A Rapid-Fire Token Sale Breaks Records

On 12 July 2025, Solana-based meme coin launchpad Pump.fun stunned the crypto world by raising $500 million in just under 12 minutes. The initial coin offering (ICO) of its native token PUMP marked one of the most explosive retail-driven launches of the year, highlighting how retail fear of missing out (FOMO) has evolved in the decentralised finance space.

With 125 billion PUMP tokens up for grabs, representing just 12.5 percent of the total 1 trillion supply, the sale attracted over 10,000 wallets. The vast majority of the $500 million, more than $448 million, was processed directly through Solana, utilising its high-speed, low-cost infrastructure. Transfers were locked for 72 hours post-sale, intensifying scarcity and driving speculation.

Memecoins Meet Mass Participation

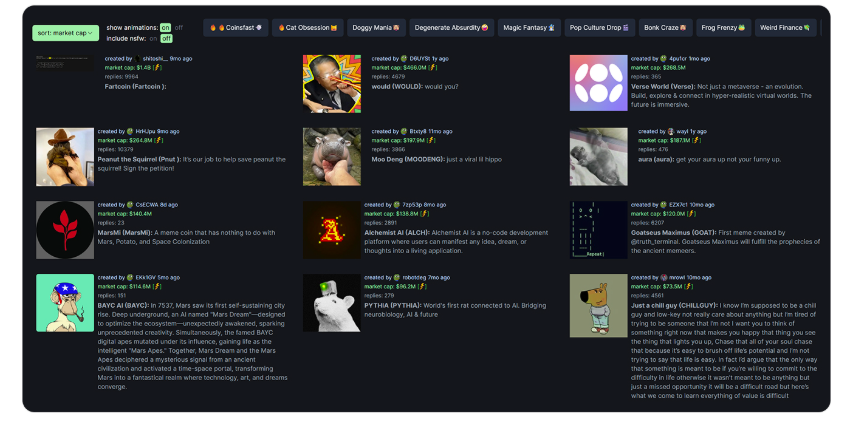

Launched in early 2024, Pump.fun quickly emerged as the go-to platform for spinning up meme coins on Solana, offering users the ability to create and trade tokens without writing any code. Its viral token launches, gamified mechanics, and livestreamed hype attracted an army of speculative traders.

The July ICO was Pump.fun’s own turn at centre stage. Pre-sale buzz was amplified by limited supply, locked transfers and a streamlined experience through PumpSwap, its proprietary swapping platform. Many wallets were pre-funded, and in some cases manipulated, with one whale reportedly seeding 500 wallets with $400 each to bypass Sybil protections and secure a larger allocation.

Following the public sale, which came after a $700 million private round, Pump.fun’s total capital raise reached $1.2 billion. The team immediately began deploying funds, acquiring Kolscan, a Solana-native wallet analytics tool, and expanding their infrastructure for transparent contract visibility.

Solana’s Speed and the Spectacle of Speculation

The launch proved just how fast and frenzied crypto fundraising can be when retail energy and blockchain performance collide. On platforms like Hyperliquid, PUMP briefly traded at a 75 percent premium over its $0.004 launch price, peaking near $0.007 before stabilising around $0.006. Meanwhile, the platform generated an estimated $60 million in fees within 48 hours, with some of those funds earmarked for token buybacks in Solana to support price momentum.

Despite the celebration, not all participants had a smooth ride. Technical issues on major centralised exchanges such as KuCoin, Gate.io and Bybit left users locked out at critical moments. In response, Pump.fun issued reimbursements and emphasised its commitment to fast, permissionless distribution as the future of DeFi.

FOMO, Risk and Regulation

The Pump.fun launch illustrates the power of retail psychology in the crypto world. The allure of catching the next 100x coin has fuelled similar frenzies in the past with Dogecoin and Shiba Inu, but Pump.fun’s platform is designed to turbocharge this behaviour for a 2025 audience.

Its combination of livestreamed hype, negligible trading fees and rapid execution has created a retail casino, with decentralised finance as the stage. However, the risks are significant. According to Solidus Labs, only 97,000 out of over 7 million tokens launched on Pump.fun have retained even $1,000 in liquidity. Most are involved in pump-and-dump or rug-pull schemes.

The project is now facing mounting scrutiny. In the United States, a class-action lawsuit has been filed alleging that Pump.fun sold unregistered securities and profited from misleading retail investors. Meanwhile, the UK’s Financial Conduct Authority has labelled the platform unauthorised, prompting a ban for UK users.

A New Era of Token Launches or Another Bubble?

While traditional launchpads have slowed, Pump.fun is accelerating the token launch model by blending creator incentives, livestream mechanics and rapid trading. Its system includes features like revenue-sharing, returning 50 percent of PumpSwap fees to meme coin creators, in what some are calling a DeFi-meets-Twitch model.

Yet even as it sets new records, questions remain about its long-term viability. The $4 billion valuation is built largely on virality and trading volume rather than fundamental project utility. Critics argue the platform thrives on hype, lacks investor protections and may be fuelling another speculative bubble.

As the dust settles on Pump.fun’s dramatic launch, the broader crypto world is left pondering whether this is the future of token distribution or simply the latest FOMO-fuelled flash in the pan.

Leave a Reply