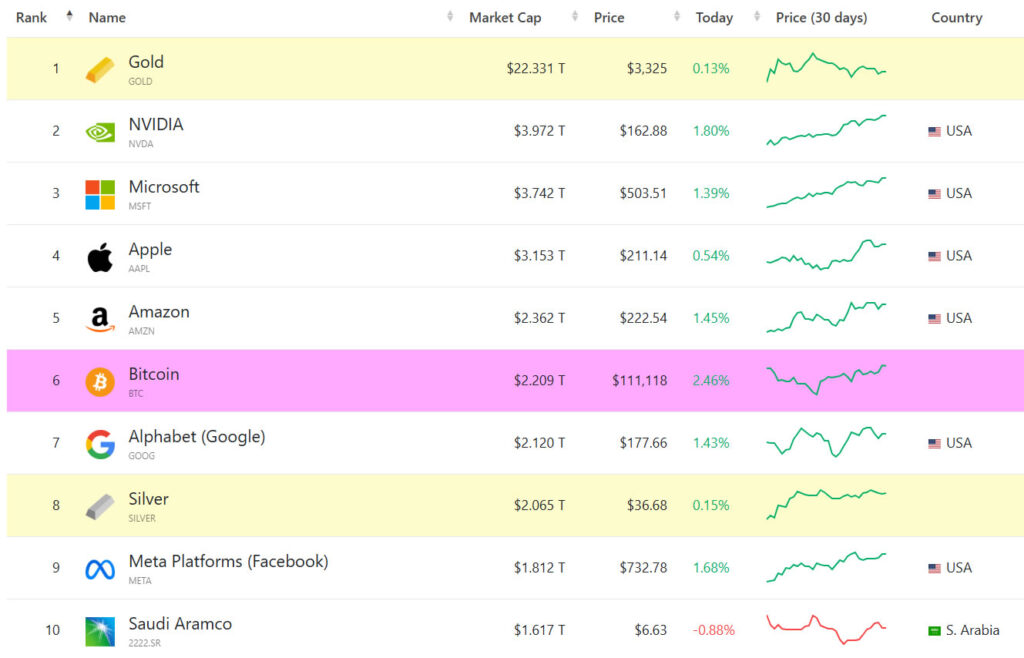

Nvidia has made history by becoming the first company to reach a $4 trillion market valuation, thanks to the ongoing global boom in artificial intelligence (AI). The American semiconductor company’s stock price surged to an all-time high of $164.32 recently, pushing its market cap past the record-breaking milestone.

Though the share price slightly dropped to $163.36 in after-hours trading, the increase was still enough to momentarily crown Nvidia as the most valuable company on Earth overtaking tech giants like Microsoft and Apple. This massive growth showcases how powerful the demand for AI computing has become in 2025.

Nvidia’s market capitalization is calculated by multiplying its 24.4 billion outstanding shares by the current share price. Even with the slight after-hours dip, the company’s value hovered around $3.98 trillion, holding strong above its competitors.

The Power Behind the Surge

The primary reason behind Nvidia’s record-breaking rise is simple: artificial intelligence. The tech industry is witnessing a major shift, with companies investing heavily in AI capabilities, data processing, and infrastructure. Nvidia, known for its powerful GPUs (graphics processing units), has become the go-to provider for AI chips.

Once known mainly for gaming and crypto mining chips, Nvidia has now rebranded itself as the backbone of AI computing. Industry analysts note that Nvidia is an early and clear winner in the AI race.

Robert Pavlik, a senior portfolio manager at Dakota Wealth, told Reuters that companies are now “shifting their asset spend in the direction of AI,” highlighting just how central AI has become to modern tech strategy.

From Setbacks to a Strong Comeback

Nvidia’s success wasn’t without hurdles. In early 2025, it suffered a $5.5 billion valuation drop due to concerns over Chinese AI competition and U.S. export restrictions. January also saw a major $600 billion market cap dip, raising investor concerns.

However, Nvidia staged a remarkable comeback. The company reported over $44 billion in revenue and $19 billion in earnings for Q1 2025, a 26% jump from the previous year. This robust performance restored investor confidence, boosting its stock price and placing it ahead of the S&P 500 index.

So far in 2025, Nvidia’s share price has climbed by 21.3%, far outperforming the broader S&P 500, which has risen only 6.5% in the same timeframe.

Bigger Than Crypto

Perhaps one of the most striking comparisons is Nvidia’s valuation versus the entire cryptocurrency market. At its peak, Nvidia’s $4 trillion market cap was larger than the entire crypto market, which sits at $3.53 trillion.

To put things into perspective:

- Bitcoin’s market cap is around $2.2 trillion, even after recently revisiting its all-time high.

- Microsoft has a market cap of $3.74 trillion, while Apple is valued at $3.15 trillion.

- Only Nvidia, Microsoft, and Apple are above the $3 trillion mark.

The comparison highlights how a single tech firm leading in AI has surpassed even the most valuable digital asset in history.

Nvidia’s rise to a $4 trillion valuation is more than just a financial headline, it signals a major shift in the global tech economy. As AI continues to reshape industries, Nvidia is riding the wave and leading the charge.

While crypto remains a revolutionary force, especially with Bitcoin’s strong recovery, Nvidia’s achievement shows where investors see the real-world value and utility being generated today in AI infrastructure, hardware, and computing power.

Leave a Reply