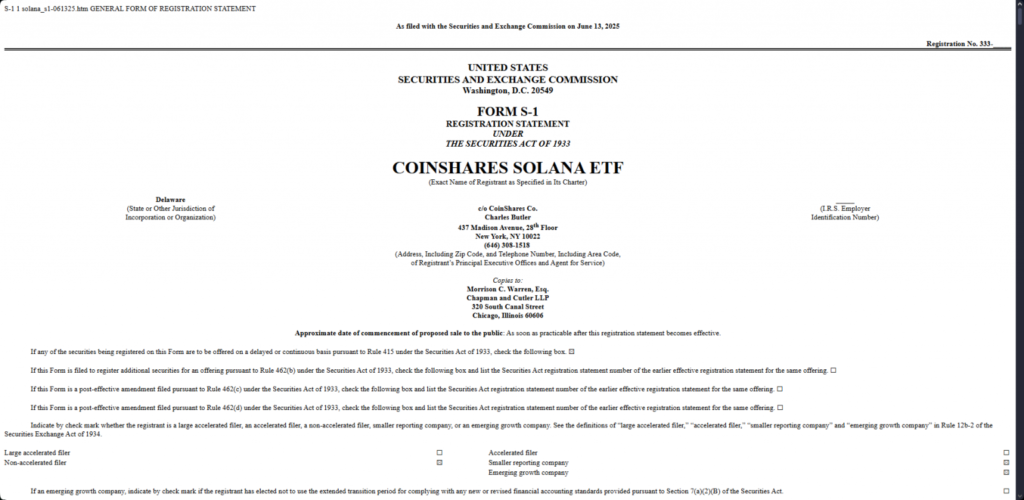

CoinShares has officially entered the race to launch a Solana Spot ETF, becoming the eighth firm to file for such a product with the U.S. Securities and Exchange Commission (SEC). As institutional demand for crypto investment vehicles grows, this filing signals a new wave of interest in Solana (SOL), one of the fastest-growing blockchain platforms in the market.

The application was submitted via a Form S-1 registration statement, with Coinbase Custody and BitGo Trust listed as custodians, two highly reputed names in digital asset security. This marks a strategic move by CoinShares to gain early footing in what could become the next big spot ETF approval, following recent momentum around Ethereum ETFs.

CoinShares Steps Into the Spotlight with Solana ETF

The move by CoinShares underscores a shift in focus from just Bitcoin and Ethereum towards alternative Layer-1 blockchain networks like Solana. This ETF would offer direct price exposure to SOL, giving investors the ability to benefit from its staking rewards, a feature that sets it apart from other spot ETF products.

According to ETF expert Eric Balchunas, the race for a Solana ETF is heating up fast:

“CoinShares has just become the eighth firm to file for a spot Solana ETF, further intensifying the race. Tons of engagement with the SEC, issuers are quickly updating/redrafting S-1s. Momentum is notably higher compared to pre-ETH ETF days.”

Balchunas’ comments reflect the growing interest in bringing regulated, institution-friendly crypto products to the market at a faster pace than seen before.

Market Reaction: Price and Sentiment on the Rise

The news of the CoinShares filing has had an immediate positive impact on Solana’s market sentiment. As of now, SOL is trading at $157.18 with a market cap of $82.95 billion, making it one of the top-performing digital assets in 2025. Analysts estimate a 70% to 90% chance of SEC approval, citing the regulator’s recent openness to crypto-based ETFs and the growing push for financial innovation.

This optimism is not unfounded. Previous rejections of crypto ETFs were based on concerns around market manipulation and custody risks, but with trusted custodians like Coinbase and BitGo involved, these concerns appear to be weakening. The filing strengthens the case for Solana as a legitimate and investable digital asset.

Strong Fundamentals: Solana’s Growth Backs the ETF Narrative

Beyond just investor excitement, Solana’s strong on-chain metrics are also helping to support the case for a spot ETF. The Total Value Locked (TVL) in Solana’s ecosystem has now hit $8.7 billion, indicating robust network activity and growing developer adoption.

This rise in TVL is a sign that the Solana network is maturing with a healthy mix of DeFi, NFT, and real-world applications being built on it. For institutional investors, these fundamentals are key indicators of long-term value, especially when compared to meme coins or tokens with speculative use cases.

The Path to Mainstream Adoption

CoinShares’ entry into the Solana Spot ETF race is more than just a headline, it’s a strategic positioning within a changing regulatory and market landscape. As traditional financial institutions warm up to the idea of digital assets, products like these can serve as a bridge between crypto and mainstream finance.

If approved, the Solana ETF could attract billions in inflows, further strengthening the network and potentially driving SOL’s price even higher. As more firms join the filing queue and the SEC responds to the growing demand, Solana could soon follow Bitcoin and Ethereum in becoming part of a regulated investment portfolio.

Leave a Reply