Bitcoin’s recent price action has sparked concerns of a deeper correction as the flagship cryptocurrency struggles to break above the $110,000 level. This marks the third time in recent months that BTC has failed to sustain momentum beyond this key psychological threshold, raising questions about the strength of the current rally.

BTC Rejected Again at $110K

After a brief push towards $110,000, Bitcoin’s price rally has stalled once again, largely due to the impact of strong US employment data and growing overhead resistance. The BTC/USD pair is currently trading around $109,100, with the $110,000 level acting as a major barrier.

Technical indicators suggest that the bulls are facing serious hurdles. Bearish divergences in the relative strength index (RSI), combined with high taker-sell volume near $110,000, reflect rising selling pressure. Meanwhile, neutral funding rates in the futures market indicate hesitation among traders, suggesting that momentum is weakening.

History Signals Possible 14–18% Decline

Historically, Bitcoin’s multiple rejections near all-time highs have often led to significant downturns. A similar scenario unfolded in January when BTC was rejected at $107,000 — just below its then-record high — leading to a 14% drop over the following two weeks. Likewise, multiple rejections at $72,000 in March 2024 preceded an 18% fall within ten days.

If history repeats itself, Bitcoin could face a correction of 14–18% from current levels, dragging the price well below $100,000. The $110,000 zone, therefore, remains a make-or-break level in the short term.

Critical Levels Below $110K

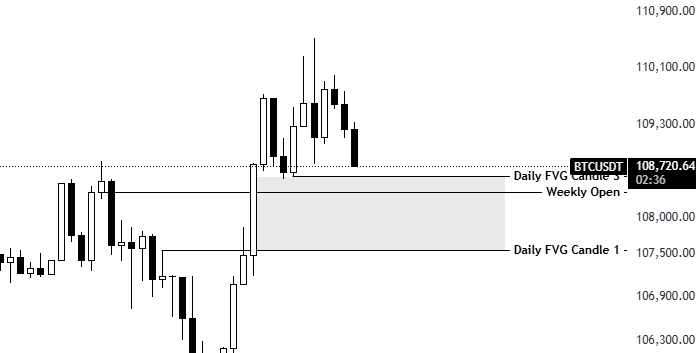

Data from TradingView identifies several key support zones beneath the current market price. The immediate area of interest lies between $107,500 — where the 50-day Simple Moving Average (SMA) is currently positioned — and $106,000, the point where the 100-day and 200-day SMAs converge.

A further drop could push BTC towards the $105,200 local low observed earlier this week, with the $104,000 psychological support also in play. According to pseudonymous trader KillaXBT, Bitcoin could stage a recovery and rally to new all-time highs if it holds the $108,000–$107,500 range. However, a breakdown below this zone may open the door to a deeper correction.

Short Squeeze or Sell-Off Ahead?

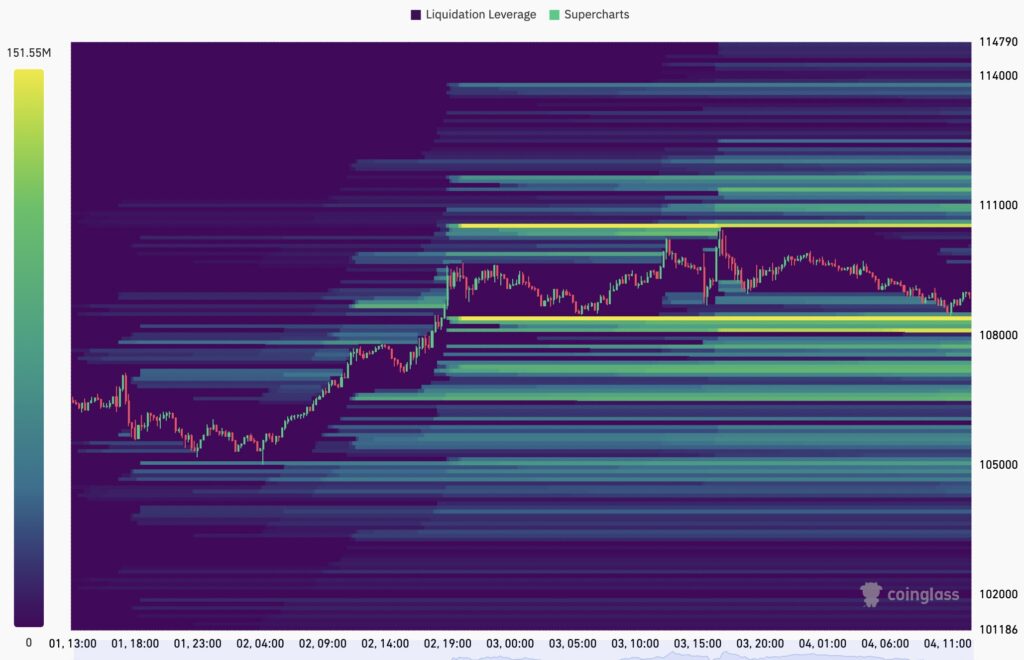

One factor that could trigger a sharp upside move is a short squeeze. According to CoinGlass data, the largest liquidation cluster — worth approximately $121 million — is currently positioned just above $110,000. If Bitcoin breaks this resistance, it may force short sellers to exit their positions, potentially driving prices as high as $114,000.

Screenshot

On the flip side, heavy bid orders are clustered around $108,000, with additional support bands extending from $107,700 to $105,000. These orders could provide some cushioning if the market corrects further, but only a decisive break above the $112,000 region would likely signal a return to price discovery.

Outlook Remains Uncertain

The ongoing struggle around $110,000 underscores the fragile balance between bullish optimism and bearish caution in the crypto market. For now, traders and analysts are closely watching whether BTC can hold key support levels or if a correction toward the $100,000 mark is on the cards.

If bulls manage to flip the $110,000 resistance into support, Bitcoin could be poised for another leg up. But if the level remains out of reach, history suggests a more painful retracement may soon follow.

Leave a Reply