Hamster Kombat (HMSTR), once a trending tap-to-earn token on Telegram, has seen its bubble burst in dramatic fashion. After enjoying a wave of hype and interest earlier this year, the token is now facing a sharp decline. With its price dropping by over 65% year-to-date and hitting a new all-time low of $0.0010, many investors are wondering.

Massive Whale Sell-Off Triggers Price Crash

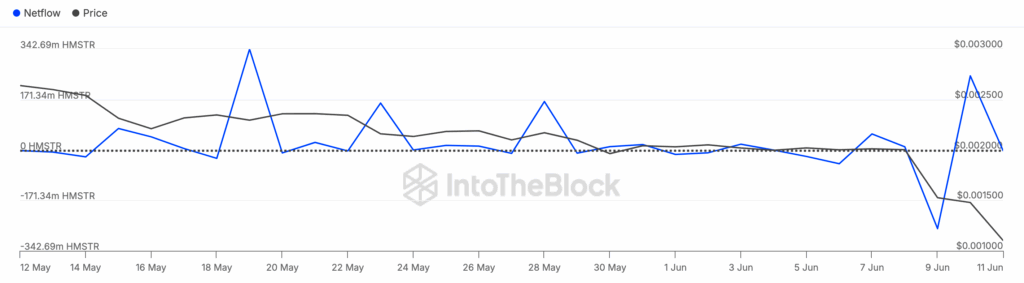

One of the biggest reasons behind HMSTR’s steep fall is a huge sell-off by whales, investors who hold large amounts of the token. According to blockchain data from IntoTheBlock, the “large holders’ netflow” a measure of whether big players are buying or selling has dropped by a whopping 90% in just one week.

On June 10, whale inflows stood at 251.99 million HMSTR. Today, that number has all but vanished. This suggests large holders are dumping their tokens, putting strong downward pressure on the price.

When big investors pull out, it usually shakes market confidence and that’s exactly what’s happening to HMSTR.

Fading Hype Around Tap-to-Earn Model

Hamster Kombat gained early traction thanks to its tap-to-earn gameplay on Telegram. But like many trends in crypto, the excitement didn’t last. Interest in tap-to-earn tokens has cooled off, and with it, demand for HMSTR has dropped significantly.

Making matters worse, the token has a massive circulating supply, 64 billion out of a total 100 billion tokens are already in the market. That’s a lot of supply with not enough demand to match it. Future unlocks could flood the market with even more tokens, creating further downside risk.

This oversupply and falling demand make it tough for HMSTR to gain any sustainable upward momentum.

Market Sentiment Turns Negative

Traders have also started turning away from HMSTR, and market sentiment has become clearly bearish. One strong indicator of this is the funding rate, a measure used in derivatives markets.

In bullish markets, long traders usually pay short traders, a sign that buyers are confident. However, in HMSTR’s case, shorts are paying less or even getting paid to stay in the trade. This points to a seller-dominated market where bearish traders are being rewarded.

With so little buying interest and funding rates favouring sellers, the short-term outlook for HMSTR remains gloomy.

Technical Indicators Confirm Bearish Trend

From a charting perspective, the situation doesn’t look much better. The MACD (Moving Average Convergence Divergence), a popular trend indicator, has flashed a bearish crossover, a signal that more downside may be ahead.

Meanwhile, the Directional Movement Index (DMI) paints a grim picture too. The +DMI (green), which measures bullish strength, has dropped to a weak 5.41. In contrast, the -DMI (red), which shows bearish control, has surged to 45.85.

These indicators confirm that sellers are firmly in charge. Unless this technical setup changes, HMSTR could slide even further below the $0.0010 level.

However, if we see a shift like the MACD turning bullish or the DMI dropping, a short-term rebound to around $0.0023 could be possible. But that scenario looks unlikely for now.

Can HMSTR Recover?

Hamster Kombat’s fall from grace serves as a reminder of how quickly hype can fade in the crypto world. With whales exiting, supply outpacing demand, and sentiment turning sour, the token is deep in bearish territory.

While a rebound isn’t impossible, it would require a serious shift in both technical indicators and market interest. Until then, traders should tread cautiously and watch for signs of stabilisation.

Leave a Reply