Polymarket, the largest decentralised prediction market, has come under fire following concerns of governance manipulation in a high-stakes political wager.

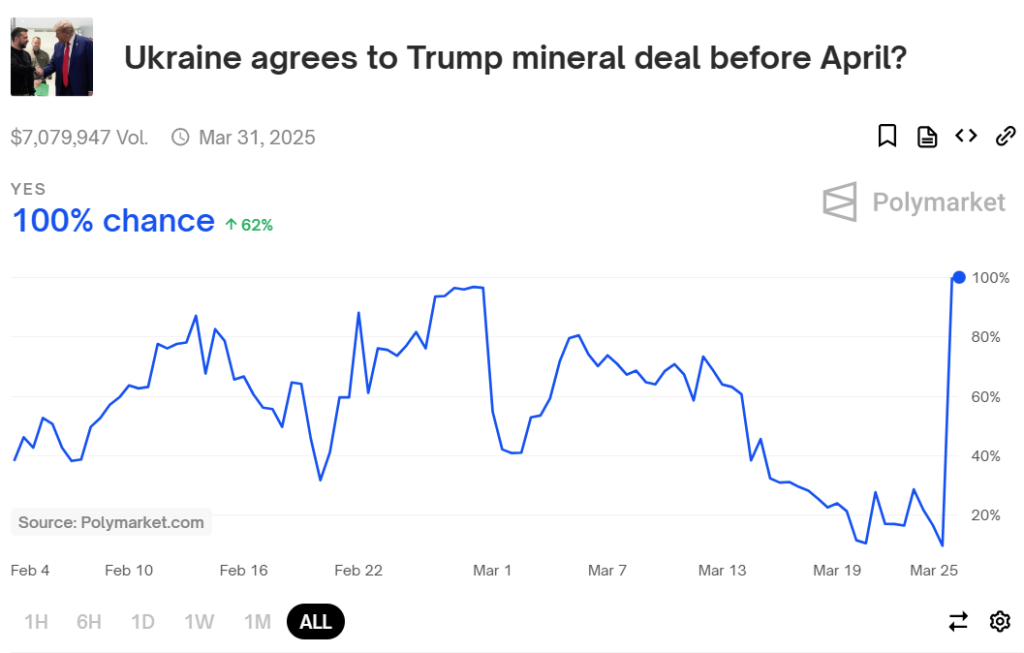

A betting market on the platform asked whether former US President Donald Trump would approve a rare earth mineral deal with Ukraine before April. Despite no such agreement occurring, the market was settled as “Yes,” triggering outrage among users and industry observers.

Crypto threat researcher Vladimir S. suggested that the outcome may have been the result of a “governance attack,” in which a prominent user manipulated the voting process. The alleged orchestrator, a whale from the UMA Protocol, reportedly used 5 million tokens across three accounts, making up 25% of the total votes, to influence the oracle’s decision and secure an unfair profit.

Polymarket, which relies on UMA Protocol’s blockchain oracles to verify real-world events and settle market outcomes, has pledged to prevent such incidents in the future. According to platform data, the market amassed over $7 million in trading volume before being settled on 25 March.

SEC to Host Four More Crypto Roundtables

The US Securities and Exchange Commission (SEC) has announced plans for four additional roundtables focusing on key aspects of cryptocurrency regulation, following its first roundtable on 21 March.

Organised by the SEC’s Crypto Task Force, the discussions will address crypto trading, custody, tokenisation, and decentralised finance (DeFi). The first session, scheduled for 11 April, will focus on adapting regulations for crypto trading, followed by a session on custody on 25 April. Tokenisation and the process of moving assets on-chain will be discussed on 12 May, while the final roundtable on 6 June will centre on DeFi.

SEC Commissioner Hester Peirce, who leads the task force, described the roundtables as an opportunity for experts to engage in discussions on the regulatory challenges within the crypto space. Specific agendas and speakers for each session have yet to be disclosed.

Ripple and SEC Reach Final Agreement After Four-Year Battle

Ripple Labs and the SEC appear to have reached the final stage of their lengthy legal dispute, with a settlement expected to be officially concluded pending court approval.

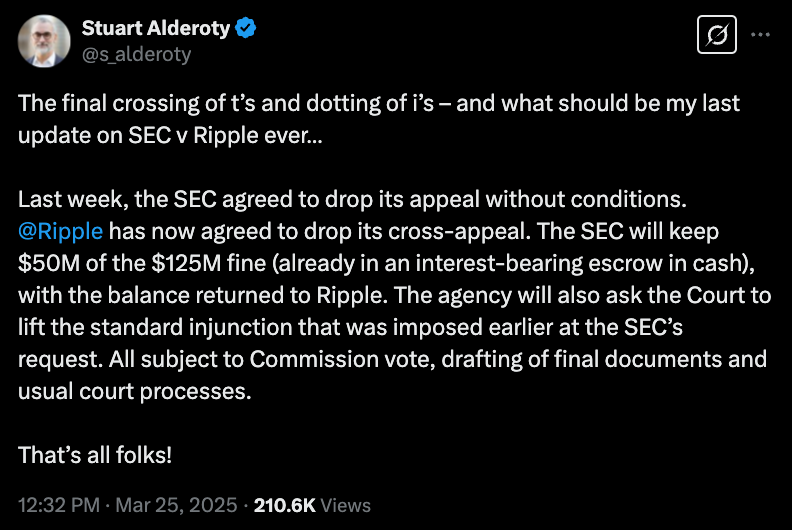

In a statement posted on 25 March, Ripple’s Chief Legal Officer, Stuart Alderoty, announced that the blockchain company would drop its cross-appeal against the SEC in the US Court of Appeals for the Second Circuit. The move follows an August 2024 ruling from the US District Court for the Southern District of New York (SDNY), which found Ripple liable for a $125 million penalty.

However, under the latest agreement, the SEC will retain only $50 million of the amount, with the remaining balance being refunded to Ripple. The regulatory agency has also agreed to request the court to lift an injunction that was previously imposed at its request.

Alderoty’s announcement follows Ripple CEO Brad Garlinghouse’s recent statement that the SEC would withdraw its appeal over the August ruling. At the time of publication, neither the SEC nor Ripple had made any additional court filings since January.

In an earlier statement, Alderoty suggested that both parties dropping their respective appeal and cross-appeal would allow the SDNY court’s original $125-million judgment to remain intact. However, Ripple and the SEC could jointly approach SDNY Judge Analisa Torres to seek modifications to the judgment before finalisation.

Leave a Reply