The cryptocurrency market continues to face downward pressure, as highlighted in a new report from US-based exchange Coinbase. While the industry is currently weathering a significant contraction, signs point to a potential recovery later in the year. Meanwhile, crypto advocacy efforts and regulatory challenges are also making headlines.

Coinbase Signals Possible ‘Crypto Winter’

Coinbase’s latest monthly report, released on 15 April, paints a bleak picture of the current state of the crypto market. The report notes a 41% decline in the altcoin market capitalisation since December 2024, with figures dropping from $1.6 trillion to $950 billion by mid-April. Data from BTC Tools shows that the market briefly hit a low of $906.9 billion on 9 April before recovering slightly to $976.9 billion at the time of writing.

David Duong, Coinbase’s Global Head of Research, warned of a possible new ‘crypto winter’, citing factors like global trade tensions, declining venture capital investments, and worsening sentiment. According to Duong, indicators such as risk-adjusted returns, the 200-day moving average, and Bitcoin’s Z-score suggest a neutral phase in the market, with the bull run likely having ended in late February 2025.

Strive Urges Intuit to Add Bitcoin to Balance Sheet

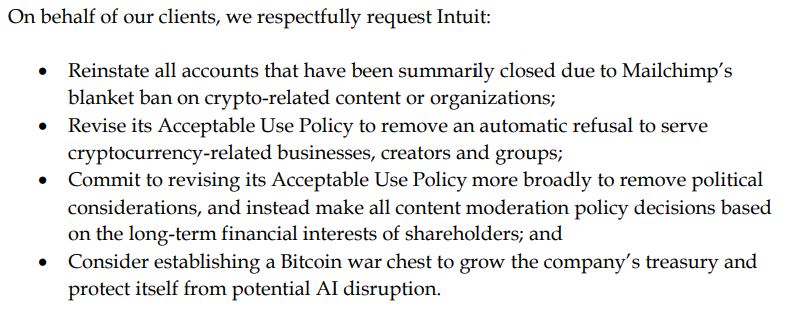

Strive Asset Management is making headlines once again, this time targeting fintech company Intuit with its Bitcoin advocacy. After successfully persuading GameStop to invest in the cryptocurrency, Strive’s CEO Matt Cole has now written an open letter to Intuit CEO Sasan Goodarz, urging the company to consider Bitcoin as a strategic hedge.

Cole emphasised the potential threat posed by artificial intelligence to Intuit’s core business operations, including its popular software products TurboTax and QuickBooks. He suggested that Bitcoin could serve as a “war chest” to safeguard the company against disruption, enabling it to maintain financial resilience amid technological upheaval.

GameStop previously revealed in early April that it had raised $1.5 billion, with part of the capital reportedly allocated to Bitcoin holdings following a similar pitch from Strive.

Ethena Labs Exits Germany After Regulatory Setback

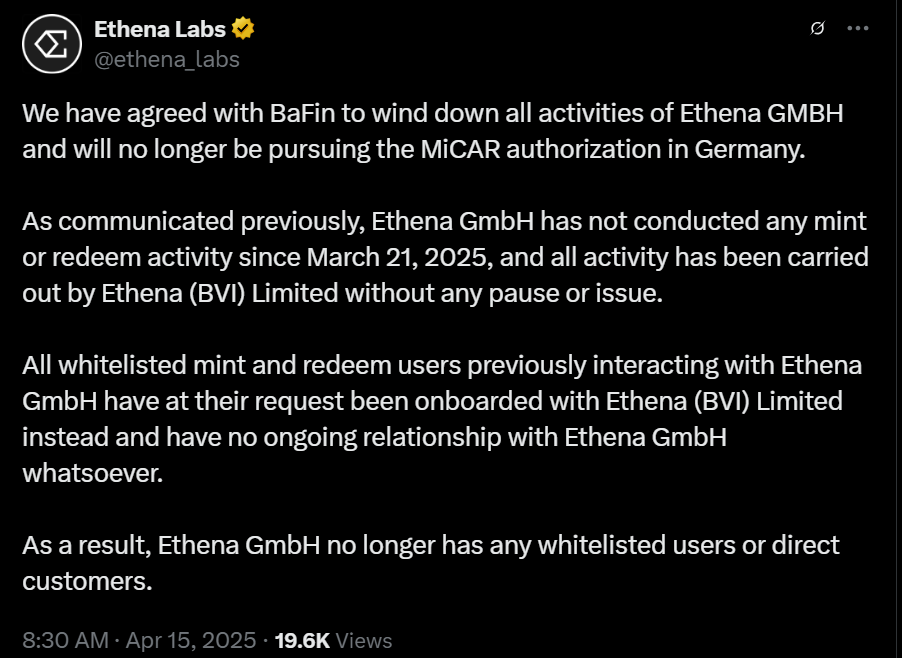

Ethena Labs, the developer of the synthetic dollar-pegged stablecoin USDe, has announced its exit from the German market following regulatory scrutiny. The firm reached an agreement with the Federal Financial Supervisory Authority (BaFin) to cease all activities conducted by its local subsidiary, Ethena GmbH.

The move follows BaFin’s March decision to halt all minting and redemption of USDe within Germany, citing compliance shortcomings and possible violations of securities law. Ethena Labs confirmed that it will no longer pursue Markets in Crypto-Assets Regulation (MiCAR) authorisation in Germany, underscoring increasing regulatory oversight in Europe’s largest economy.

Despite the growing challenges in both regulatory and market environments, many in the industry remain cautiously optimistic that the crypto sector could see signs of revival by the latter part of 2025.

Leave a Reply