Iran’s largest cryptocurrency exchange, Nobitex, has fallen victim to a significant hack, losing over $81 million in digital assets. The attack, attributed to the pro-Israel hacker group “Gonjeshke Darande,” exploited the exchange’s hot wallets using vanity addresses, according to onchain investigator ZachXBT.

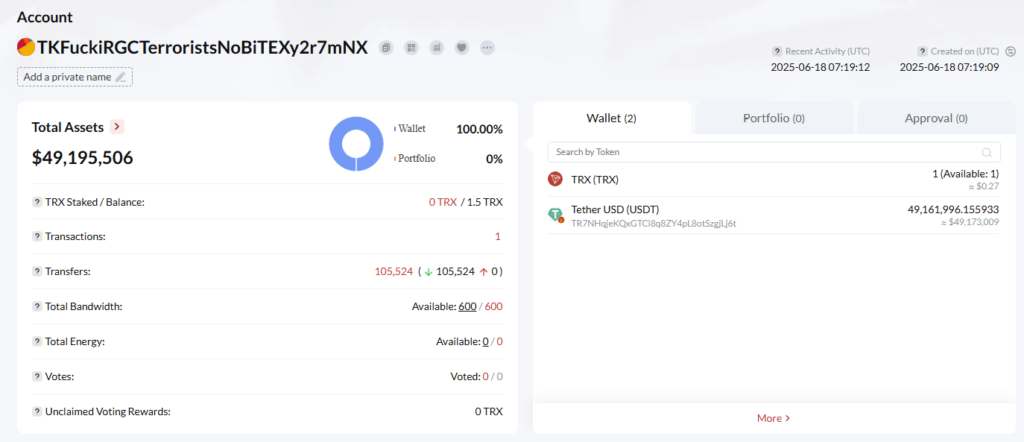

The first exploit address, “TKFuckiRGCTerroristsNoBiTEXy2r7mNX,” was used to siphon $49 million. A second, “0xffFFfFFffFFffFfFffFFfFfFfFFFFfFfFFFFDead,” facilitated further theft, with stolen funds spread across Tron and Ethereum-compatible blockchains.

Nobitex acknowledged the breach, confirming “unauthorised access” to a portion of its hot wallets, which were immediately suspended. The exchange assured users that their assets held in cold storage remain safe, promising to compensate affected funds through its insurance reserve.

Security Flaws and Stolen Assets

Blockchain security firm Cyvers identified critical failures in Nobitex’s access controls, allowing attackers to infiltrate systems and drain assets from multiple blockchains. Despite the large-scale theft, the stolen funds remain unmoved, raising questions about the hackers’ intentions.

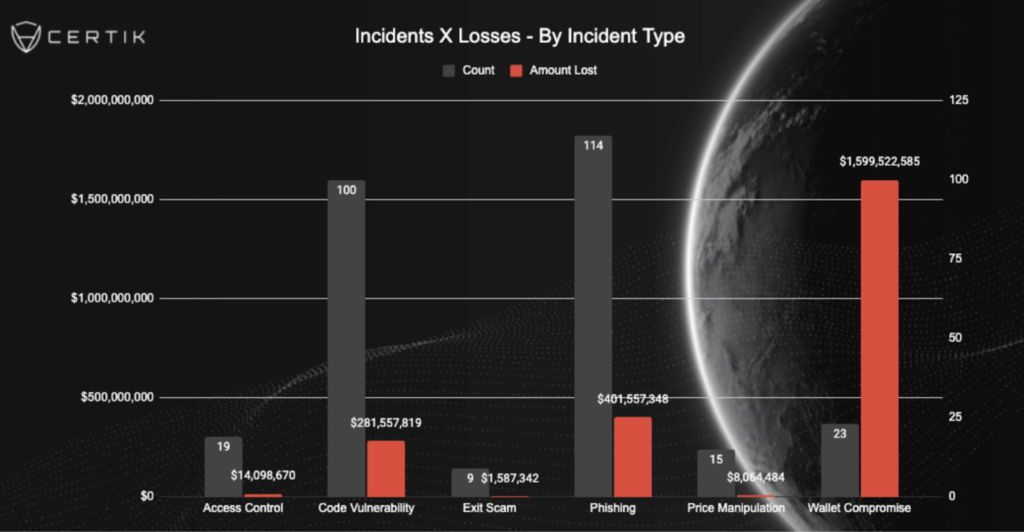

The breach reflects a broader trend in crypto security vulnerabilities. Blockchain security firm CertiK reports that over $2.1 billion in digital assets have been stolen in 2025 alone, primarily due to wallet compromises, operational errors, and key mismanagement. CertiK also notes a rise in social engineering scams, where psychological manipulation tricks users into transferring funds to fraudulent addresses.

Political Motivations Behind the Hack

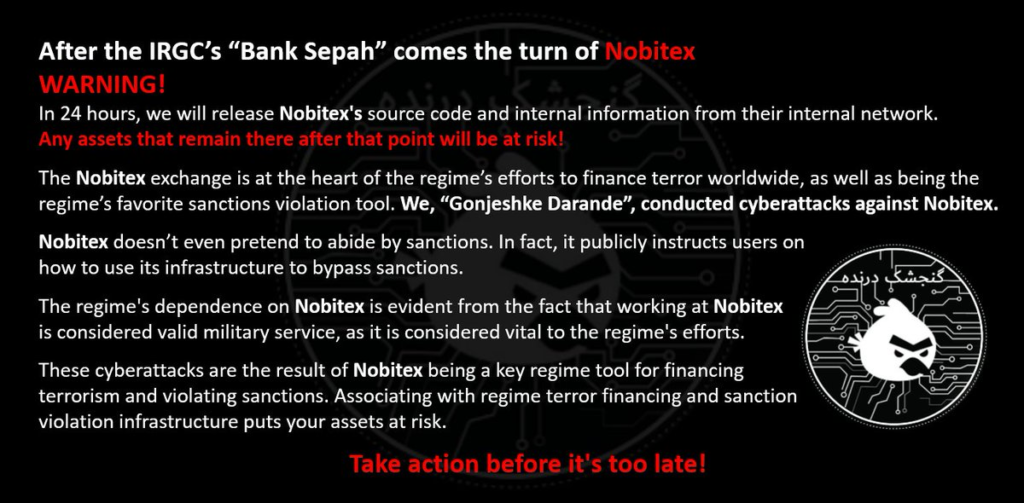

Unlike traditional financially motivated cybercrimes, the Nobitex exploit appears to carry a political message. The hacker group labelled Nobitex as a key tool for Iran’s regime to bypass sanctions and finance terrorism. In an X post, the group threatened to release Nobitex’s source code and internal files, warning users of imminent risks.

The timing of the hack coincides with escalating hostilities between Iran and Israel. On June 13, Israel launched its largest attack on Iran since the 1980s, with missile strikes leading to hundreds of casualties. In retaliation, Iran conducted strategic strikes, intensifying fears of a broader regional conflict.

Yehor Rudytsia, a security researcher at Hacken, remarked that the attack was likely a “political statement,” noting that assets across 20 tokens were sent to burner addresses. He added that the only potential recovery could come from Tether’s reissuance of $55 million in stolen USDT.

Community and Industry Implications

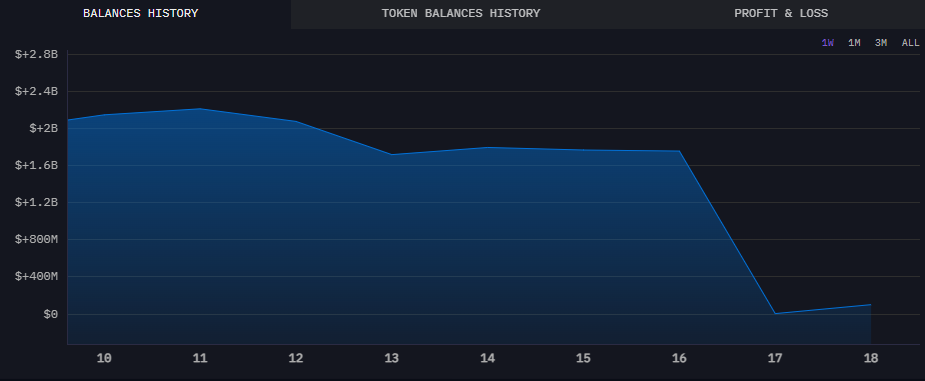

The Nobitex hack has sent ripples across the crypto community. Blockchain analytics firm Arkham reported that the exchange’s wallet holdings plunged by over 90% in just two days, from $1.8 billion to $96 million. However, Cyvers clarified that Nobitex frequently migrates its hot wallets, and this decline might not represent additional losses.

The incident highlights the need for robust access controls and security protocols in crypto exchanges. As geopolitical tensions merge with cyber warfare, blockchain firms must prioritise resilience to ensure user safety and market stability.

A Grim Reminder for Crypto Security

The Nobitex breach underscores the dual threats facing the crypto industry: advanced cyber-attacks and their potential entanglement with geopolitical conflicts. While Nobitex’s promise to compensate users provides some reassurance, the hack serves as a stark reminder of the vulnerabilities within blockchain systems.

As the crypto landscape evolves, exchanges must bolster security measures to safeguard assets and maintain investor confidence in an increasingly volatile world.

Leave a Reply