In a striking turn of events, the Trump-themed memecoin officially backed by US President Donald Trump has raked in over $172 million in trading fees for major crypto exchanges just six months after launch. According to a Reuters report, the coin’s explosive debut and unprecedented listing speed were driven by massive market demand, despite serious concerns over supply concentration and investor risk.

Top exchanges including Binance, Coinbase, OKX, MEXC, Bitget, Gate.io, Upbit, Crypto.com, Bybit, and HTX benefited from the hype, with some making millions in trading fees in a matter of weeks.

Listing Speed Shocks Market Observers

One of the standout revelations was how quickly these centralised exchanges (CEXs) listed the TRUMP token. On average, it took just four days from launch for TRUMP to be listed, while other popular memecoins like Pepe, Bonk, and Dogwifhat waited 129 days on average.

Coinbase was the fastest to act, approving the listing in just one day, despite past concerns about listing tokens with highly concentrated supply. “We were confident that users could engage with the token positively and safely,” said Paul Grewal, Coinbase’s Chief Legal Officer. He noted the coin was listed as an “experimental token” due to its volatility and risk profile.

Exchanges Ignored Red Flags

Reuters found that 80% of TRUMP’s total supply was held by Trump’s family and close partners. Normally, such concentration would be seen as a serious risk factor. However, many exchanges admitted they chose to ignore this red flag to meet overwhelming user demand.

Bitget CEO Gracy Chen admitted, “Eighty percent held by the team, even though there’s a bit of a lock-up period, is in my opinion very risky. But user trading volume overrode the so-called risky factor here.”

Even MEXC, another exchange that listed the token early, acknowledged that they compromised on due diligence in favour of capturing market momentum.

Users Lost Billions While Elites Profited

While exchanges and a select group of wallets profited massively, the broader user base did not fare well. Only 45 wallets reportedly generated $1.2 billion in profits, while a staggering 712,777 wallets collectively lost over $4.3 billion, showing the classic “pump-and-dump” pattern often seen in sentiment-driven tokens.

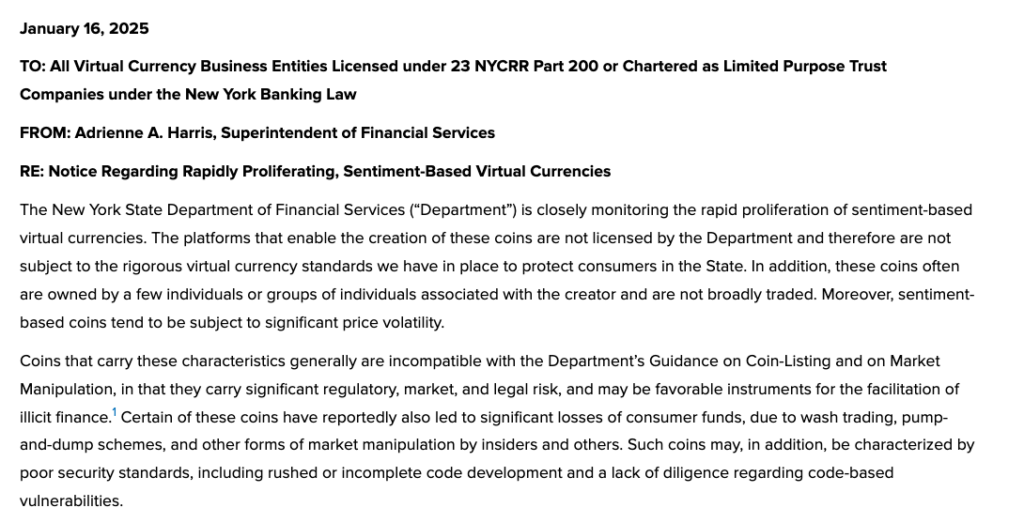

The New York State Department of Financial Services (NYDFS) had previously issued a warning about memecoins like TRUMP, citing risks of market manipulation, wash trading, and pump-and-dump schemes. In response to this, Coinbase blocked New York residents from accessing TRUMP, citing compliance with NYDFS guidance.

Trump Coin’s Operators Also Cashed In

Exchanges weren’t the only ones making big money. Earlier reports from the Financial Times estimated that TRUMP’s operators made $314 million in direct token sales and collected $36 million in Solana gas fees within just the first three months of launch. This paints a broader picture of a project that, while publicly branded as a populist crypto token, has funnelled enormous wealth to a small group of insiders and platforms.

The TRUMP memecoin saga highlights a troubling trend in crypto, where hype and market demand often outweigh caution and investor protection. While the coin’s meteoric rise has enriched exchanges and insiders, retail investors have largely borne the brunt of losses.

With regulatory scrutiny intensifying and concerns about market fairness growing, the TRUMP coin may become a defining case study in how centralised platforms prioritise profits over prudence in the fast-moving world of digital assets.

Leave a Reply