The Texas House of Representatives has taken a pivotal step in securing the state’s digital future by passing Senate Bill 21 (SB 21), which proposes the creation of a Strategic Bitcoin Reserve. This legislation positions Texas as a trailblazer in integrating cryptocurrency into state-level financial strategies, signaling a bold embrace of digital assets.

A Historic Step for Bitcoin in Texas

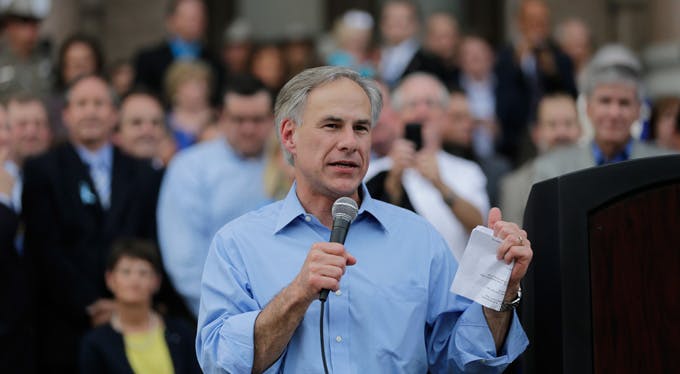

SB 21, authored by state Senator Charles Schwertner, passed its third reading in the Texas House with a decisive 101-42 vote. The bill now heads to Governor Greg Abbott’s desk, where it awaits either his signature or veto. If signed into law, Texas will become the third U.S. state to officially hold Bitcoin in its treasury, following a growing national trend toward state-backed cryptocurrency reserves.

The legislation grants the Texas comptroller the authority to manage Bitcoin holdings on behalf of the state. Under the bill, the comptroller can invest in cryptocurrencies with a market capitalization exceeding $500 billion over the previous 24 months. At present, Bitcoin is the only cryptocurrency meeting this stringent criterion, reflecting the legislation’s intent to prioritise stable and well-established digital assets.

Bipartisan Support and Legislative Momentum

The proposal has garnered strong bipartisan support, underscoring a rare unity in an often-divided political landscape. During the debate, Representative Giovanni Capriglione highlighted the bill’s significance, describing it as a “pivotal moment in securing Texas’s leadership in the digital age.”

The House had earlier amended the bill to increase the eligibility period for cryptocurrencies from 12 months to 24 months. This adjustment makes it significantly harder for altcoins to qualify for inclusion, ensuring that only the most robust and consistent assets are considered. This mirrors similar precautions taken by New Hampshire, the first U.S. state to establish a Bitcoin Reserve.

Operational Framework and Safeguards

If enacted, SB 21 will authorise the Texas comptroller’s office to oversee Bitcoin transactions, including buying, holding, and selling the cryptocurrency. The bill also allocates state funds for the reserve’s operational needs, providing a structured framework to ensure its sustainability.

By prioritising long-term stability, Texas seeks to mitigate risks associated with cryptocurrency volatility. The stringent eligibility requirements for inclusion in the reserve underscore the state’s cautious approach, balancing innovation with fiscal responsibility.

National Context and Market Reactions

Texas’s initiative comes amidst a growing trend of U.S. states exploring Bitcoin reserves as a hedge against inflation and economic uncertainty. While Arizona and New Hampshire have made strides in this direction, other states like Florida have encountered legislative roadblocks despite initial enthusiasm.

The momentum of SB 21 has also resonated within the cryptocurrency market, contributing to a surge in Bitcoin prices. Following the bill’s passage in the House, Bitcoin reached a value of $106,000, nearing its all-time high. This uptick reflects increased investor confidence in Bitcoin’s integration into mainstream financial systems.

The Road Ahead

With Governor Greg Abbott’s pro-Bitcoin stance, the bill’s prospects for final approval are promising. However, the journey to adoption highlights the challenges inherent in aligning innovative financial strategies with traditional governance structures.

Should SB 21 become law, Texas will solidify its position as a leader in cryptocurrency adoption, setting a precedent for other states to follow. The establishment of a Strategic Bitcoin Reserve could mark a turning point in how state governments leverage digital assets for economic resilience and future growth.

By embracing Bitcoin, Texas signals its readiness to lead in the digital economy, securing its role as a pioneer in the evolving landscape of state-level cryptocurrency adoption.

Leave a Reply