In a powerful vote of confidence for Bitcoin’s role in corporate finance, the Norwegian Block Exchange (NBX) saw its stock surge by over 138% on 2 June following the announcement of its new Bitcoin treasury strategy. The Oslo-based cryptocurrency platform revealed it had purchased 6 Bitcoin valued at approximately $633,700 and plans to expand its holdings to 10 BTC by the end of the month.

This bold move appears to have electrified the market, with NBX shares closing at 0.033 euros ($0.038), up from their previous trading value. While still far from its all-time high of 0.93 euros ($1.06), which it reached in January 2022, the jump underscores renewed investor interest in companies directly adopting Bitcoin into their corporate strategies.

NBX Joins the Corporate Bitcoin Wave

The announcement puts NBX in line with a growing trend among public firms integrating Bitcoin into their treasuries as a strategic asset. The exchange’s decision isn’t simply about holding Bitcoin, it’s part of a broader agenda to transform itself into a digital asset bank.

NBX stated that it plans to use its Bitcoin holdings as collateral to issue USDM, a stablecoin built on the Cardano blockchain. The platform aims to generate yield both on its Bitcoin assets and within the Cardano ecosystem, suggesting a hybrid approach to blockchain finance that leverages the strengths of both Bitcoin and Cardano.

In a statement, the company noted that “Bitcoin is becoming an important part of the global financial infrastructure,” highlighting its goal to improve operational efficiency and draw capital from businesses with growing crypto exposure.

The board is also exploring Bitcoin-backed loans, further positioning NBX as a crypto-first financial institution.

Bitcoin to Power Stablecoins and Yield in Cardano Ecosystem

A key element of NBX’s plan involves integrating Bitcoin into the Cardano blockchain, a smart contract platform known for its low fees and energy-efficient model. The company’s stablecoin, USDM, will be backed by Bitcoin, opening the door for a new financial product aimed at decentralised finance (DeFi) participants.

This dual-chain strategy is relatively rare among exchanges but reflects a growing appetite for cross-chain finance solutions. NBX’s approach mirrors that of large institutions experimenting with yield generation via decentralised platforms, adding another layer of innovation to their crypto adoption.

The use of Bitcoin as collateral further cements its role as a reserve asset in the digital economy, a trend being echoed across the globe by both startups and institutional giants.

Other Norwegian Firms Embrace Bitcoin Strategy

NBX is not alone in its Bitcoin ambition. Other Norwegian firms have also joined the movement, with Aker ASA, a major industrial holding company, launching its Bitcoin-focused subsidiary Seetee in 2021. Through Seetee, Aker holds 1,170 BTC, purchased at an average price of $50,200 a stash now worth around $123 million.

Another player, K33, a Norwegian crypto brokerage, has raised 60 million Swedish krona ($6.2 million) to buy and hold Bitcoin, reinforcing the broader shift in corporate strategy towards Bitcoin as a treasury reserve asset.

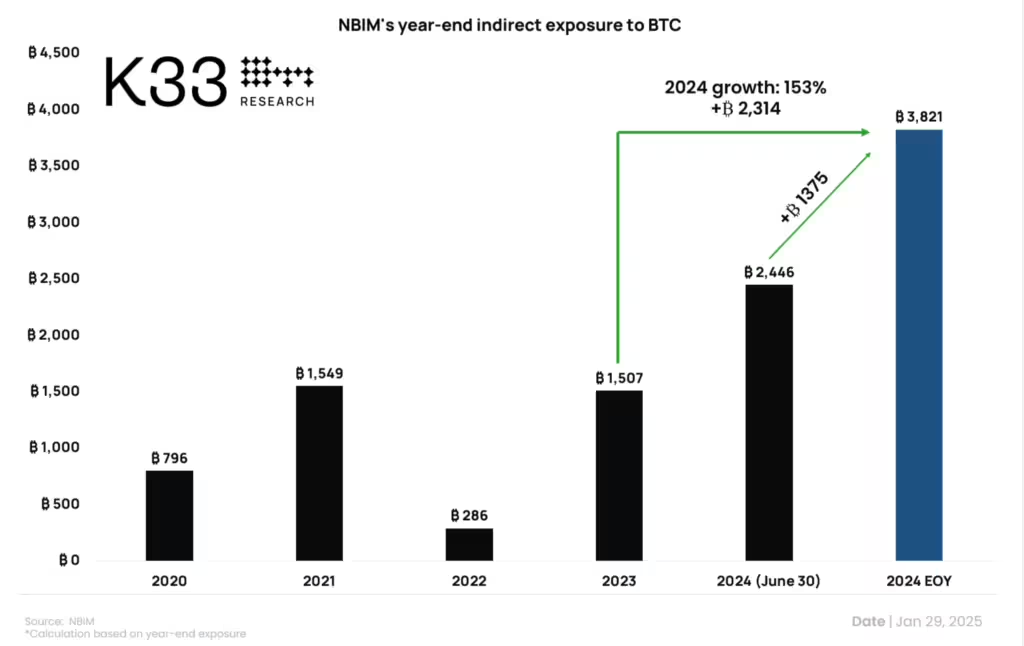

Meanwhile, Norges Bank, Norway’s $1.7 trillion sovereign wealth fund, held 3,821 BTC indirectly via its equity investments as of the end of 2024. This makes the Norwegian state one of the most significant institutional Bitcoin holders globally, albeit indirectly.

Global Trend: Companies Fuel Bullish Sentiment with Bitcoin Holdings

NBX’s stock movement mirrors similar surges seen globally when companies announce Bitcoin acquisition strategies. French crypto firm Blockchain Group witnessed a 225% jump in share price after it began buying Bitcoin in November 2024. In Indonesia, DigiAsia Corp saw its stock rise by 91% following its announcement of a $100 million Bitcoin buying plan.

According to Bitbo, corporate Bitcoin treasuries now collectively hold over 3 million BTC, valued at more than $342 billion. This institutional momentum highlights the evolving role of Bitcoin as more than a speculative asset, it is becoming a foundational pillar of modern finance.

As traditional and crypto-native firms increasingly converge on Bitcoin, the market is responding with enthusiasm, and NBX’s meteoric share spike is just the latest signal of the asset’s growing legitimacy in corporate finance.

Leave a Reply