Ethereum researcher and Merge architect Justin Drake has claimed that launching a 51% attack on Bitcoin would be significantly cheaper than on Ethereum. According to Drake, such an attack on Bitcoin could cost as little as $10 billion, compared to much higher costs associated with Ethereum’s proof-of-stake (PoS) network.

Cost of a Bitcoin Attack ‘Much Cheaper’

Speaking recently, Drake asserted that it would be “much cheaper to 51% attack Bitcoin,” estimating the cost to be “on the order of $10 billion.” He led Ethereum’s transition from proof-of-work (PoW) to PoS through the 2022 Merge and is considered one of the leading voices in Ethereum’s development.

Drake’s comments follow a May 14 post by Grant Hummer, co-founder of Ethereum-focused firm Etherealize, who also criticised Bitcoin’s security model. Hummer claimed that Bitcoin “is completely screwed because of its security budget,” and suggested that an $8 billion investment could successfully execute a 51% attack — with the risk becoming “virtually certain” if the figure drops to $2 billion.

A 51% attack occurs when a single entity or group controls the majority of a blockchain’s mining or staking power, enabling them to disrupt network consensus, double-spend coins, and censor transactions.

Ethereum’s Higher Attack Barrier

In contrast, Drake explained that launching such an attack on Ethereum would require acquiring over half of all staked ETH — a feat that would be exponentially more difficult.

“To have 100% control of the chain, you need 50% plus one of the stake,” Drake said. “A rich nation-state can probably pull it off,” he admitted, but emphasised the enormous cost and complexity involved.

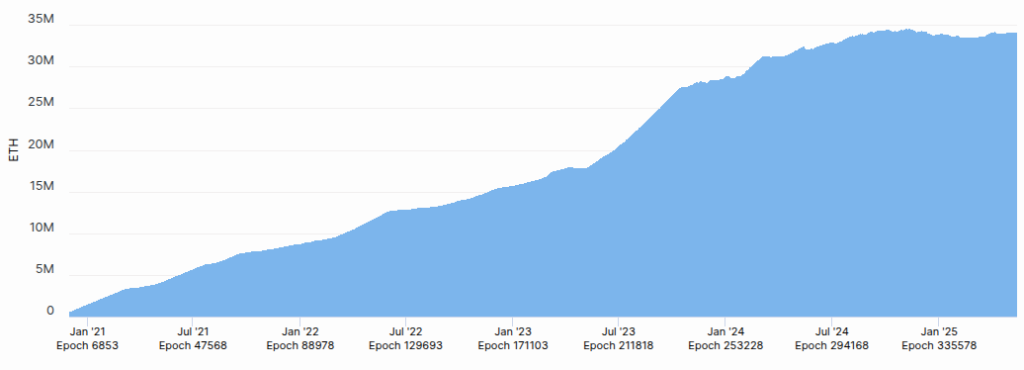

As of now, there are more than 34 million staked Ether (ETH), with a combined value of approximately $89.6 billion. Gaining control of just over half would require around $44.8 billion worth of ETH at current prices.

However, in reality, the cost would likely be far greater. Such a massive acquisition would lead to increased demand, driving up the price of ETH and escalating the required investment. Currently, the amount of ETH needed for such an attack represents roughly 14.2% of the total market capitalisation of $316 billion and more than 180% of the daily trading volume of $25 billion.

Social Layer as Ethereum’s “Superpower”

Beyond economics, Ethereum has an additional layer of defence: its community. Matan Sitbon, CEO of blockchain firm Lightblocks, pointed out that Ethereum’s “ultimate security lies not solely in cryptography or protocol rules, but in the community’s powerful social and economic coordination mechanisms.”

Drake supported this view, highlighting that Ethereum’s PoS model enables the community to respond actively to attacks. “If there is a 51% attack, the social layer can identify the attacker and socially slash it,” he said. Social slashing refers to the ability of Ethereum’s validators and users to coordinate and penalise malicious actors, something that Bitcoin’s PoW system lacks.

“This is a superpower of PoS that is not available with PoW,” Drake added, underlining the resilience built into Ethereum’s consensus model.

Bitcoin’s Longstanding Security Record

While Ethereum advocates argue for the superiority of PoS, some experts maintain that Bitcoin’s design still offers formidable protection. Hassan Khan, CEO of Bitcoin liquidity protocol Ordeez, remarked that although 51% attacks are theoretically possible, they remain highly impractical due to the immense energy and computing power required.

“For Bitcoin, the necessary amount of computing power and energy makes a sustained attack highly improbable,” he said. He also noted that Ethereum’s PoS model includes governance and economic deterrents that act as additional protective layers.

Pavel Yashin, researcher at staking provider P2P.org, added that centralisation or compromise on any blockchain could be countered by the community through a fork. “The old token would end up being delisted, and the compromised chain would fall into irrelevancy,” he explained.

Security Budgets Under Scrutiny

The debate surrounding the feasibility of a 51% attack has reignited broader concerns about blockchain security budgets and decentralisation. Bitcoin’s PoW model has proven reliable over time but is increasingly scrutinised for its long-term sustainability as block rewards diminish.

Ethereum, on the other hand, continues to evolve with its PoS mechanism, which not only reduces energy usage but also enhances community-driven resilience. According to Ethereum proponents, this evolution could make it the most decentralised and secure store of value in the long run.

In the words of Grant Hummer, “ETH is the only truly decentralised crypto-asset that can become the internet’s store of value.”

Leave a Reply