Nearly $980 Million Wiped Off the Market in 24 Hours

The cryptocurrency market witnessed a sharp decline on March 4, with nearly $980 million wiped off in just 24 hours. The downturn erased all gains from former US President Donald Trump’s US Crypto Strategic Reserve announcement, leading to a 14.7% plunge in market value. The total market capitalisation now stands at $2.64 trillion, reversing recent bullish momentum.

US Tariffs Spark Global Market Uncertainty

The primary driver behind the sudden market crash is the intensifying tariff war between the United States and key global economies. Washington’s new tariffs on Mexico, China, and Canada came into effect on March 4, prompting retaliatory measures from these nations.

- Beijing imposed tariffs of up to 15% on US exports.

- Ottawa responded with 25% tariffs on $107 billion worth of US goods.

The tit-for-tat measures have fueled economic uncertainty, causing traders to adopt a risk-off stance. The selling behaviour mirrors previous declines following Trump’s tariff threats, such as the market routs on February 3 and February 28.

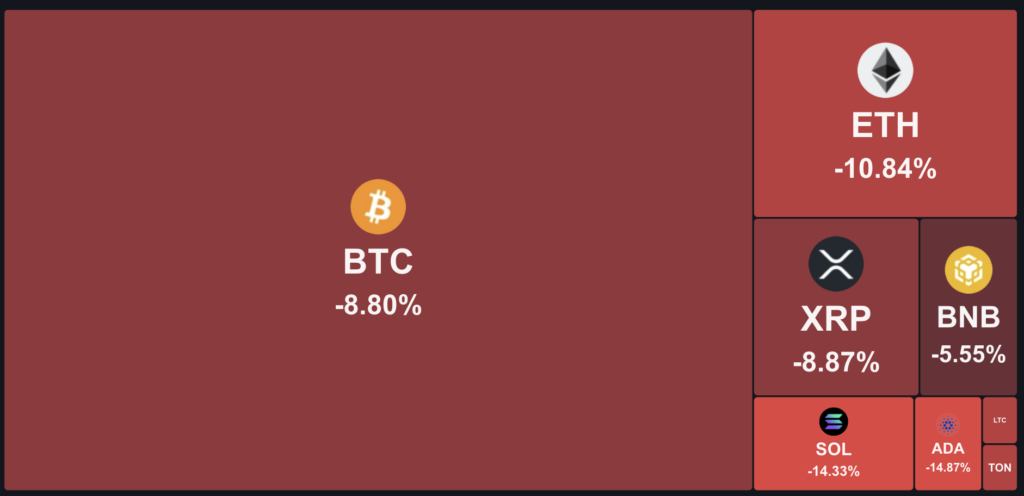

Bitcoin Leads the Decline

Bitcoin (BTC), which dominates approximately 60% of the total crypto market, is at the forefront of the downturn. The leading cryptocurrency plummeted by 8.8% in the past 24 hours, contributing significantly to the broader market’s downward trend.

Analysts highlight Bitcoin’s correlation with US equity markets, which also faced notable losses:

- The S&P 500 fell by 1.76% on March 3.

- The Nasdaq Composite Index declined by 2.64%.

- The Dow Jones Index recorded its second consecutive daily loss, dropping 1.48%.

Crypto market expert Stefan Luebeck noted that Bitcoin’s long-term recovery largely hinges on the Nasdaq 100’s ability to rebound. Furthermore, the recent downturn in Nvidia’s stock price has added further pressure on the digital asset space.

Mass Liquidations Intensify Market Sell-Off

The crypto market downturn has been exacerbated by large-scale liquidations, further driving prices downward. Over the past 24 hours, nearly $980 million in leveraged positions have been liquidated.

- Long positions suffered the most, with $831.96 million liquidated.

- Bitcoin and Ethereum were the hardest hit, with $370.52 million and $193.73 million in liquidations, respectively.

When long positions are liquidated, traders’ holdings are automatically sold, increasing market supply and accelerating price declines. This mass liquidation event has placed further downward pressure on the already struggling market.

Technical Analysis: Market Struggles at Key Resistance Levels

From a technical standpoint, the crypto market’s decline is part of an ongoing correction trend, which began after hitting a crucial distribution area. Analysts point to the failure to decisively break above the 200-4H Exponential Moving Average (EMA) since the February 3 crash.

- The last attempt to reclaim the 200-4H EMA as support on February 21 was unsuccessful, leading to a further 20%+ decline.

- The market’s latest retest of this key level has been met with strong selling pressure, reinforcing bearish control.

On the weekly chart, the ongoing correction appears to follow a descending triangle pattern, a bearish continuation setup. The pattern is characterised by lower highs and a flat support level at the bottom.

- If the breakdown continues, the market could decline toward $2.47 trillion.

- A sustained sell-off could push the total crypto market capitalisation to the 200-week EMA (~$1.76 trillion).

- Holding the 50-week EMA (~$2.63 trillion) as support may enable a potential rebound towards the $3 trillion level.

Outlook: Uncertainty Looms Over Crypto Markets

With global trade tensions escalating and risk-off sentiment prevailing, the crypto market remains under considerable pressure. While some investors may see this as a buying opportunity, sustained recovery will likely depend on broader economic conditions, particularly in the US equities market. Until market sentiment stabilises, crypto traders may continue to brace for further volatility.

Leave a Reply