Cryptocurrency companies poured more than $134 million into the 2024 US elections, sparking concerns over their growing political influence and the potential risks this poses to regulatory stability, according to a report by the Center for Political Accountability (CPA).

Growing Influence of Crypto in Politics

The increasing involvement of crypto firms in US politics has alarmed regulators, investors, and the broader financial system. The CPA’s report, published on 7 March, highlighted the industry’s “unchecked political spending,” warning that such contributions could erode public trust and expose companies to legal, reputational, and business risks.

“While the companies making these contributions may be seeking a favourable regulatory environment, these political donations further erode public trust and expose companies to legal, reputational, and business risks that cannot be ignored,” the report stated.

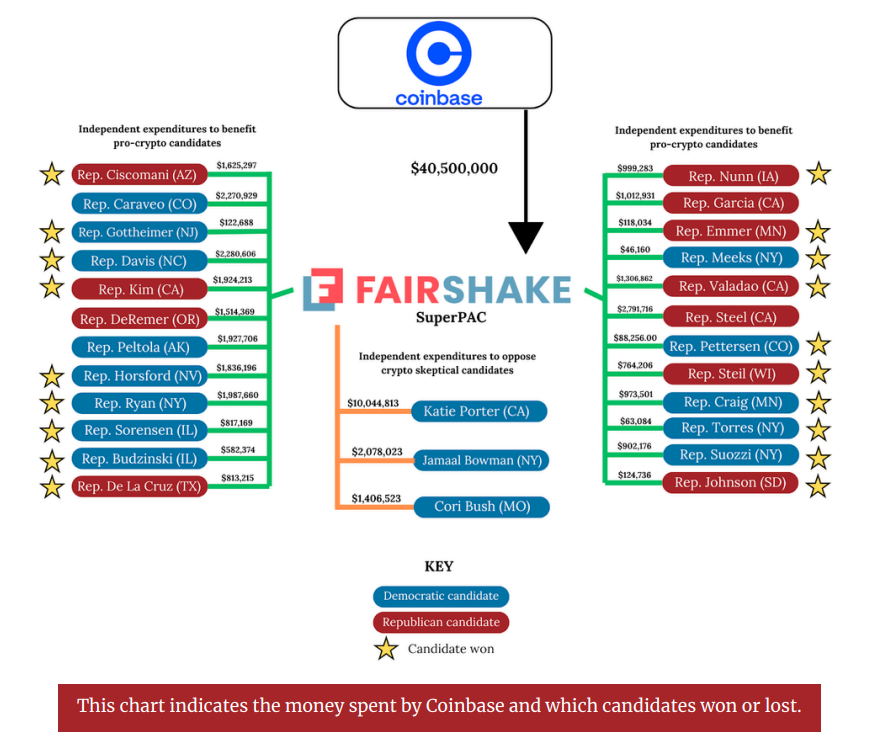

One of the largest contributors was Fairshake, a political action committee (PAC) backed by major crypto firms, including Coinbase, Ripple, and venture capital firm Andreessen Horowitz. Fairshake spent over $40 million to support candidates with pro-crypto policies and played a key role in congressional races aimed at shaping legislation favourable to digital assets.

Regulatory Concerns and Legal Challenges

The influx of crypto money into politics has not gone unnoticed by regulators. In August 2024, consumer advocacy group Public Citizen filed a complaint with the Federal Election Commission (FEC), alleging that Coinbase’s corporate contributions to Fairshake and the Congressional Leadership Fund violated federal election laws due to its status as a federal contractor.

Despite these challenges, Coinbase has committed an additional $25 million to Fairshake for the 2026 midterm elections. “The stakes are too high for us to stand on the sidelines, and that’s why we at Coinbase are proud to help do our part,” the company wrote in an October 2024 blog post.

Push for Regulatory Clarity

While critics warn of regulatory capture, where large firms prioritise their interests over broader industry needs, some experts argue that crypto’s political spending is essential for establishing clearer regulations.

Anndy Lian, an intergovernmental blockchain expert, believes these contributions could ultimately benefit the industry by reducing uncertainty and boosting investor confidence. “It seems likely to boost investor confidence by reducing uncertainty, as seen in pro-crypto candidate wins boosting market sentiment, like Bitcoin’s post-election high,” Lian said.

He acknowledged concerns over regulatory capture but suggested that the transparency and decentralisation of the crypto community might help mitigate these risks. “While controversial, I don’t find it problematic, viewing it as the industry’s maturation, though public backlash could destabilise politics if seen as buying favour,” he added.

Libra Token Collapse Highlights Risks

The debate over crypto’s role in politics comes in the wake of a major scandal involving the Libra (LIBRA) token, a memecoin endorsed by Argentine President Javier Milei. The project collapsed after insiders allegedly siphoned over $107 million in a rug pull, causing a 94% price drop within hours and wiping out $4 billion in value.

More than 100 fraud complaints have been filed in Argentina since the incident, underscoring the dangers of government-backed unregulated assets. The CPA report pointed to this case as an example of the risks involved when political figures promote digital assets without proper oversight.

As the crypto industry’s influence in politics grows, the balance between fostering innovation and ensuring regulatory integrity remains a contentious issue. With further elections and policy debates on the horizon, the extent to which crypto firms will shape the future of financial regulation remains to be seen.

Leave a Reply