Coinbase Premium Soars Amid Renewed US Demand

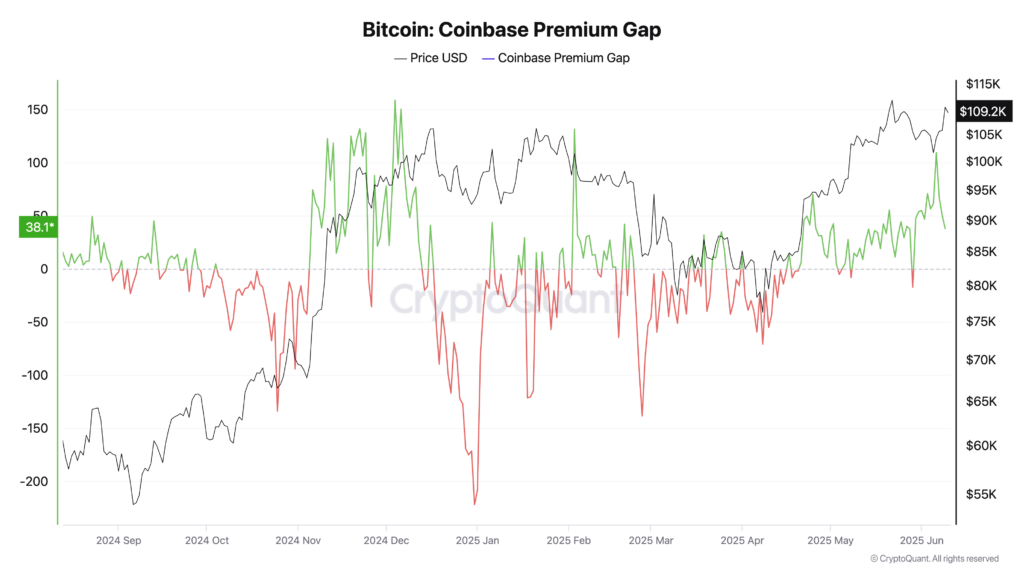

The price gap between Bitcoin on US-based Coinbase and global exchanges has reached its highest point in four months, signalling a strong resurgence in American demand for the leading cryptocurrency. According to on-chain analytics platform CryptoQuant, the Coinbase Premium—an indicator measuring the price difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair—hit $109.55 on 6 June, marking the largest premium since 3 February.

This uptick is considered a reflection of increased buying pressure from US investors. The Coinbase Premium is often seen as a proxy for retail and institutional appetite in the US market, and its rise suggests a bullish sentiment returning to American traders and institutions alike.

CryptoQuant contributor Crypto Dan highlighted that this pattern, emerging without signs of market overheating, is typical in recovery phases following corrections. “This positive movement… suggests optimistic trends in the cryptocurrency market in the second half of 2025,” he wrote in a 10 June market update.

US Institutional Interest Back in Focus

Institutional interest in Bitcoin also appears to be rebounding. Recent volatility, which saw BTC/USD briefly retesting the $100,000 support level, had triggered a momentary pullback in institutional flows. However, confidence seems to be returning swiftly.

One of the most notable examples is BlackRock’s iShares Bitcoin Trust (IBIT), which recently became the fastest ETF to reach $70 billion in assets under management. This surge is being interpreted as a sign that major investors are once again committing capital to Bitcoin, encouraged by long-term macro trends and market stabilisation.

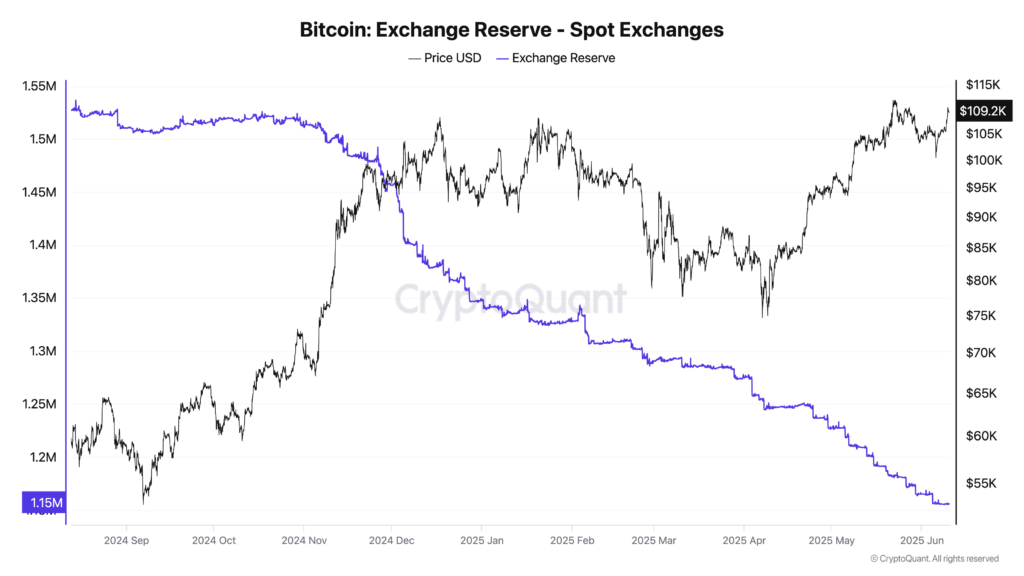

Exchange Reserves Plummet as Holders Accumulate

A parallel trend driving this bullish momentum is the sharp drop in Bitcoin reserves held on spot exchanges. According to CryptoQuant, over 550,000 BTC have been withdrawn from such platforms since July 2024—a reduction of nearly one-third in less than a year.

The declining reserves suggest that investors are increasingly moving their holdings to private wallets, a common sign of long-term holding behaviour rather than short-term speculation. “Every rally is the result of unseen preparation,” noted CryptoQuant contributor Baykuş in a recent post. “They’re not day trading, they’re holding for the long term.”

This trend supports a classic supply-demand narrative. With fewer coins available on exchanges, supply pressure eases, potentially setting the stage for price appreciation.

No Signs of Overheating Despite Price Momentum

Despite this wave of optimism, analysts stress that there is currently no indication of overheating in the market. Historically, overheating in crypto markets has been associated with rapid price increases, excessive leverage, and euphoric sentiment—all of which are largely absent from the present environment.

Crypto Dan’s analysis described the current phase as one of steady recovery, marked by gradual accumulation rather than speculative mania. Such a backdrop is often seen as healthy and sustainable for long-term price growth.

Looking Ahead: Bullish Signals Into 2025

The confluence of rising US demand, increasing institutional participation, and declining exchange reserves paints a largely bullish picture for Bitcoin going into the latter half of 2025. While short-term fluctuations remain possible, the underlying data suggests a strengthening foundation for further price gains.

CryptoQuant’s insights offer a reminder that much of the groundwork for major rallies occurs quietly, behind the scenes. As the cryptocurrency marches towards the $110,000 mark, the market seems to be shifting from speculative hype to strategic accumulation—a signal that the next leg of the bull cycle may already be underway.

Leave a Reply