James Wynn Goes All-In on Bitcoin with High-Leverage Trade

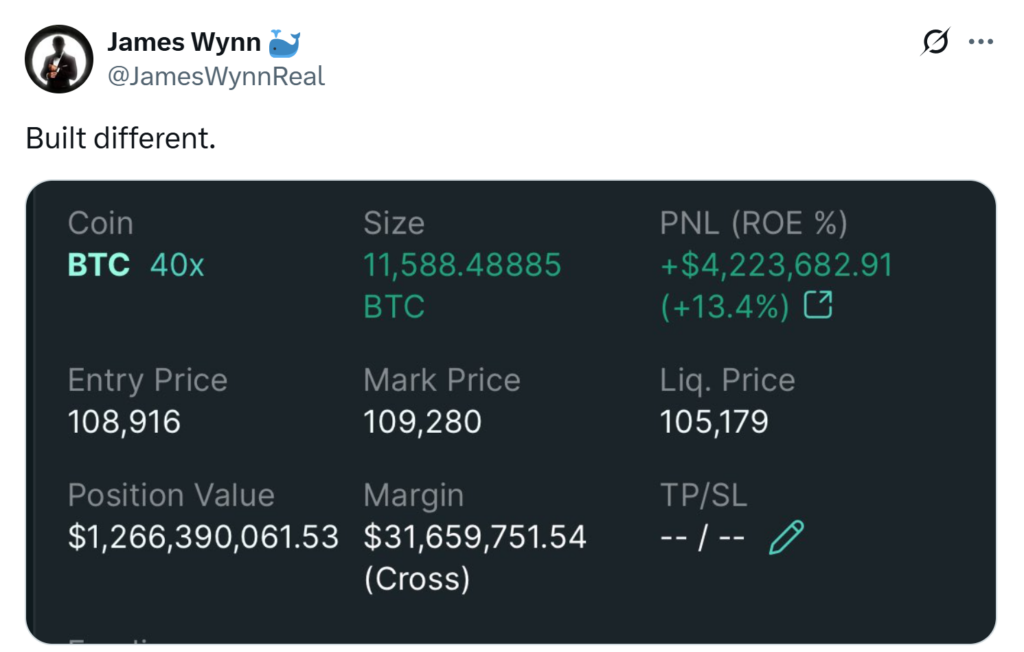

Well-known crypto trader James Wynn has gone “all-in” on Bitcoin, pushing his long position on decentralised exchange Hyperliquid to a staggering $1.25 billion. Utilising 40x leverage, Wynn’s high-stakes bet has drawn attention across the crypto community. The move followed his exit from memecoin PEPE, where he secured a profit of $25.2 million.

According to on-chain analytics platform Lookonchain, Wynn’s position consists of 11,588 BTC at an average entry price of $108,243, with a liquidation level set at $105,180. His strategy, while bold, leaves little room for error given the narrow gap between current market levels and liquidation.

Major Profits, Sudden Losses

Wynn’s journey to this massive Bitcoin long began on 21 May with an $830 million position. That same day, he secured $400 million in profits before increasing his exposure again to $1.1 billion. As Bitcoin surged past $110,000, Wynn’s leveraged position showed a $39 million unrealised gain. He cashed in part of this by selling 540 BTC for $60 million, bagging a $1.5 million profit.

However, not all trades have gone in his favour. Just hours before increasing his Bitcoin position, Wynn exited Ether and Sui longs at a combined $5.3 million loss. He reportedly used the proceeds to double down on Bitcoin.

Trump’s Tariff Shock Hits Markets

Wynn’s bullish stance took a major blow on 23 May after former US President Donald Trump announced a proposed 50% tariff on all imports from the European Union. The announcement rattled financial markets worldwide, with Bitcoin plunging below $107,000. The sharp downturn also affected Ether, which dropped to $2,504, and led to significant selloffs across memecoins.

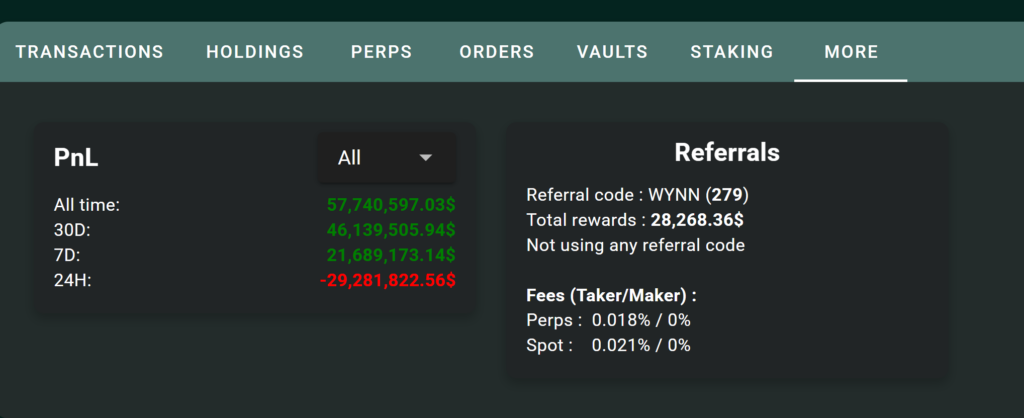

Data from blockchain explorer HypurrScan reveals Wynn suffered over $29 million in losses in a single day as a result of the sudden downturn. Despite the setback, his trading history remains largely profitable—Wynn is up over $46 million in the last month alone and more than $57 million in total trading gains.

A Self-Described Risk-Taker and Memecoin Enthusiast

Wynn is known for his aggressive trading style and self-identifies as a “high-risk leverage trader” and “memecoin maxi.” He claims to have identified PEPE as a strong buy when its market cap was only $600,000, underlining his interest in early-stage crypto projects.

He began using Hyperliquid just two months ago, initially depositing $4.65 million worth of USDC stablecoin onto the platform. Since then, his profile on HypurrScan has become a case study in high-leverage, high-risk crypto trading.

About Hyperliquid and Its Platform

Hyperliquid is a decentralised exchange (DEX) built on its own layer-1 blockchain. It supports a wide range of trading services, including spot trading, borrowing, and lending. The DEX has gained traction in recent months for its low fees, high-speed execution, and support for leveraged trading, which has attracted traders like Wynn.

However, such aggressive use of leverage comes with increased exposure to volatility. With Bitcoin hovering near $109,000, even a minor correction could threaten Wynn’s position given the liquidation level of $105,180. Market observers will be watching closely to see whether the high-stakes trader can ride out the storm or face another major setback.

Conclusion

James Wynn’s high-leverage bet on Bitcoin showcases both the potential for immense profit and the dangers of volatility in crypto markets. While he has reaped millions in gains over the past month, Trump’s recent tariff announcement illustrates how quickly sentiment can shift. As market conditions remain unpredictable, Wynn’s trade stands as a striking example of the razor-thin margin between risk and reward in the world of crypto trading.

Leave a Reply