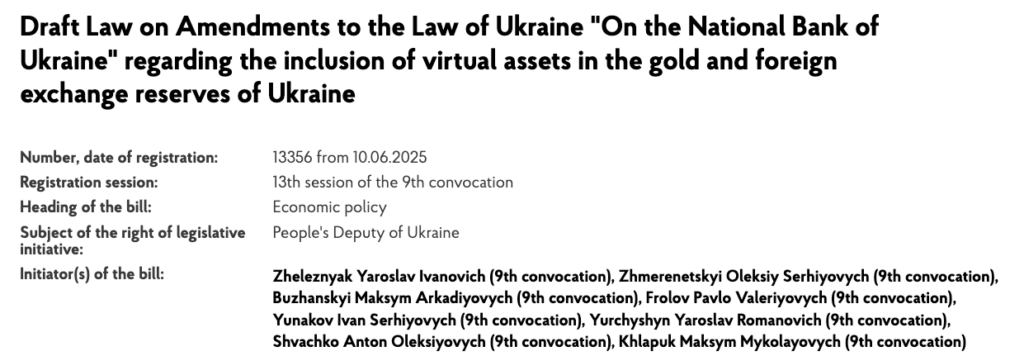

As the world increasingly leans toward financial innovation, Ukraine has taken a notable step in exploring the use of cryptocurrencies in national monetary policy. On Tuesday, a landmark draft bill numbered 13356 was introduced to the Verkhovna Rada, Ukraine’s parliament, that could allow the National Bank of Ukraine (NBU) to hold cryptocurrencies like Bitcoin as part of its official state reserves.

While the bill empowers the central bank to consider digital assets alongside traditional reserve instruments such as gold and foreign currencies, it does not obligate the NBU to act. Rather, the decision on whether to include crypto, how much to allocate, and when to do so is left entirely to the bank’s discretion.

Legislative Flexibility, Not a Mandate

The bill is designed as a permissive, not prescriptive, amendment to Ukraine’s existing Law on the National Bank of Ukraine. According to Yaroslav Zhelezniak, a member of parliament and one of the bill’s backers, the goal is to grant the central bank the option to diversify its holdings into crypto assets if it deems appropriate.

“How, when and how much should be the decision of the regulator itself,” said Zhelezniak, who announced the bill via his official Telegram channel. His remarks clarify that the move should not be seen as a crypto endorsement campaign but rather an effort to stay abreast of global financial trends.

This flexible approach could appeal to cautious central bankers while laying the groundwork for future adoption of crypto reserves, should the global environment and Ukraine’s economic needs align.

Bolstering Stability Through Crypto?

Proponents of the bill argue that establishing a potential crypto reserve could play a strategic role in strengthening Ukraine’s macroeconomic stability and digital economy. Zhelezniak, in a video discussion with Kyrylo Khomiakov, regional head at Binance for Central and Eastern Europe and Central Asia, framed the legislation as a gateway to greater financial resilience and global integration.

“Proper management of crypto reserves will help strengthen macroeconomic stability and create new opportunities for the development of the digital economy,” Zhelezniak noted.

Khomiakov, who reportedly assisted in drafting the legislation, has been instrumental in Binance’s ongoing advisory efforts with governments worldwide regarding crypto reserves. His involvement underscores growing collaboration between public institutions and crypto industry leaders.

Strategic Timing Amid Geopolitical Uncertainty

The bill’s timing is particularly noteworthy. Ukraine remains embroiled in its ongoing war with Russia, and this initiative appears to reflect a forward-looking strategy to enhance economic tools amid geopolitical and financial uncertainty.

By signalling openness to cryptocurrencies in its national reserves, Ukraine aligns itself with a global movement led by countries such as El Salvador which famously made Bitcoin legal tender and the United States, where discussions around state-held digital assets have become more frequent.

Zhelezniak acknowledged this global context in his commentary, stating, “This story has the right to life, and, as we see, many countries are implementing it.”

Expert Involvement and Legal Engineering

Beyond Khomiakov’s input, the bill also features contributions from Petr Bilyk, head of the AI practice at Juscutum Legal Engineering and a member of Ukraine’s expert committee on AI development. Bilyk’s involvement hints at a tech-forward legislative strategy, one that blends blockchain innovation with legal and regulatory expertise.

With such diverse input from both tech industry experts and seasoned lawmakers, the bill aims to serve as a practical framework, not just a symbolic gesture. It builds on prior government efforts to regulate the crypto sector while remaining cautiously open to adoption.

A Cautious Yet Pioneering Step

Ukraine’s new draft bill on crypto reserves represents a measured yet bold move toward financial innovation. It does not impose new requirements on the central bank, but it opens the door for future crypto integration, a clear signal that Ukraine wants to be ready for the next phase of digital finance.

As the global financial system continues to evolve, Ukraine appears determined not to be left behind, positioning itself as a potential early adopter of crypto in state finance, without rushing into uncharted territory.

Leave a Reply