The United States Treasury Department has imposed strict sanctions on a Philippines-based technology company, Funnull Technology, and its alleged administrator, Chinese national Liu Lizhi. According to the Treasury’s Office of Foreign Assets Control (OFAC), Funnull is a critical enabler of a massive global crypto scam network responsible for over $200 million in losses. The network is reportedly tied to thousands of fraudulent investment platforms that impersonate legitimate financial services to lure unsuspecting victims.

Funnull’s Alleged Role in Enabling Crypto Fraud

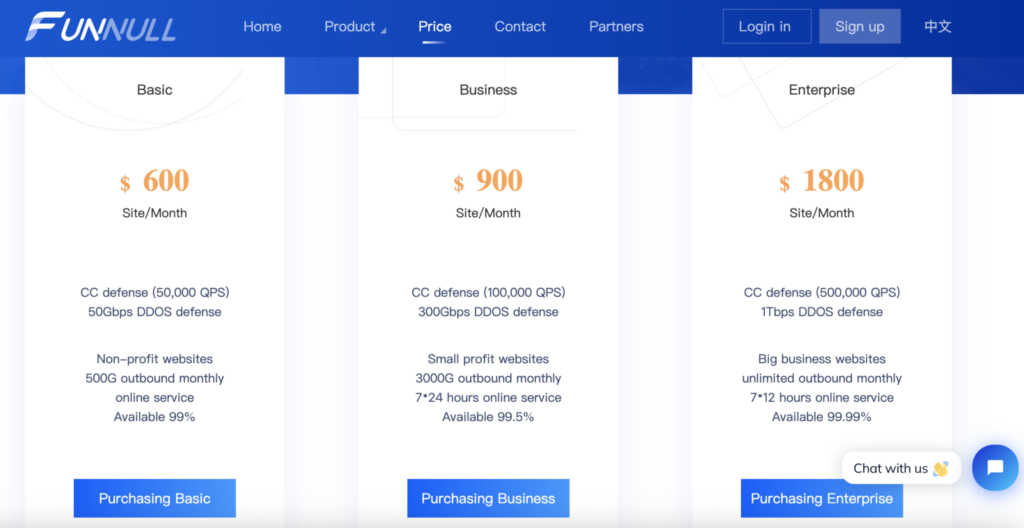

In a press release on 29 May, OFAC detailed the extensive involvement of Funnull Technology in a coordinated crypto scam operation. The company is accused of supplying infrastructure and digital services that empower cybercriminals to host and operate fake investment and trading websites.

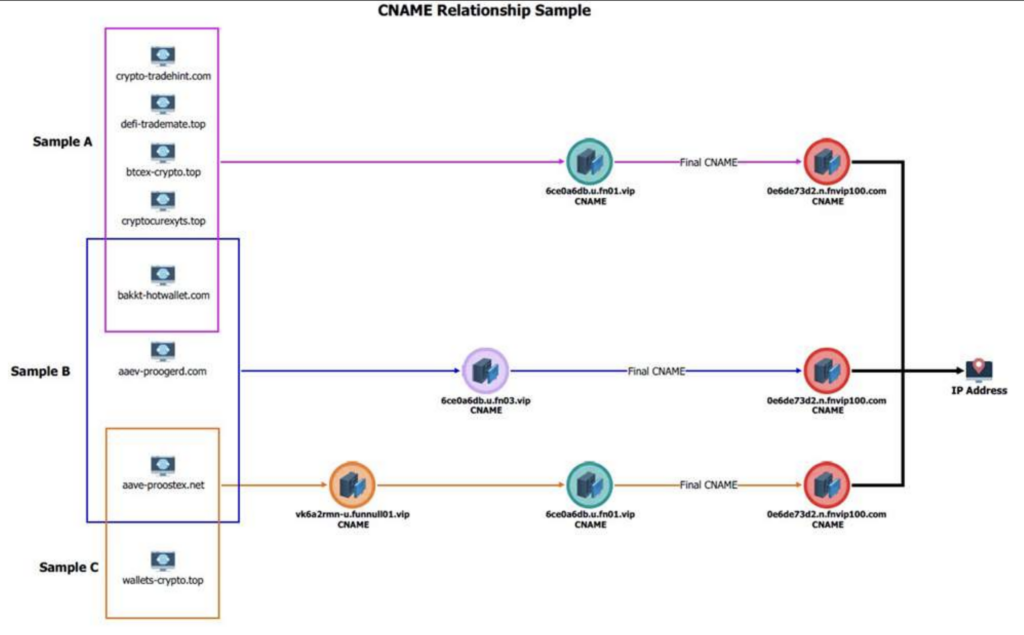

One of the main methods employed by Funnull was the bulk purchase of IP addresses from cloud service providers. These IPs were then sold to scammers who used them to clone reputable platforms, making it difficult for users to distinguish the legitimate from the fake. The firm allegedly facilitated rapid domain switching, allowing scam sites to avoid takedown efforts by authorities and cybersecurity firms.

In a notable 2024 incident, OFAC said Funnull obtained a widely used code repository developed for web applications. The firm allegedly altered this code to automatically redirect visitors from legitimate websites to fraudulent crypto investment sites or online gambling portals, thereby hijacking traffic and exploiting users’ trust.

Administrator Liu Lizhi Placed on US SDN List

The sanctions also target Liu Lizhi, identified as Funnull’s administrator. A Chinese national, Lizhi is believed to have overseen operations and managed employees involved in the scheme. He has been placed on the OFAC’s Specially Designated Nationals and Blocked Persons (SDN) list.

Being on the SDN list means that all Lizhi’s assets within US jurisdiction are frozen. Furthermore, it is now illegal for any US individual or entity to conduct business with him or Funnull, including handling any property or interests where either holds 50% or more ownership. Violators could face steep civil or even criminal penalties.

Two Crypto Wallets Linked to Scam Operations

In addition to targeting the company and its administrator, OFAC also sanctioned two cryptocurrency wallet addresses associated with Funnull. These wallets, according to blockchain analytics firm Chainalysis, were likely used to receive payments from cybercriminals operating within the scam network.

Chainalysis’s investigation highlights that these wallet addresses also show “indirect exposure to various types of scams and domain management infrastructure vendors,” further tying Funnull to a broader cybercrime ecosystem.

Funnull’s Central Role in the Triad Nexus

Chainalysis identified Funnull as a pivotal player within a broader scam infrastructure network it terms the Triad Nexus. This network reportedly supports over 200,000 unique hostnames linked to deceptive trading apps and investment platforms.

The Triad Nexus is believed to be responsible for an escalating wave of online fraud campaigns that impersonate legitimate financial brands, siphoning funds from unsuspecting investors around the world. Funnull’s infrastructure enabled these scammers to operate with near-impunity, rotating domains and mimicking trusted platforms with alarming speed and precision.

Implications and Global Crypto Security Concerns

These sanctions reflect growing concerns from US authorities over the use of advanced technology services to fuel cybercrime, particularly in the rapidly evolving crypto space. By cutting off Funnull and its administrator from the US financial system, OFAC hopes to disrupt a key node in a dangerous fraud network.

The move sends a clear message: service providers who knowingly or recklessly enable crypto scams will face severe consequences, even if based outside the United States. It also signals increased regulatory vigilance as governments attempt to curb the rise in online investment fraud targeting global crypto users.

Leave a Reply