Ethereum is making a strong comeback in the decentralised finance (DeFi) ecosystem, with a surge in stablecoin activity and bot-driven efficiency placing the Layer-1 (L1) network back at the centre of the DeFi movement in 2025. According to a report released on 4 June by crypto trading platform CEX.io, Ethereum processed a record $480 billion in stablecoin transactions in May alone, a clear indication that the network is reclaiming relevance amidst rising competition from Layer-2 (L2) solutions and rival blockchains.

Stablecoin Volume Hits Record High on Ethereum Mainnet

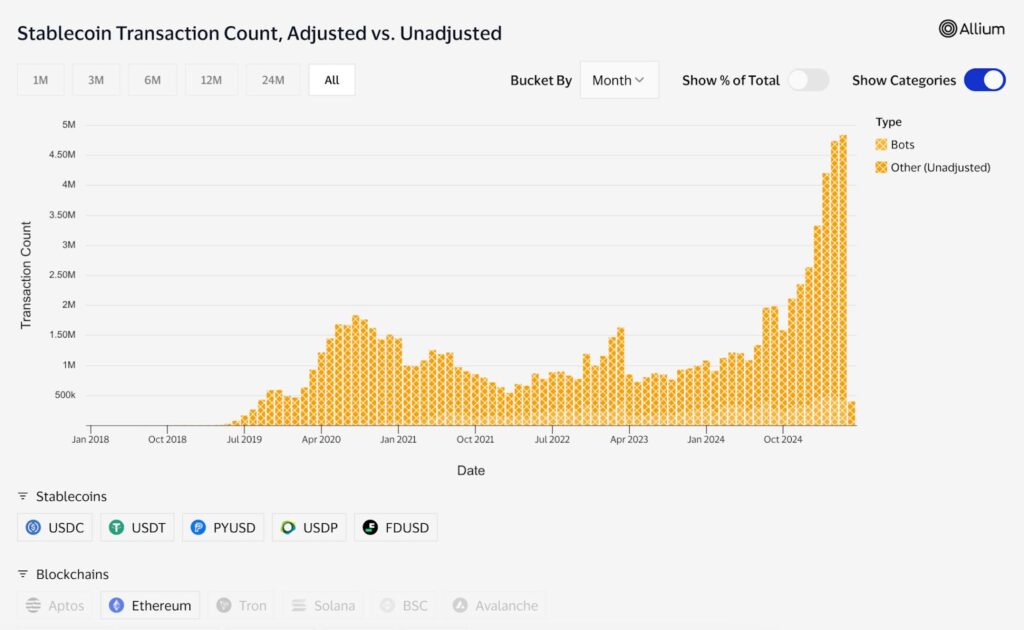

In May 2025, automated bots executed over 4.84 million stablecoin transactions on Ethereum’s L1, according to data from CEX.io. This activity pushed stablecoin volume on the network to an all-time high of $480 billion. CEX.io lead analyst Illia Otychenko attributes this surge to significantly lower gas fees seen earlier in the year. The fee drop appears to have reversed a years-long trend of users and liquidity migrating to cheaper L2 networks such as Arbitrum and Optimism.

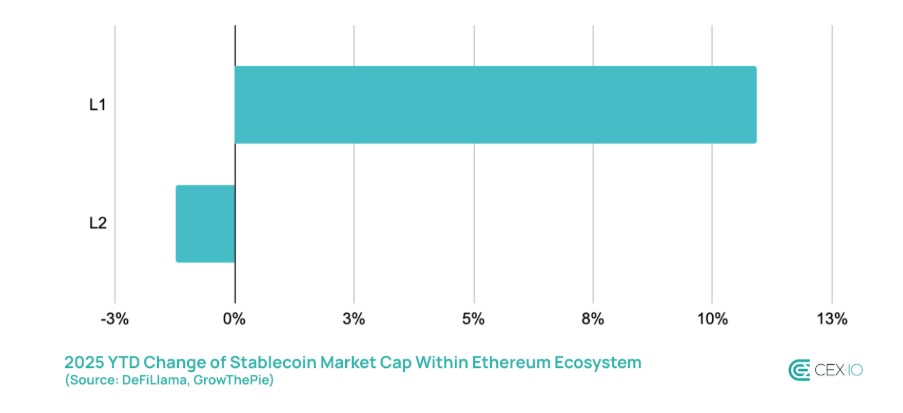

Notably, Ethereum’s mainnet stablecoin market capitalisation expanded by 11% in 2025, directly at the expense of its own L2s, whose combined stablecoin market share dipped by just 1%. This shift underscores a broader resurgence in L1 activity and may signal a strategic rebalancing within the Ethereum ecosystem.

From MEV Villains to Liquidity Enablers

Bots have long been criticised for exploiting Ethereum through maximum extractable value (MEV) strategies and sandwich attacks. However, their role is being reassessed. In a notable shift, bots are now recognised for enhancing decentralised exchange (DEX) liquidity and overall market efficiency.

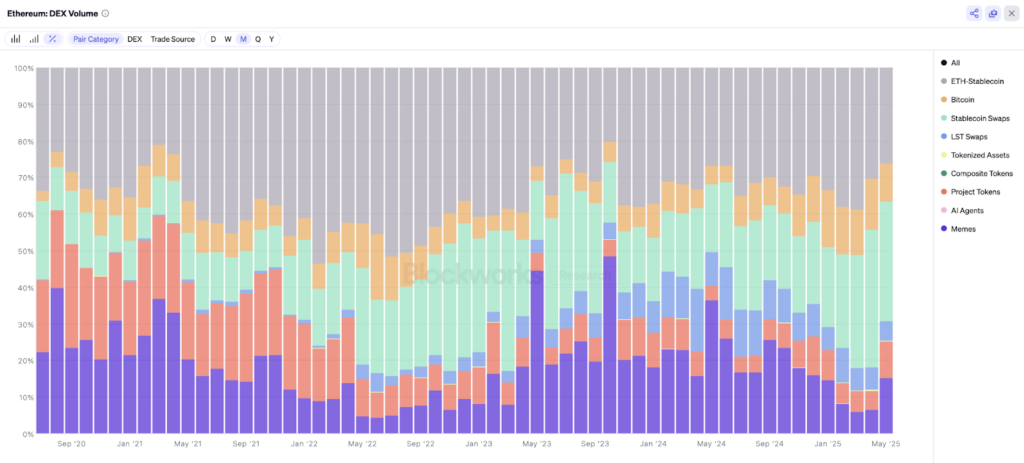

CEX.io revealed that bot activity catapulted stablecoin swaps to the top of Ethereum’s DEX volume categories, making up 37% of all trades in April and 32% in May. This shift marks a significant pivot in trading behaviour, away from speculative altcoins and towards stablecoins, signalling a maturing market focus on utility and reliability.

USDC Emerges as the Anchor Asset

As Ethereum’s DeFi landscape evolves, stablecoins are taking centre stage. Circle’s USDC became the most-traded asset on the network, reflecting a growing preference for assets suited to payments and settlements over speculation.

This renewed focus suggests that ETH is shifting from being merely a platform for yield farming and token speculation to becoming a stable, global settlement layer for decentralised payments. It also aligns with broader market trends showing increased demand for fast, borderless transactions in emerging economies.

Cross-Layer Fragmentation: Ethereum’s Next Hurdle

While ETH’s momentum is promising, challenges remain. Analyst Illia Otychenko cautions that the network’s long-term leadership in DeFi hinges on solving liquidity and cost fragmentation across layers. “This isn’t just a technical issue,” Otychenko told Cointelegraph. “It’s what will decide whether Ethereum leads or lags in the next phase of adoption.”

Fragmentation makes user experience clunky and hinders capital efficiency. Despite Ethereum’s recent gains, bridging assets and liquidity between L1 and L2 remains a bottleneck for mainstream scalability. Without addressing this, Ethereum risks losing its edge as competitors improve interoperability and user experience.

Ethereum’s resurgence in 2025, driven by bot efficiency and stablecoin volume, signals a shift towards a more utility-focused DeFi landscape. If the network can sustain low fees and resolve fragmentation issues, it may solidify its position as the premier settlement layer for the next generation of decentralised finance. However, long-term success will depend not just on momentum, but on critical infrastructure upgrades and seamless cross-layer liquidity.

Leave a Reply