As anticipation of a major crypto bull run gains momentum, investors are eyeing high-potential digital assets that could outperform the market. With Bitcoin forecasted to reach anywhere between $200,000 and $2.4 million in the coming years by major institutions like BlackRock, Ark Invest, and Standard Chartered, the ripple effect on altcoins could be substantial.

Recent developments, including increasing ETF inflows, bullish chart patterns, and dwindling exchange-held balances, are fueling optimism. While Bitcoin remains the anchor, altcoins with strong fundamentals and strategic positioning are set to benefit significantly. Here’s a look at four standout cryptocurrencies that are positioned to surge in the next phase of the market cycle.

Solana: High Throughput, Rapid Growth, ETF Momentum

Solana (SOL) has emerged as one of the most active and scalable blockchains in the ecosystem. Known for its blazing-fast transaction speeds and low fees, Solana continues to attract developers, users, and capital at an impressive rate.

Over the past 30 days, Solana has processed more than 1.75 billion transactions, with over 101 million active addresses, surpassing other leading blockchains combined. This explosive growth has led to a vibrant ecosystem that now supports meme coins worth over $15 billion, and decentralised exchanges (DEXs) like Meteora, Orca, and Raydium are seeing increasing user adoption.

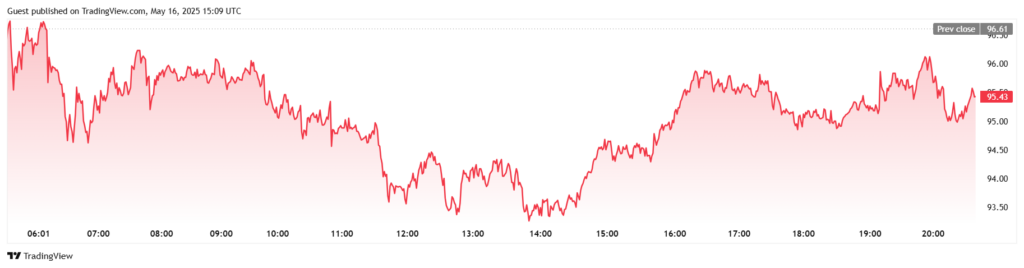

Adding to the bullish outlook is the rising likelihood of a spot SOL ETF approval, which is currently priced at over 80% odds on Polymarket. A technical cup and handle formation on Solana’s price chart also suggests a breakout toward $500, further reinforcing the case for accumulation.

Quant: Driving Interoperability and Asset Tokenisation

Quant (QNT) remains an underrated gem in the crypto space, largely due to its enterprise focus and interoperability-first approach. Its flagship product, Overledger, acts as an operating system that facilitates seamless communication between different blockchain networks. This functionality makes Quant a central figure in the fast-growing world of real-world asset tokenisation.

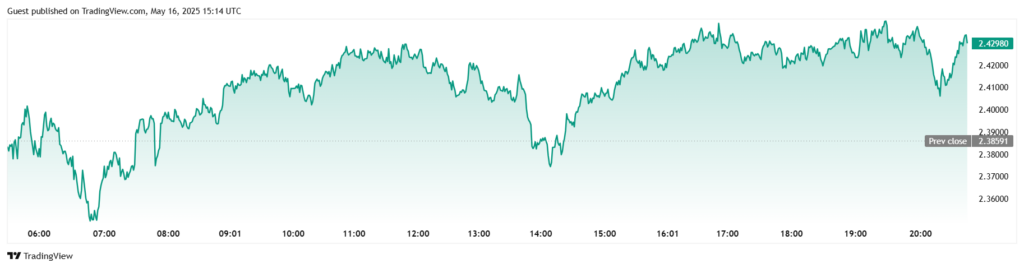

What sets Quant apart is its institutional partnerships. Collaborations with the European Central Bank, Oracle, and Hitachi add significant credibility to its long-term potential. Meanwhile, a steady decline in QNT balances on centralised exchanges suggests ongoing accumulation by long-term holders.

In a future where blockchains need to be interoperable and scalable for real-world applications, Quant is well-positioned to become a critical infrastructure provider.

XRP: From Legal Relief to Institutional Adoption

XRP, the native token of the Ripple network, has weathered regulatory storms and is now regaining its footing in the global financial ecosystem. Following a favourable outcome in its legal battle with the U.S. Securities and Exchange Commission (SEC), XRP is regaining institutional and retail interest.

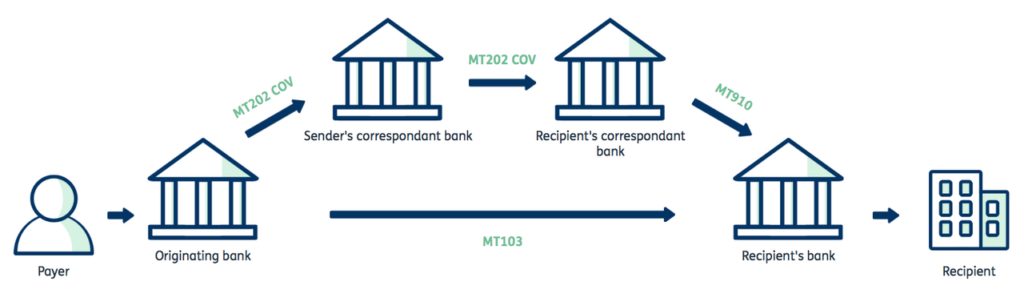

Ripple aims to disrupt the SWIFT payment system through faster and cheaper cross-border transactions. With the Ripple USD stablecoin gaining traction, XRP is seeing a resurgence in usage across its ledger. Of particular interest is the onboarding of Hidden Road transactions—valued at nearly $10 billion per day—which are set to boost on-chain activity significantly.

An XRP ETF approval is now more plausible than ever, with JPMorgan predicting $8 billion in inflows within the first year if greenlit. As the legal overhang fades, XRP may become a dominant player in international finance.

Hedera Hashgraph: Enterprise Blockchain with Real-World Use Cases

Hedera Hashgraph (HBAR) distinguishes itself with a unique governance model and partnerships that include global powerhouses like Google, IBM, Ubisoft, and Tata Communications. Its technology offers high throughput and energy efficiency, making it a strong contender in the race for scalable, enterprise-grade blockchain solutions.

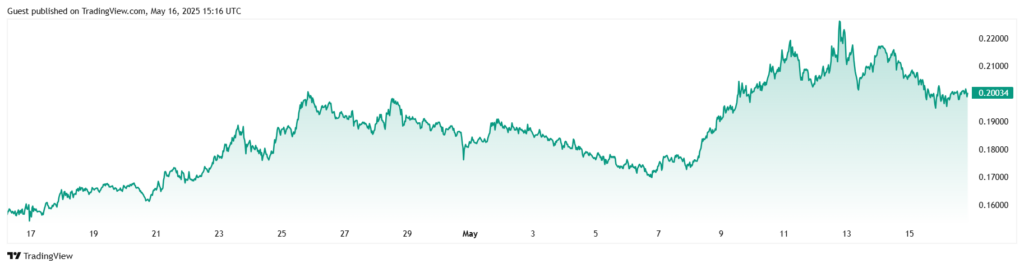

HBAR’s Stablecoin Studio has allowed developers to quickly launch and manage stablecoins on its network, expanding Hedera’s footprint in the blockchain-based payments and real-world asset (RWA) sectors. Its stablecoin market cap is steadily growing, a sign of rising confidence among developers and users alike.

Looking ahead, Hedera has a strong chance of securing ETF approval by 2025, a development that could significantly elevate its visibility and valuation.

Why These Altcoins Could Be the Smartest Buys of This Bull Cycle

With a historic bull run on the horizon and institutional capital flowing in, the crypto landscape is primed for explosive growth. While Bitcoin will likely remain the primary beneficiary, select altcoins like Solana, Quant, XRP, and Hedera Hashgraph offer compelling upside potential due to strong fundamentals, network growth, and increasing chances of regulatory clarity through ETF approvals.

Investors seeking to position themselves ahead of the curve should consider diversifying into these high-conviction assets. As always, thorough research and prudent risk management are key in the ever-volatile world of crypto investing.

Leave a Reply