Metaplanet, a leading Japanese firm also known as “Japan’s Strategy,” has announced an ambitious plan to acquire 100,000 Bitcoin (BTC) by the end of 2026. The move marks a significant revision from its initial target of 21,000 BTC. The announcement, made on June 6 by CEO Simon Gerovich via X (formerly Twitter), positions Metaplanet as a key player in the evolving cryptocurrency landscape.

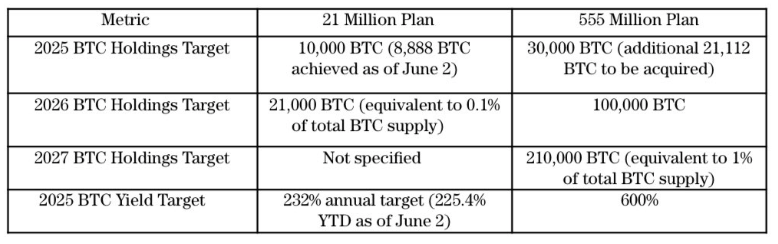

The company, which currently holds 8,888 BTC, recently added 1,088 BTC to its treasury on June 2. To meet its new goal, Metaplanet plans to purchase at least 91,112 BTC over the next 18 months, marking a historic commitment to Bitcoin adoption.

Economic Shifts Drive Bitcoin Demand

Metaplanet’s revised strategy is a response to global economic transformations. CEO Simon Gerovich highlighted the transition from traditional economic structures, reliant on capital and labour, to systems driven by information technology. These shifts, coupled with geopolitical risks, trade policy uncertainties, and soaring sovereign debt levels, have diminished confidence in traditional “safe” assets like long-term government bonds.

“Gold has already reached record-high valuations against major currencies,” Gerovich stated, pointing to Bitcoin’s unique attributes such as scarcity, ease of transfer, and independence from credit intermediaries as reasons for its growing strategic importance.

Funding the BTC Acquisition: The 555 Million Plan

To finance its ambitious goal, Metaplanet has launched the “555 million plan.” This initiative involves issuing up to 555 million new shares, adding to the 210 million shares issued under its original “21 million plan.” The firm aims to raise ¥770.3 billion ($5.32 billion) through these measures, with an initial share price set at ¥1,388 ($9.6).

Metaplanet’s aggressive Bitcoin acquisition strategy aligns with its long-term vision of holding over 210,000 BTC by 2027. This would place the firm among the elite “1% Club” of entities controlling at least 1% of Bitcoin’s 21 million total supply.

Bitcoin’s Strategic Role in Financial Portfolios

The move underscores Bitcoin’s rising appeal as a hedge against economic uncertainty. As traditional assets lose their allure, public companies like Metaplanet are increasingly turning to Bitcoin. Despite concerns raised by institutions such as Standard Chartered Bank regarding risks associated with such strategies, the trend is gaining momentum.

Currently, 61 out of 124 public companies with Bitcoin investments collectively hold 3.2% of Bitcoin’s total supply. Metaplanet’s bold strategy could significantly increase this figure, further embedding Bitcoin into global financial systems.

Metaplanet’s ambitious Bitcoin plan highlights the cryptocurrency’s growing role as a strategic asset in an uncertain economic environment. By committing to hold 100,000 BTC by 2026 and aiming for 210,000 BTC by 2027, the company sets a precedent for large-scale corporate Bitcoin adoption. As the global financial landscape evolves, Bitcoin’s scarcity and independence make it an increasingly attractive asset for companies seeking long-term stability and growth.

Leave a Reply