The upcoming week is poised to bring significant shifts to the cryptocurrency market, with several major token unlocks scheduled between May 19 and May 25. These events often increase circulating supply, potentially affecting token prices and market dynamics. Savvy traders and investors will be closely monitoring these developments to anticipate short-term volatility and long-term implications.

Polyhedra Network (ZKJ): Unlocking $33 Million Worth of Tokens

On May 19, Polyhedra Network will release 15.5 million ZKJ tokens, valued at approximately $33 million. This event represents a major milestone for the project, known for its ZK-proof infrastructure supporting Web3 interoperability.

The unlock distribution is spread across key strategic categories:

- Ecosystem and Network Incentives (8.47 million tokens, 2.65%): Aimed at bolstering protocol utility and user participation.

- Community, Airdrop, and Marketing (2.61 million tokens, 1.74%): Designed to drive brand visibility and engagement.

- Foundation Reserves (3.61 million tokens, 2.41%): To ensure sustainability.

- Pre-TGE Purchasers (800,000 tokens, 4%): Early investors may choose to sell, introducing short-term price pressure.

While the unlock supports long-term project growth, it could also lead to increased volatility as early backers and traders react to the influx of liquidity.

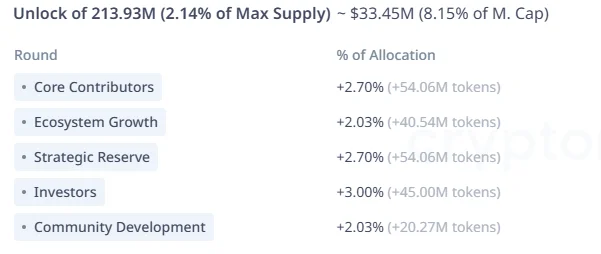

Saros (SAROS): Unlocking 213.93 Million Tokens on May 19

The Saros ecosystem will release 213.93 million SAROS tokens on May 19, adding $28 million worth of liquidity to the market. This unlock represents 8.15% of the token’s circulating supply, marking a significant event for the project, which is part of the Solana ecosystem.

Notable allocations include:

- Core Contributors (54.06 million tokens): Supporting the project’s foundational team.

- Ecosystem Growth (40.54 million tokens): Fueling innovation and user acquisition.

While the broader strength of the Solana ecosystem might mitigate selling pressure, investors should brace for potential price instability during this period. Market sentiment and liquidity will play pivotal roles in determining the short-term impact.

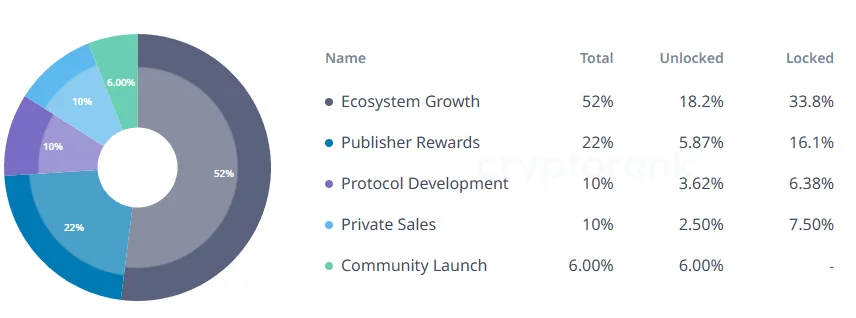

Pyth Network (PYTH): Over Half of Total Supply to Be Unlocked

One of the most significant unlocks of 2025, Pyth Network will release a staggering 2.13 billion PYTH tokens on May 20, valued at over $330 million. This unlock accounts for 58.3% of the circulating supply, marking a pivotal moment for the project.

The token allocation reflects a blend of growth-focused and risk-prone areas:

- Ecosystem Growth (21.6%): Allocating 1.13 billion tokens to expand Oracle network adoption.

- Publisher Rewards (24.4%): Distributing 537.53 million tokens to incentivize data providers.

- Protocol Development (21.3%): Supporting technical enhancements with 212.5 million tokens.

- Private Sale Investors (25%): Unlocking 250 million tokens, potentially driving selling pressure.

The sheer size of this unlock could cause substantial market turbulence unless offset by strong demand or bullish catalysts. Historically, token releases of this magnitude often lead to short-term price corrections.

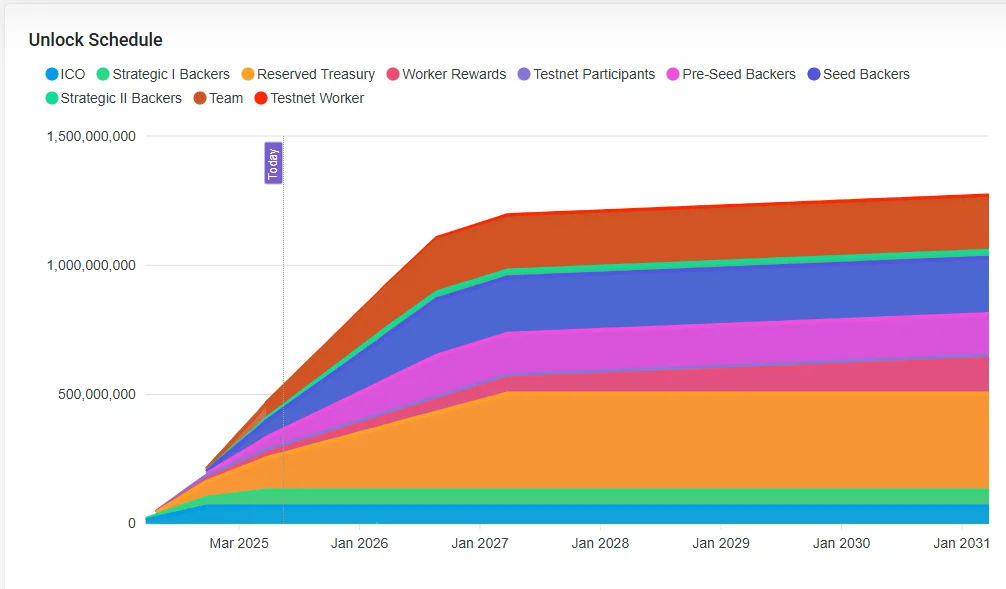

Subsquid (SQD): A Modest Yet Notable Unlock on May 25

Rounding out the week, Subsquid will unlock 38.1 million SQD tokens on May 25, valued at approximately $10.2 million. While this represents only 2.86% of the total supply, the project’s relatively low liquidity could amplify the impact on its price.

Subsquid, a new player in blockchain data infrastructure, faces the challenge of balancing market growth with selling pressures from early investors. However, if the project sustains its momentum in on-chain data demand, the token could recover quickly from any short-term dips.

What These Token Unlocks Mean for Traders

Token unlock events are double-edged swords for crypto markets. While they can indicate progress and encourage ecosystem growth, they also introduce selling pressure that could lead to price volatility. Here’s what traders should consider:

- Market Sentiment: Positive developments in the broader crypto market could absorb increased liquidity.

- Early Investor Actions: Selling by early backers can create downward price pressure, particularly for larger unlocks.

- Ecosystem Strength: Projects with strong user adoption and utility are better positioned to weather volatility.

The scheduled unlocks for ZKJ, SAROS, PYTH, and SQD highlight the importance of strategic token management in ensuring sustainable growth. Traders should remain vigilant, as the balance between supply influx and demand will determine market trajectories.

Leave a Reply