Despite a sharp rise in stablecoin supply on the Avalanche (AVAX) network, its native token remains under pressure. AVAX has lost nearly 60% of its value over the past year, highlighting concerns over capital deployment in DeFi and broader market uncertainty.

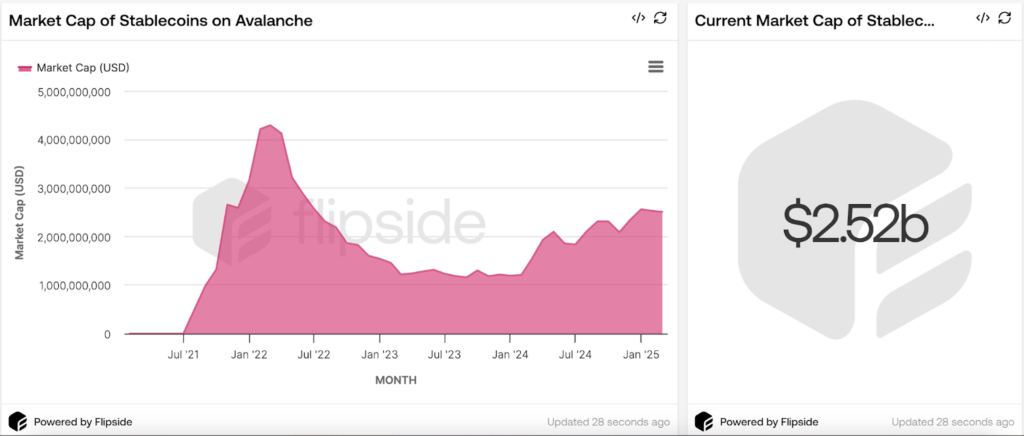

Stablecoin Supply Jumps to $2.5B

The stablecoin supply on Avalanche surged by over 70% in the past year, rising from $1.5 billion in March 2024 to $2.5 billion by March 2025. Stablecoins serve as a key bridge between fiat and crypto, often signalling increased liquidity and potential buying pressure.

However, this influx has not translated into strong demand for AVAX. The token remains in a prolonged downtrend, trading just above $19 despite the additional $1 billion in stablecoin liquidity.

Why AVAX Demand Remains Weak

According to Juan Pellicer, senior research analyst at IntoTheBlock, much of this stablecoin liquidity is sitting idle rather than being actively used within Avalanche’s DeFi ecosystem.

A large share of the inflows consists of bridged Tether (USDT), which appears to be inactive treasury holdings rather than capital deployed in lending, swapping, or other DeFi activities that drive AVAX demand. Without active utilisation, stablecoin growth alone cannot push AVAX prices higher.

Global Uncertainty Weighs on Crypto Markets

AVAX’s struggles also reflect the broader crypto market downturn, influenced by macroeconomic uncertainty. Investors remain cautious ahead of U.S. President Donald Trump’s import tariff announcement on April 2, a move aimed at reducing the country’s $1.2 trillion trade deficit.

Traditional markets are also under pressure, with major U.S. equity indexes and Bitcoin (BTC) struggling below key technical levels like their 200-day moving averages.

Market Bottom Likely by June?

Despite the current weakness, analysts at Nansen predict a 70% chance that the crypto market will bottom by June as trade negotiations progress. Aurelie Barthere, a principal research analyst at Nansen, suggests that once the most challenging aspects of the negotiations are behind, risk assets like crypto could stabilise.

For now, Avalanche’s rising stablecoin supply presents an intriguing contradiction—while liquidity is growing, the lack of DeFi deployment and ongoing market uncertainty continue to limit AVAX’s recovery. Whether this capital will eventually fuel growth remains the key question for investors.

Leave a Reply