Tether Tightens AML Measures

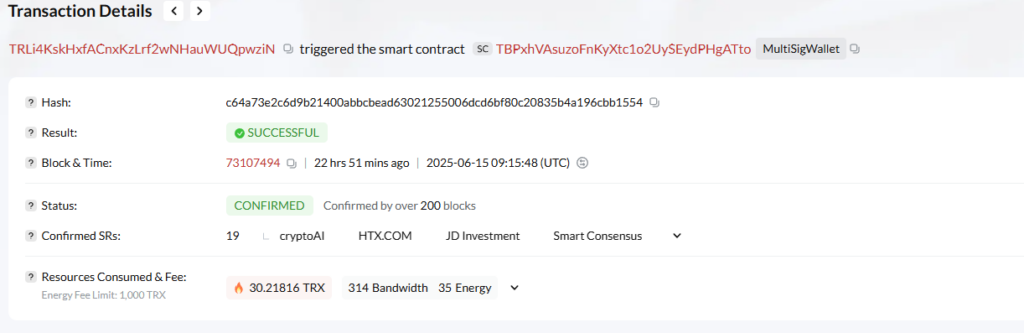

Tether, the issuer behind the world’s largest stablecoin USDt, has frozen over $12.3 million worth of USDT on the Tron blockchain. The move, executed at 9:15 am UTC on Sunday, is part of Tether’s ongoing crackdown on illicit activity and suspected Anti-Money Laundering (AML) violations.

Although the company has not yet released an official statement regarding this specific action, blockchain data from Tronscan confirms the freeze. The decision is believed to be linked to potential breaches involving sanctions or AML regulations, as Tether enforces strict compliance policies aligned with international regulatory bodies.

In a previous blog post dated 7 March, Tether emphasised its adherence to the U.S. Treasury’s Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) list. “Tether enforces a strict wallet-freezing policy to combat money laundering, nuclear proliferation and terrorist financing,” the company stated.

History of Strategic Freezes

This latest freeze follows a similar action on 6 March, when Tether locked $27 million worth of USDT on wallets connected to the Russian crypto exchange Garantex. The same day, Garantex suspended operations, accusing Tether of joining what it called “a war against the Russian crypto market.”

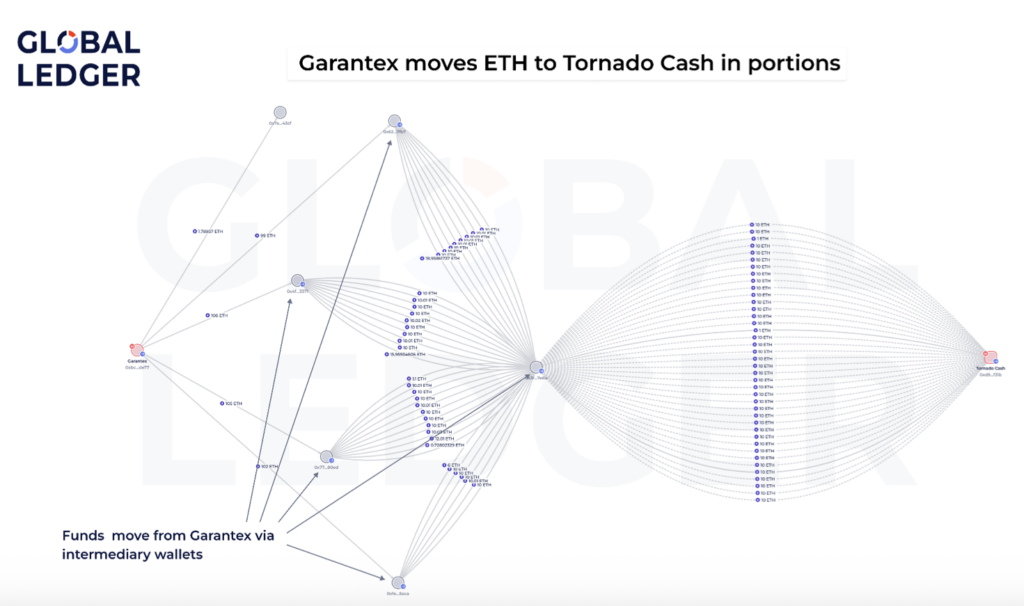

Garantex had previously come under fire from OFAC, which sanctioned the exchange in April 2022 for allegedly violating AML and other regulatory frameworks. Despite the sanction, blockchain analytics firm Global Ledger recently identified over $15 million in active reserves still linked to Garantex as of 5 June.

Lazarus Group Remains Under Watch

Tether’s freezing powers have drawn criticism from some decentralisation advocates. However, supporters argue that these capabilities have effectively disrupted the flow of illicit funds in the crypto space. One of the key beneficiaries of Tether’s actions has been the international fight against groups like North Korea’s Lazarus Group.

Active since 2009, the Lazarus Group is one of the most notorious state-backed hacking entities. Between 2020 and 2023 alone, the group laundered over $200 million in stolen cryptocurrency, and total thefts linked to the group have exceeded $3 billion over six years. In November 2023, Tether blacklisted over $374,000 in stolen funds tied to Lazarus. Meanwhile, other stablecoin issuers have collectively frozen an additional $3.4 million linked to Lazarus-related addresses.

Tether’s Financial Crimes Unit Plays a Key Role

Central to these initiatives is the Tether-led T3 Financial Crimes Unit (FCU), which collaborates with the Tron Network and blockchain intelligence firm TRM Labs. Launched in 2024, the FCU was established to assist global law enforcement in tracking and freezing crypto linked to financial crime. In its first six months alone, the unit helped block over $126 million worth of illicit USDT transactions.

While controversial, Tether’s robust response to suspicious activities highlights the growing importance of stablecoin issuers in maintaining financial integrity within the decentralised finance ecosystem.

Leave a Reply