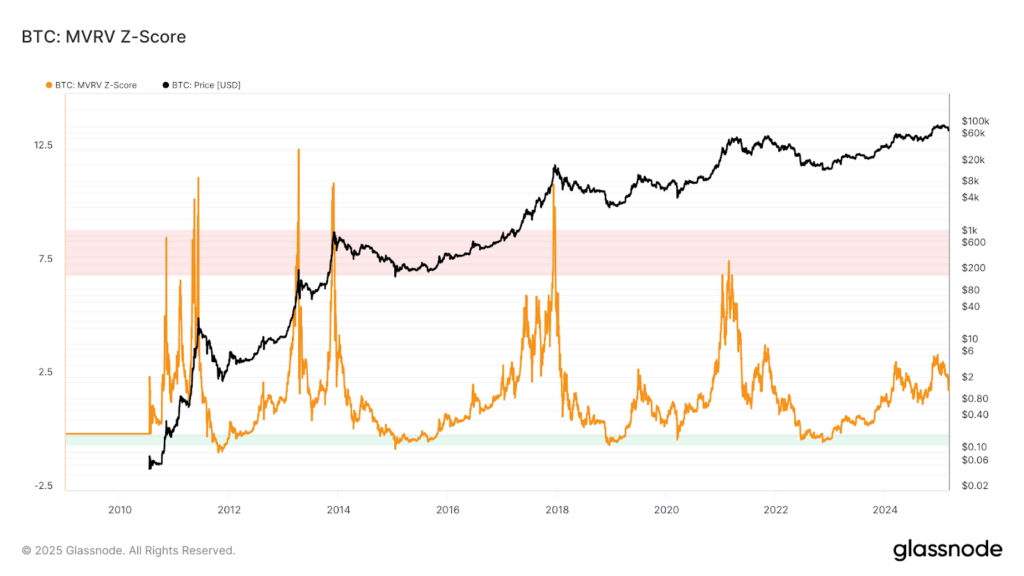

Despite ongoing short-term volatility, technical indicators suggest Bitcoin is closer to forming a market bottom than reaching a local peak. The Market Value to Realised Value (MVRV) Z-score—a key metric used to assess whether an asset is overbought or oversold—stood at 2.01 on 1 March.

A lower Z-score indicates that Bitcoin is approaching oversold conditions, with Glassnode data suggesting it is entering the “green territory” on the chart. Historically, such levels have often preceded a rebound in price.

While market conditions remain uncertain, these indicators point towards a potential stabilisation and recovery for Bitcoin in the near future.

Leave a Reply