As Sweden reevaluates its ambition to become a fully cashless society, Ethereum co-founder Vitalik Buterin has weighed in on the debate, emphasising the risks of centralised digital payment systems and the importance of decentralised alternatives like Ethereum during times of crisis.

Sweden Walks Back on Cashless Ambition

Sweden has long been a frontrunner in digital payments, with a 2018 prediction by a former central bank official suggesting the country would be cashless by 2025. That forecast has largely materialised—by 2025, only one in ten transactions in Sweden involve physical cash, according to The Guardian.

However, recent geopolitical instability, cybersecurity concerns, and civil defence considerations have led Swedish authorities to encourage citizens to keep at least a week’s worth of cash at home in case of emergencies, such as war or a major crisis. The move reflects growing unease over the reliability of fully centralised digital payment infrastructures.

Buterin: Centralised Systems Are Fragile in Crises

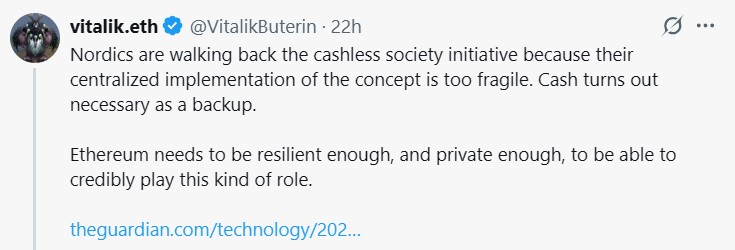

Reacting to this shift, Vitalik Buterin pointed out the limitations of centralised digital systems. Referencing The Guardian’s March 16 report, Buterin wrote, “Nordics are walking back the cashless society initiative because their centralised implementation of the concept is too fragile. Cash turns out necessary as a backup.”

Buterin suggested that while centralised systems may offer efficiency and convenience, they often fail to provide the resilience required during times of national or global instability. He used Sweden’s changing stance to highlight the need for decentralised financial systems that can function independently of central authorities.

Ethereum as a Financial Fallback

Buterin believes Ethereum could serve as a robust and decentralised financial safety net in crisis situations. He stated that the blockchain network must be both “resilient enough, and private enough” to fulfil this role effectively.

Addressing the potential for Ethereum to support offline transactions, Buterin said that fully private, offline crypto transfers using zero-knowledge (ZK) technologies are technically feasible but come with caveats. “We basically know how to do it,” he explained, “but with the limitation that any solution depends on trusted hardware and/or post hoc enforcement against double-spenders.”

Such technologies could, in theory, enable financial transactions even in the absence of internet or power, offering a critical layer of support during emergencies when traditional systems fail.

Crypto and Fiat to Coexist, Says Industry Executive

While Ethereum’s founder sees potential in decentralised systems during crises, not everyone in the crypto industry believes digital currencies will replace fiat money entirely. Petr Kozyakov, co-founder and CEO of crypto payment platform Mercuryo, stated that cryptocurrencies and fiat will coexist rather than compete.

In a recent interview, Kozyakov observed a growing demand for crypto payment solutions, but noted that most people will continue to use fiat money when it proves more convenient. “People will use crypto when it’s easier and more practical,” he said, suggesting a future where both systems serve different purposes based on user needs and circumstances.

A Balanced Future for Payments?

Sweden’s reconsideration of its cashless push has reignited global discussion around the vulnerabilities of centralised digital finance. As governments explore ways to secure their financial infrastructure against unforeseen crises, decentralised systems like Ethereum are increasingly seen not just as speculative investments, but as potentially vital parts of a nation’s contingency planning.

Buterin’s comments underscore a broader philosophical divide between centralised efficiency and decentralised resilience—a debate that may shape the future of money more than ever before.

Leave a Reply