President Donald Trump’s tariff letters to 14 countries has sent shockwaves through the global financial system with the crypto market bearing the brunt. Within 24 hours of the announcement, the total crypto market cap dropped by 4.5%, leading to a red day for top coins and related stocks alike.

Alongside cryptocurrencies, the US stock market and Bitcoin mining companies also took a hit, pointing to broader investor anxiety over escalating trade tensions and growing economic uncertainty.

Trump’s New Tariffs Spark Market Selloff

On July 7, President Trump issued tariff letters to 14 nations, including economic allies like Japan and South Korea, as well as smaller economies such as Bangladesh, Cambodia, South Africa, and Tunisia. The new tariffs, ranging from 25% to 40%, were framed as a response to ongoing trade imbalances.

Trump warned that any retaliation from these countries would be met with even harsher trade restrictions. According to The Kobeissi Letter, the White House is preparing more letters, as over 100 countries have yet to respond with acceptable trade agreements.

The aim, according to Trump, is to reduce trade deficits and push foreign governments into new deals. However, several economists argue that the approach is misguided.

“Our trade deficits aren’t caused by unfair tariffs but by American consumers preferring foreign goods,” economist Peter Schiff stated.

He noted that Japan’s average tariffs on US goods are under 2%, while South Korea’s are under 1%. In his view, the tariffs will do little to change trade deficits and could instead worsen the situation by weakening the dollar and raising import costs.

Crypto Prices Sink Across the Board

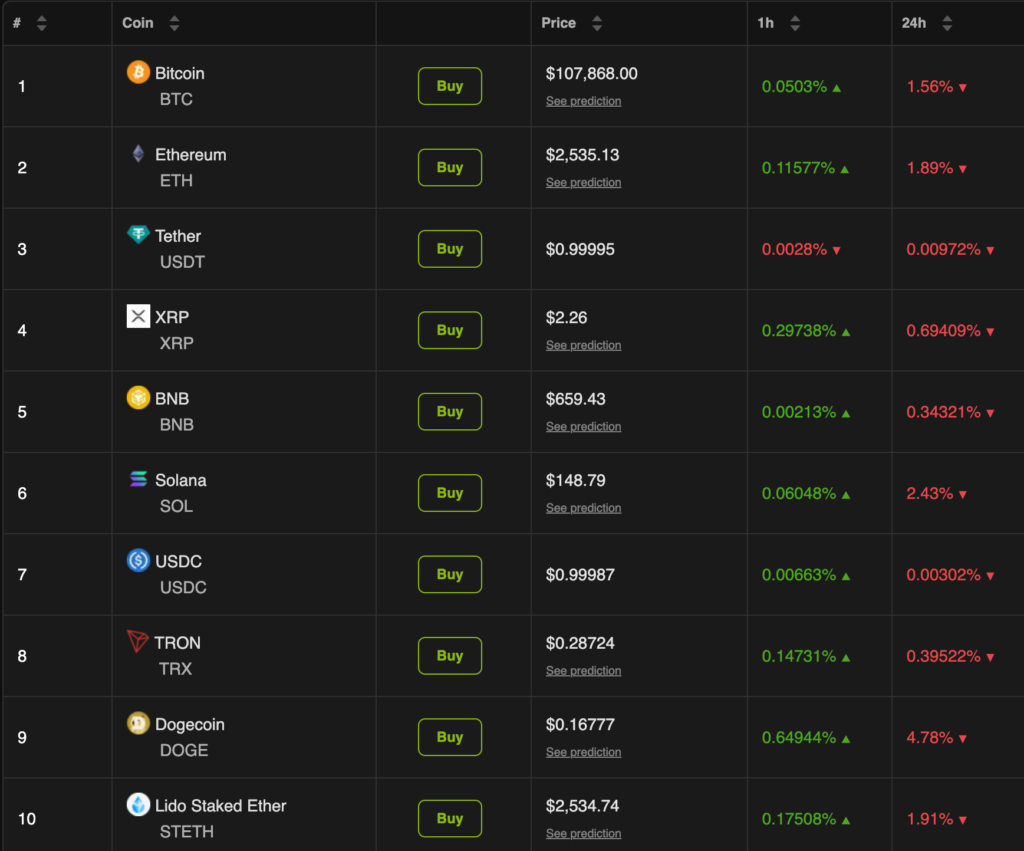

As the news broke, crypto investors reacted swiftly. According to BeInCrypto, all major cryptocurrencies saw losses:

- Bitcoin (BTC) fell 1.56%, dipping below $108,000, trading at $107,688

- Ethereum (ETH) dropped 1.89%, sitting at $2,535

- Dogecoin (DOGE) suffered the worst, plunging 4.78%

The broader crypto market cap shrank by 4.5% in just 24 hours, a significant move even for the volatile digital asset space.

Historically, crypto has often moved independently of traditional markets. However, in recent years, Bitcoin and altcoins have become more correlated with macroeconomic trends, especially those driven by US monetary policy and geopolitical tensions.

Trump’s tariffs, with their wide-ranging global impact, are the latest example of how non-crypto events can dramatically shake the crypto landscape.

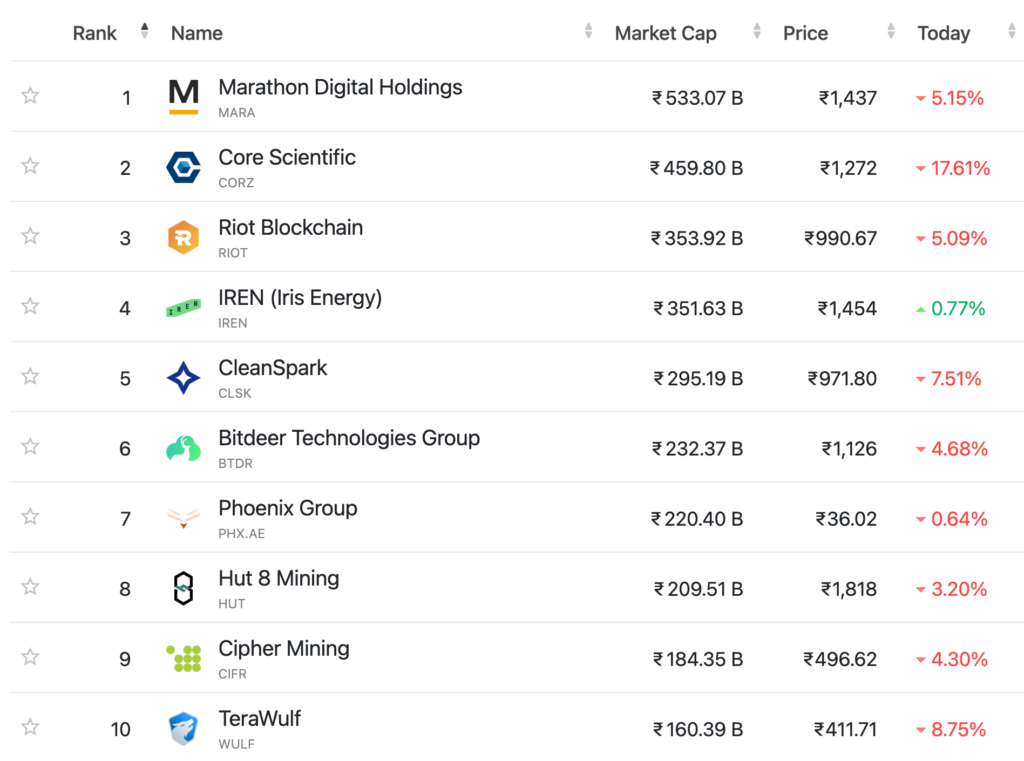

Crypto Stocks and Bitcoin Miners Hit Hard

The sell-off extended beyond coins to crypto-related stocks, many of which are publicly traded and highly sensitive to Bitcoin’s movements.

- MicroStrategy (MSTR) shares fell 2%

- Robinhood ended the day down 1%

- Bitcoin mining firms posted even deeper losses, though exact numbers varied across companies

Investors have grown cautious amid rising geopolitical risk and fears that tighter global trade could reduce institutional investment in digital assets.

Moreover, Bitcoin miners whose business models rely on steady price growth and cheap infrastructure are particularly vulnerable to global economic instability, supply chain issues, and higher energy prices, all of which could be worsened by global trade disruptions.

US Stock Market Joins the Downturn

Crypto wasn’t alone in its decline. Traditional US markets also slid sharply:

- Dow Jones dropped 422 points

- S&P 500 lost 49 points

- NASDAQ fell 188 points

Bond markets reacted too, with the 10-Year Treasury yield rising to 4.40%, nearing levels last seen during a previous trade pause announcement. Analysts say this rise in yields is more about deficit spending concerns than the trade war itself, but the timing shows how tightly markets are now linked to policy decisions.

According to The Kobeissi Letter:

“Deficit spending has completely taken control of long-term rates. Yields are rising regardless of the trade war situation.”

More Trouble Ahead?

The newly announced tariffs are set to go into effect on August 1. If affected countries retaliate or if further letters go out, markets could face continued pressure.

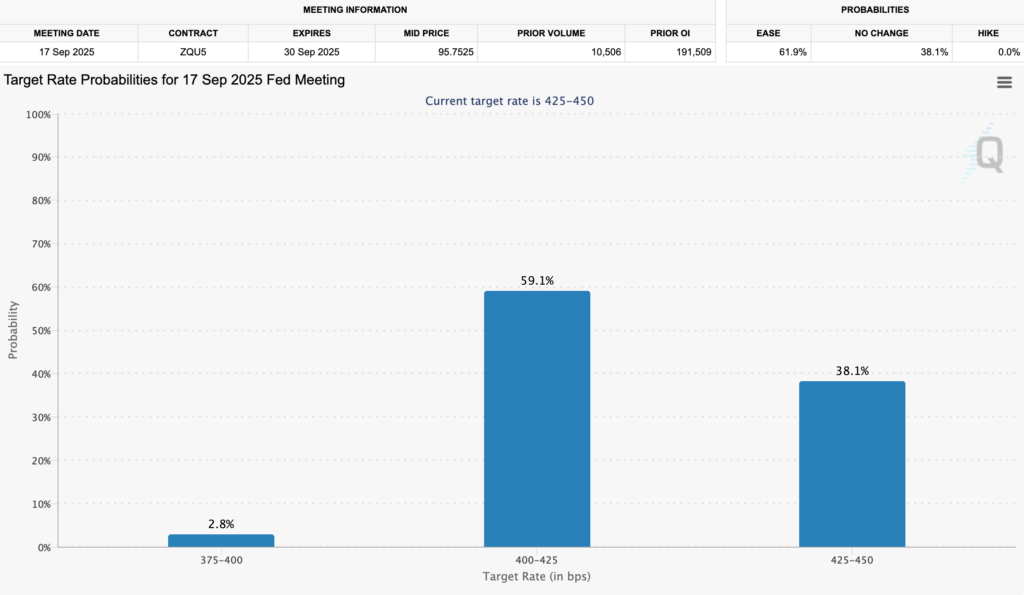

Meanwhile, the odds of an interest rate cut by the US Federal Reserve have also dropped, adding another layer of bearish sentiment. Data from the CME FedWatch Tool shows the likelihood of a July rate cut has fallen below 5%, while chances for a September cut now stand at 61.9%, down sharply from 90% just two weeks ago.

In April, similar tariff tensions that time between the US and China pushed Bitcoin below $80,000 and triggered massive liquidations. If history repeats, we could see another wave of price drops and liquidations across the crypto market.

Leave a Reply