XRP Holds Key Support Amid Market Uncertainty

XRP’s price has shown a 7% recovery in the past 10 days, benefiting from a broader crypto market rebound and the conclusion of Ripple’s legal battle with the US Securities and Exchange Commission (SEC). However, concerns remain over the token’s stability as key support levels face renewed pressure.

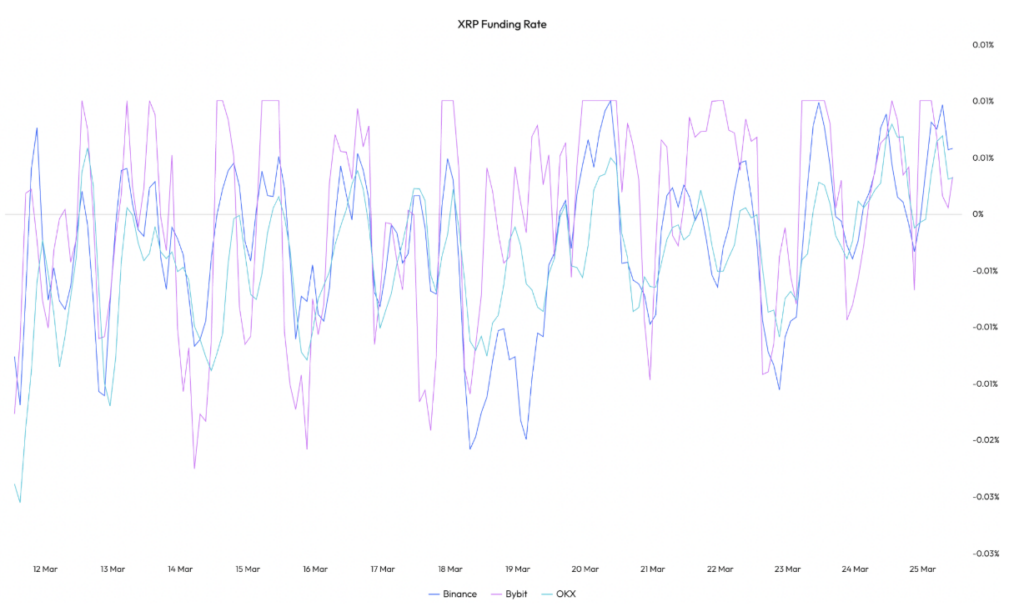

Futures Market Signals Bearish Sentiment

Currently trading at $2.43, XRP remains 30% below its multi-year high of $3.40. Unlike the strong buying momentum seen in late 2024, current market activity appears subdued.

Cumulative open interest (OI) in perpetual futures has remained below $4 billion since March 4, significantly lower than the $7.86 billion recorded on January 18, when XRP hit its seven-year high. Meanwhile, XRP funding rates have oscillated around zero, often turning negative, indicating that short traders are paying to maintain their positions—typically a bearish signal.

Additionally, XRP’s spot cumulative volume delta (CVD), which tracks net capital inflows, has remained negative over the past two weeks. This suggests that selling pressure has outpaced buying interest, raising doubts over the token’s ability to sustain upward momentum.

Whale Activity Remains Muted

Large-scale investors have shown little movement, with wallets holding between 1 million and 10 million XRP maintaining a steady balance of around 5.8 billion tokens since March 15. While this has limited volatility, it also suggests a lack of conviction from major holders, leaving XRP’s price movement driven largely by retail investors.

Some analysts suggest this inactivity reflects a wait-and-see approach, which could keep XRP in a consolidation phase unless an external catalyst shifts market sentiment.

Key Support Levels to Watch

XRP recently reclaimed the $2.40 psychological support level, but traders are monitoring downside risks should this threshold fail. The next key range lies between the March 18 low of $2.22 and the previous support at $1.90 from March 11. A loss of the $2.40 level could see XRP testing this liquidity cluster.

Further declines could bring XRP towards the February 3 low of $1.76, where the 200-day simple moving average (SMA) offers potential support.

Crypto analyst Gemxbt described XRP’s current range as a consolidation phase, with support around $2.35 and resistance at $2.50. “The neutral RSI at 51 and low volume suggest a lack of strong price action. A break of these levels is needed for a clearer direction,” they noted.

With whale activity subdued and futures markets showing bearish tendencies, XRP’s price may remain range-bound unless a strong catalyst emerges to drive momentum.

Leave a Reply