London, 10 June 2025 — American Bitcoin, a cryptocurrency mining firm backed by Eric Trump and Donald Trump Jr., has quietly built up a reserve of 215 BTC, currently valued at over $23 million, since its official launch on 1 April. The company, known formally as ABTC, is preparing to go public through a merger with Gryphon Digital Mining, according to a filing made with the U.S. Securities and Exchange Commission (SEC) on 6 June.

Strategic Bitcoin Accumulation at the Core

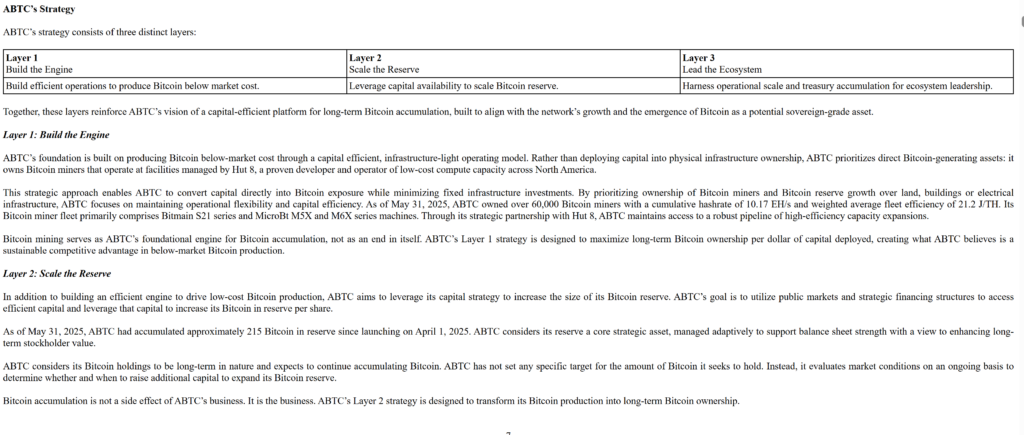

ABTC has positioned itself not simply as a mining company, but as a long-term accumulator of Bitcoin. The firm disclosed that its growing BTC reserve is a central strategic asset, managed with the goal of enhancing shareholder value. Unlike many mining firms that liquidate their holdings to manage operational costs, ABTC sees accumulation as its core mission.

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in its filing, further elaborating that the firm maintains an open-ended accumulation strategy. Rather than targeting a fixed number of Bitcoins, it will continue to assess market conditions and raise capital when favourable, expanding its holdings accordingly.

Efficient Mining Without Real Estate Ownership

The company currently operates over 60,000 mining rigs sourced from major manufacturers Bitmain and MicroBT. These miners are distributed across three data centres managed by Hut 8, located in New York, Alberta, and Texas. This outsourcing model allows ABTC to avoid direct investment in real estate and infrastructure while maintaining a combined hashrate of 10.17 exahashes per second and an average efficiency of 21.2 joules per terahash.

The mining operations contribute computational power to well-established pools such as Foundry and Luxor. In return, ABTC receives daily rewards proportional to its hashrate contribution, with minimal pool fees of under 1%. By maintaining a lean operational footprint, the company aims to preserve capital flexibility and scale output efficiently.

Secure Storage and Custody Measures

To safeguard its growing Bitcoin reserves, ABTC has partnered with Coinbase Custody for secure cold wallet storage. The firm has implemented robust security protocols, including multi-factor authentication and whitelisted withdrawal procedures, ensuring a high level of protection for its digital assets.

This focus on security is part of a broader three-pronged strategy that underpins ABTC’s operations: building a low-cost, efficient mining system; leveraging capital for Bitcoin acquisition; and actively participating in the wider Bitcoin ecosystem.

Merger With Gryphon and Future Prospects

On 12 May, ABTC confirmed it would go public via a merger with Gryphon Digital Mining. The deal, structured as a stock-for-stock transaction, will result in the combined entity continuing under the American Bitcoin brand. Post-merger, Eric Trump is set to join the board of directors, while Hut 8 — which currently owns a majority stake in ABTC — will continue managing mining operations.

Following the merger, American Bitcoin’s existing shareholders will retain approximately 98% of the new entity. Hut 8 is expected to play a key role going forward, maintaining control over infrastructure and operational management through long-term agreements.

As American Bitcoin gears up for its public debut, its combination of strategic accumulation, efficient mining practices, and high-profile backing positions it as a distinctive player in the evolving crypto-mining landscape.

Leave a Reply