Bitcoin is inching closer to the much-anticipated $100,000 mark, with recent data and market analysis signalling the potential start of a powerful bull cycle. Experts suggest that the cryptocurrency’s latest price movement, supported by consistent capital inflows and record-breaking on-chain metrics, could pave the way for a significant price surge.

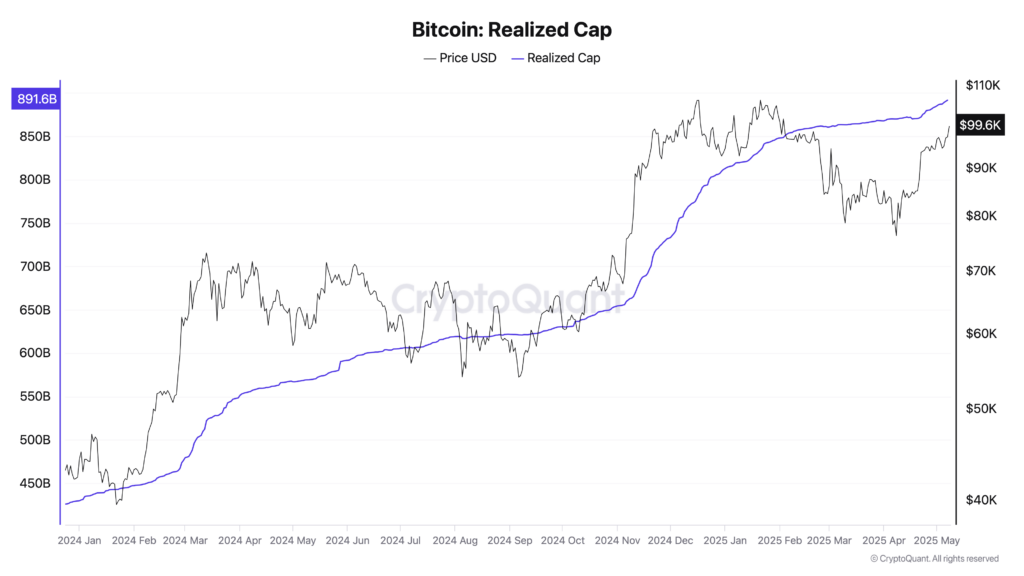

Realised Cap Hits All-Time High

Bitcoin’s realised market capitalisation — a key metric that reflects the value of coins based on their last on-chain movement — has surged to nearly $900 billion, according to analytics firm CryptoQuant. As of 7 May, the realised cap stood at $891 billion, marking new all-time highs since mid-April.

Carmelo Alemán, a contributor at CryptoQuant, highlighted that the uptrend reflects a growing conviction among investors. “This new all-time high in Realised Cap not only reflects a surge in invested capital but also a growing belief in Bitcoin’s long-term value,” Alemán wrote.

He added that steady accumulation from both long-term holders (LTHs) and short-term holders (STHs) suggests the market is laying the groundwork for a major price breakout.

Sustained Capital Inflows Since 2023

Bitcoin’s rally is not new. Since late 2023, the cryptocurrency has seen a steady return of investment interest, with inflows consistently outpacing outflows. Despite occasional volatility and concerns over profit-taking, the market continues to attract fresh capital.

“Bitcoin has experienced a steady flow of capital inflows in recent weeks, reflecting renewed interest from investors,” Alemán noted. This aligns with earlier findings suggesting that the latest rally is backed by real demand rather than speculative spikes.

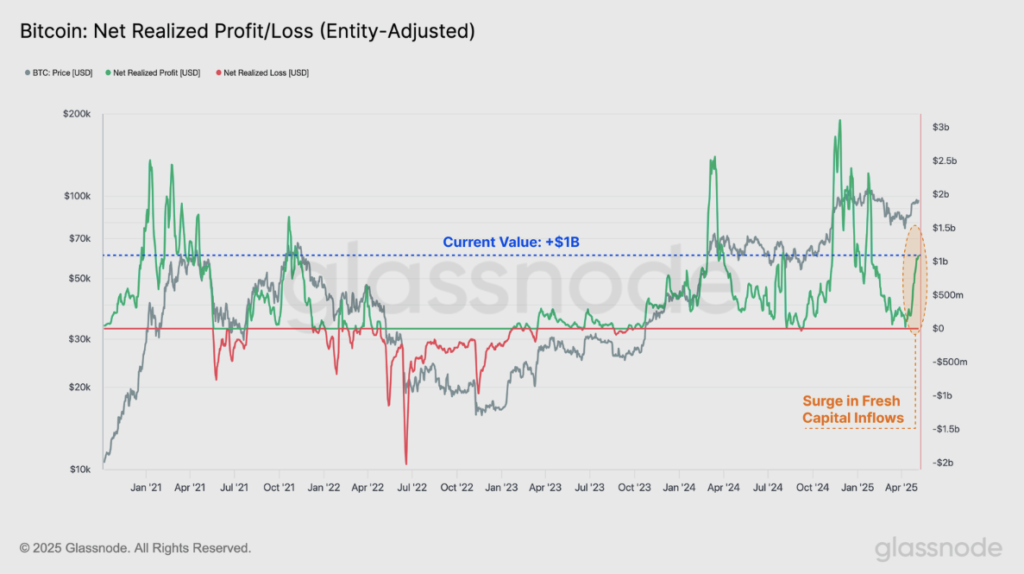

Profit-Taking Doesn’t Dampen Bullish Momentum

Profit-taking, typically a bearish signal, appears not to be hindering Bitcoin’s upward trajectory. According to the latest “Week Onchain” report by Glassnode, both buying and selling pressures are now balanced, even with daily profit-taking averaging over $1 billion.

“A surge in profit-taking can be observed in recent weeks… This points to a wave of demand which is absorbing the incoming supply,” the report said. This indicates that buyers are still entering the market in large numbers, keeping the momentum strong.

Early Signs of a Bull Market

With Bitcoin trading near $100,000 and its realised cap at historic highs, many analysts believe that a new bull market is in its early stages.

Glassnode emphasised that since October 2023, the market has operated in a “profit-driven regime”, with consistent net capital inflows. This steady accumulation is viewed as a constructive sign for future price movement.

If the current trend continues, Bitcoin could soon not only break through six-figure territory but also mark the start of one of its most significant bull runs to date.

Leave a Reply