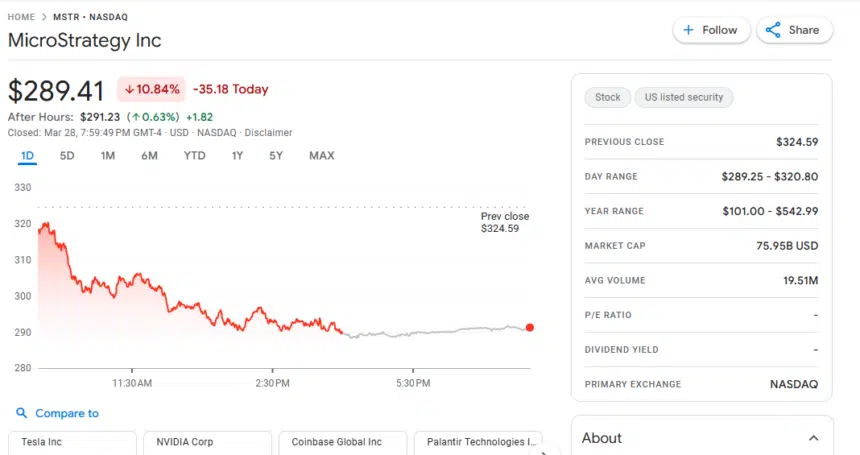

MicroStrategy’s (MSTR) stock took a sharp hit on March 28, plunging 11% to close at $289.41, sparking concerns across the crypto space. Given the company’s massive Bitcoin holdings (over 140,000 BTC), its stock performance often mirrors Bitcoin’s. But this time, the fall in MSTR was far steeper than that of Bitcoin itself — raising red flags among investors.

MSTR Drops, Bitcoin Holds Steady

While MicroStrategy fell by $35 in a single day, Bitcoin’s decline was relatively modest, dipping just 1% to hover around $83,000. This decoupling has sparked debate: is MSTR’s slump a unique event, or an early warning for Bitcoin?

The disparity stems from reports of insider selling at MicroStrategy, shaking investor confidence. Meanwhile, broader concerns around the tech sector and crypto market fatigue have only added fuel to the fire.

Crypto Trading Volume Declines Sharply

One major cause for concern is the 45% drop in trading volume across crypto markets. Lower activity often signals reduced interest or looming volatility, making some traders wary.

MicroStrategy’s close ties to Bitcoin have made it something of a proxy stock for the digital asset. Its poor performance could be hinting at waning sentiment in the crypto market, even if Bitcoin has remained comparatively stable — for now.

Bitcoin Struggles for Momentum

March saw Bitcoin go full circle — starting at $84,000 and ending the month at around $82,981, offering no gains for holders. Price action has been mostly flat, but some analysts point to bearish signals on the chart, with the $80,000 support level now under pressure.

There’s even talk of Bitcoin dropping to $78,000 in April, especially if market conditions remain weak. Still, despite this, sentiment among retail traders remains surprisingly optimistic.

Bullish Sentiment Still Intact — For Now

According to CoinMarketCap, 82% of users remain bullish on Bitcoin, suggesting that confidence in the long-term trend hasn’t faded. Many investors see the current pause as a healthy correction, not the start of a crash.

However, with MicroStrategy acting as a bellwether, its sharp decline may hint at deeper uncertainty. Whether Bitcoin follows suit will depend on market confidence, institutional moves, and how support levels hold up in the coming weeks.

Leave a Reply