Long-Term Bitcoin Holders Refuse to Sell Despite Record Prices

Bitcoin investors who purchased the cryptocurrency between 2020 and 2022 are holding onto their assets despite the price reaching an all-time high of $109,000. According to on-chain analytics firm Glassnode, many mid-term holders, even those with a cost basis as low as $3,600, are unwilling to sell.

Glassnode’s latest findings, shared on social media platform X on April 1, indicate that the majority of Bitcoin buyers from the past five years are still waiting for higher price levels before cashing out.

Bitcoin Investors From 2020 Still Holding Strong

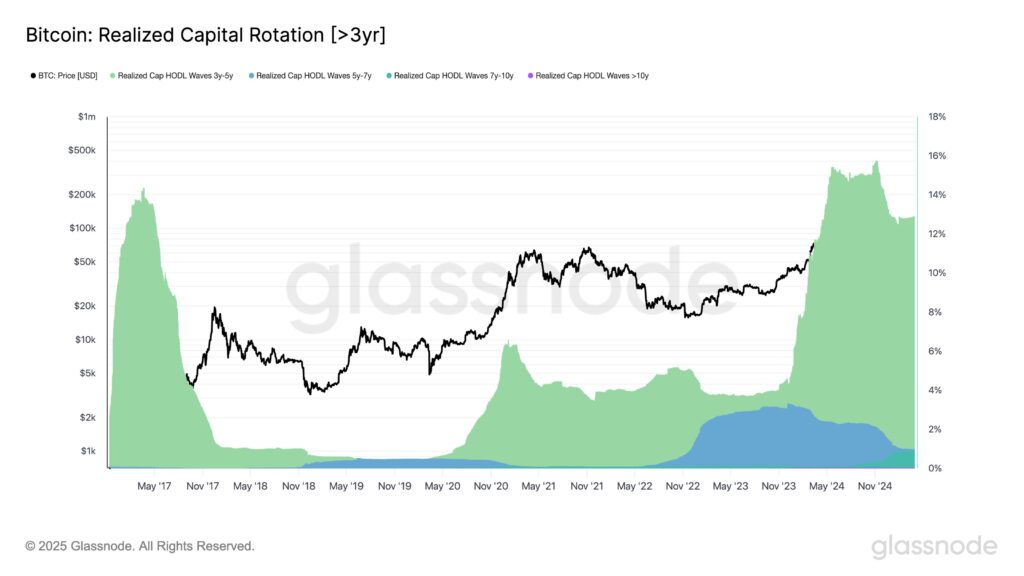

Bitcoin holders who entered the market between three and five years ago have retained their holdings despite significant price surges. Glassnode’s data shows that this cohort, whose cost basis falls between the 2020 market lows of $3,600 and the 2021 peak of $69,000, is yet to offload their assets in large numbers.

“Although the share of wealth held by investors who bought Bitcoin three to five years ago has declined by three percentage points since its November 2024 peak, it remains at historically elevated levels,” Glassnode stated.

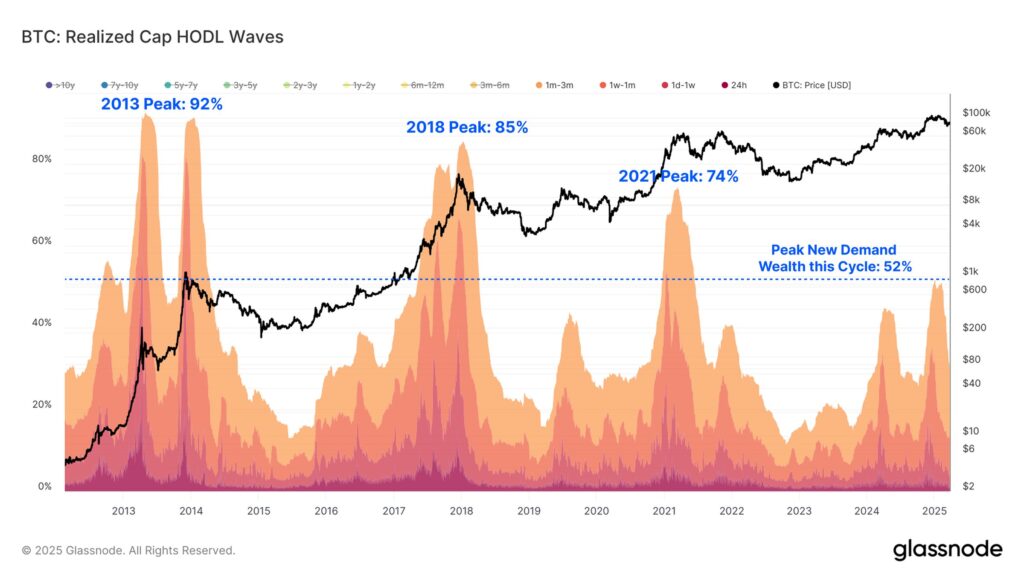

The findings suggest that the majority of investors who entered the market between 2020 and 2022 remain confident in Bitcoin’s future growth potential. An analysis of Realised Cap HODL Waves, which categorises Bitcoin supply based on the last time coins were moved on-chain, highlights this trend.

In contrast, investors who bought Bitcoin five to seven years ago have largely exited their positions. Glassnode’s data reveals that more than two-thirds of this group sold their holdings by December 2024, reflecting their lower cost basis and a different investment approach.

Short-Term Holders Show Caution at Record Highs

Recent Bitcoin buyers, classified as short-term holders (STHs), have shown far greater sensitivity to market volatility. Over the past six months, as Bitcoin hit new record highs before facing corrections of up to 30%, panic selling among STHs has been a recurring pattern.

Despite this, Glassnode’s analysis suggests that the current level of speculative activity is lower than in previous market cycles. “Short-term holders currently hold around 40% of Bitcoin’s network wealth, after peaking near 50% earlier in 2025,” the firm noted.

This figure remains well below previous cycle tops, where new investor wealth reached 70–90%. The data suggests that the ongoing bull market is more measured and widely distributed compared to previous Bitcoin cycles, which were often characterised by frenzied speculative activity.

Market Outlook Remains Optimistic

With Bitcoin’s price continuing to climb, the market remains in a strong position, bolstered by long-term holders who appear confident in further gains. While short-term investors are more reactive to price fluctuations, the overall market structure suggests a more stable and evenly distributed rally compared to previous cycles.

As Bitcoin edges closer to the $110,000 mark, the key question remains: will long-term holders continue to resist the temptation to sell, or will new price milestones eventually encourage profit-taking?

Leave a Reply