Bitcoin appears to be mimicking a familiar bullish setup that previously triggered an 80% rally, as renewed geopolitical tensions between Israel and Iran send ripples across financial markets. Market analysts are pointing to a combination of technical support, macro tailwinds, and whale accumulation as signs that the cryptocurrency could soon break out to new all-time highs.

Bitcoin Rebounds After Israel-Iran Conflict Escalates

On Friday, Bitcoin (BTC) bounced back after a sharp 5.5% drop, triggered by renewed conflict in the Middle East. The cryptocurrency slid to a low of approximately $102,800 following Israel’s airstrikes on Iranian targets. However, it quickly recovered a portion of its losses, climbing above $105,500 by the end of the day.

This rebound marks a successful retest of the 50-day simple moving average (SMA), a key technical support level closely watched by traders. The 50-day SMA has consistently served as a reliable price floor during previous pullbacks, most notably during October 2024. Back then, Bitcoin fell by 8.8% following Iran’s missile attacks on Israel, only to bottom near $60,500 and rally more than 80% by December, peaking at around $108,365.

Technical Patterns Signal Possible Breakout

The current price action bears a striking resemblance to that late-2024 setup. According to crypto market analyst Merlijn The Trader, Bitcoin is once again displaying a fractal pattern that suggests a breakout may be imminent. His analysis highlights a “liquidity grab” structure—where short-term price dips attract sellers, only to be followed by a sharp reversal upward.

“Same structure. Same trap. Same breakout,” he commented on social media, comparing the current trend to the previous bull run. He noted that Bitcoin is breaking above a descending trendline and key resistance levels, just as it did before surpassing the $100,000 milestone last year.

This pattern, often driven by trader psychology and market liquidity dynamics, is seen as a potential precursor to another major price surge.

Geopolitical Events Often Followed by Recovery

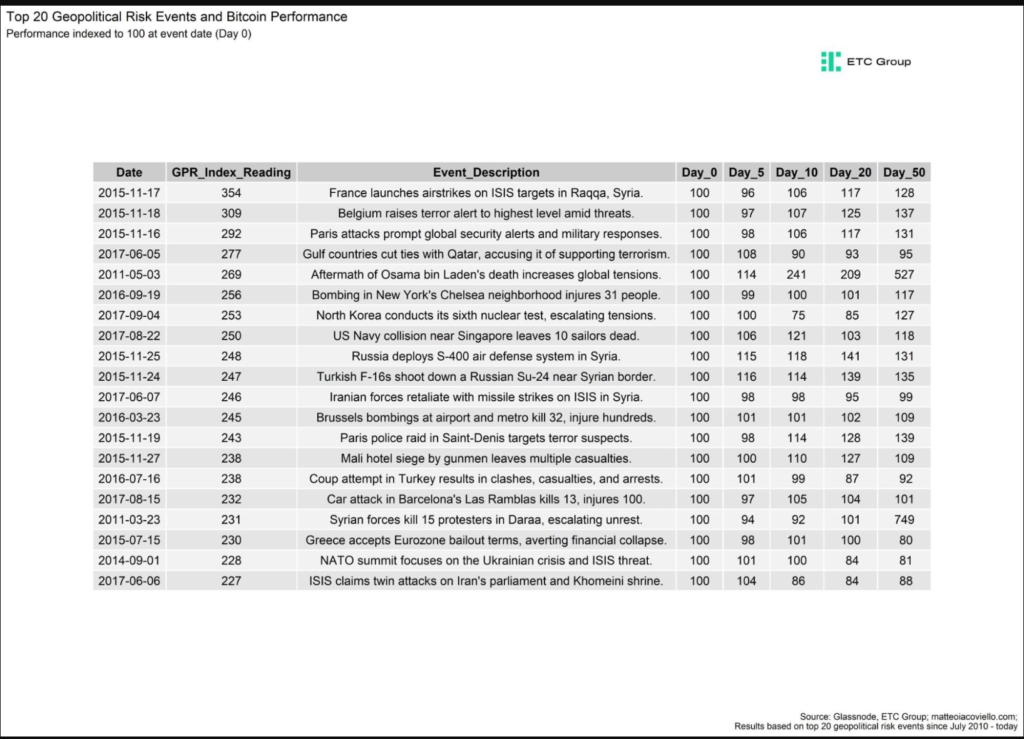

Andre Dragosch, head of research at Bitwise’s ETC Group, supports the view that Bitcoin typically recovers quickly after geopolitical shocks. His study indicates that while such events cause short-term declines, BTC generally rebounds within 50 days and often exceeds pre-event price levels.

This resilience may be rooted in Bitcoin’s perception as a non-sovereign store of value, particularly in times of economic or geopolitical uncertainty. As traditional markets waver, investors often turn to BTC as a hedge, driving demand even during periods of heightened global tension.

Whales Buy the Dip as Macro Tailwinds Strengthen

Adding to the bullish sentiment is the evidence of renewed whale accumulation. On-chain data shows that large investors are purchasing Bitcoin during this dip, a common indicator of confidence in the asset’s long-term trajectory.

At the same time, macroeconomic conditions are beginning to favour risk assets. The rising likelihood of interest rate cuts by the Federal Reserve, combined with signs of easing tensions in US-China trade relations, is creating a more supportive environment for Bitcoin and other cryptocurrencies.

These factors, combined with historical patterns, are leading some analysts to predict new all-time highs in the coming months.

Price Targets Range from $150K to $200K in 2025

With Bitcoin currently trading around $105,290, many in the crypto community believe the asset could breach its previous record of $112,000 and continue climbing. Forecasts for year-end 2025 range from $150,000 to over $200,000, based on both technical and macroeconomic analyses.

However, not all analysts are convinced. Some warn that Bitcoin’s current uptrend may be losing momentum, especially after its recent peak. One contrarian view suggests that the cryptocurrency might have already exhausted much of its bullish potential for the near term.

Despite such concerns, the broader market outlook remains optimistic. As long as Bitcoin holds key support levels and whale accumulation continues, the cryptocurrency may be poised for another explosive rally—mirroring the one that followed the Israel-Iran conflict in late 2024.

Leave a Reply