MicroStrategy, the largest corporate Bitcoin holder, has increased its convertible senior note offering from $1.75 billion to $2.6 billion. The funds raised are earmarked for acquiring more Bitcoin, the company announced. Founder Michael Saylor highlighted overwhelming investor demand for the 0% convertible bonds, due in 2029.

The offering includes a $400 million greenshoe option, allowing buyers to purchase additional notes within three days of issuance. The bonds can be converted into cash, MicroStrategy’s class A common stock, or a combination of both, at the company’s discretion.

MicroStrategy’s BTC Investment Milestones

Since initiating its Bitcoin buying spree in 2020, MicroStrategy has accumulated 331,200 BTC, spending approximately $16.5 billion at an average cost of $49,874 per Bitcoin. Its latest purchase of 51,780 BTC was made at an average price of $88,627.

Bitcoin’s price has surged since the company adopted its Bitcoin-centric treasury strategy. At the time of writing, BTC traded at $93,915, following a new all-time high of $94,891.

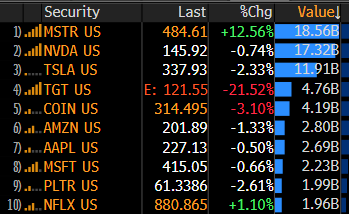

MSTR Stock Outpaces Market Giants

MicroStrategy’s bold strategy has paid off, with its stock price soaring 620% year-to-date and an astonishing 3,159% over the past five years. MSTR has outperformed major stocks like Tesla and Nvidia in trading volume, becoming the most traded stock in America this year, according to Bloomberg analyst Eric Balchunas.

Impact on Institutional Bitcoin Adoption

MicroStrategy’s Bitcoin strategy has inspired other corporations to explore BTC as a treasury reserve asset. As Bitcoin’s price climbs and institutional interest grows, the company’s move underscores the rising importance of digital assets in corporate finance.

With its upsized offering, MicroStrategy solidifies its position as a key player in the Bitcoin ecosystem, pushing the boundaries of corporate crypto adoption.

Leave a Reply