Bitcoin traders are closely watching the $107,500 level as a critical zone that could determine whether the world’s leading cryptocurrency sets new all-time highs. As BTC consolidates between increasingly thick liquidity bands, market sentiment suggests a major breakout may be on the horizon — but not without macroeconomic headwinds.

Liquidity Builds Around $107.5K and $104.5K

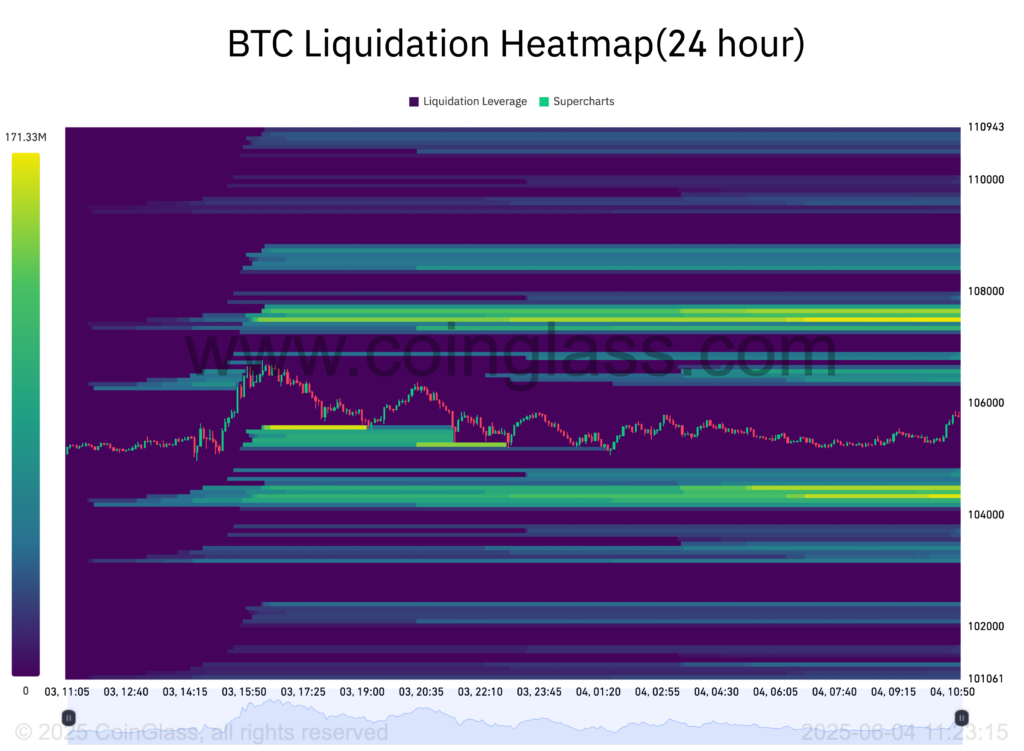

Bitcoin (BTC), trading at around $104,851 at the time of writing, has been fluctuating near the $106,000 level ahead of the June 4 Wall Street open. According to TradingView data, the asset has been targeting liquidity on both sides of the current price range, with brief spikes to $107,000 and dips toward $105,000 neutralizing long and short positions alike.

Data from analytics platform CoinGlass highlighted growing liquidity concentrations at $104,500 and $107,500, forming what some analysts are calling “guard rails” for BTC’s short-term trajectory.

Michaël van de Poppe, a well-known crypto analyst and entrepreneur, pointed to the upper band as particularly crucial. Sharing a chart on social media, he wrote, “This is why this level is so vital for Bitcoin. No breakout above it yet, but if it happens, we’re all the way towards a new ATH and $3,000 per ETH.”

Rangebound Trading Continues Amid Lack of Catalysts

Despite the excitement surrounding a potential breakout, the broader picture remains muted. QCP Capital, a prominent trading firm, reported that BTC continues to trade within a narrow range, with “light positioning and a normalized skew suggesting little directional conviction.”

Their latest update to Telegram subscribers underlined the absence of strong macroeconomic triggers as a key reason for subdued volatility. “BTC is unlikely to break materially out of its current range,” the firm noted.

This aligns with recent price action, which has seen Bitcoin oscillate between support and resistance levels without establishing a clear trend. Traders are waiting for a decisive move, but until one occurs, rangebound behavior is expected to persist.

Macroeconomic Outlook Clouds Q3 Prospects

Looking ahead, QCP Capital highlighted several macroeconomic challenges that could influence market sentiment in the coming months. Among these are the potential fallout from tariff-related developments and looming fiscal risks associated with the so-called “Big Beautiful Bill” (BBB) and the US debt ceiling.

While volatility remains low across most risk assets, QCP warned that Q3 could be more turbulent if these fiscal issues begin to impact broader macroeconomic data. However, until a definitive catalyst emerges, the firm sees little likelihood of Bitcoin making a meaningful break from its current pattern.

Nonfarm Payroll Data Could Be a Short-Term Catalyst

One potential trigger for near-term volatility lies in the upcoming US employment data. Nonfarm payroll (NFP) numbers are due later this week, and any significant deviation from expectations could influence the Federal Reserve’s interest rate outlook.

“A steady NFP would cement the Fed’s narrative of a resilient labour market, reinforcing expectations that rates will remain on hold,” QCP noted.

Should the data surprise in either direction, it may provide the impetus Bitcoin needs to either break above $107,500 or slide below its current support zone.

Conclusion

For now, Bitcoin remains locked within a narrow corridor, with $107,500 emerging as a critical resistance level for any push toward new all-time highs. While traders and analysts monitor liquidity flows and await macroeconomic signals, the market remains cautiously optimistic — but ultimately still indecisive.

Leave a Reply