A new report by Swiss blockchain analytics firm Global Ledger paints a troubling picture for the crypto space in 2025. In the first half of the year alone, over $3.01 billion was stolen across 119 hacks, surpassing the total losses for all of 2024. But what’s more alarming than the numbers is the speed at which the money disappears.

According to the report, cybercriminals are now laundering stolen crypto within minutes, often before anyone even knows a hack has occurred. In nearly 23% of cases, laundering was fully completed before the breach was publicly disclosed. In most other instances, funds had already been moved through mixers, cross-chain bridges, or centralized exchanges (CEXs) by the time victims became aware of the theft.

One striking example involved hackers transferring funds just four seconds after an exploit, with laundering completed in under three minutes.

A Race Against Time & AML Systems

The findings show that 31.1% of all laundering is completed within 24 hours. Meanwhile, public disclosure of hacks typically lags behind, taking around 37 hours on average. This gives criminals a 20-hour head start, allowing them to move funds well before law enforcement or affected parties can react.

In 68.1% of incidents, funds were already in motion before any announcements appeared on social media, press releases, or alert systems. Once laundering is complete, it becomes extremely difficult to trace and recover the stolen assets. Unsurprisingly, only 4.2% of stolen funds were recovered in the first six months of 2025.

Centralised Exchanges Still Vulnerable

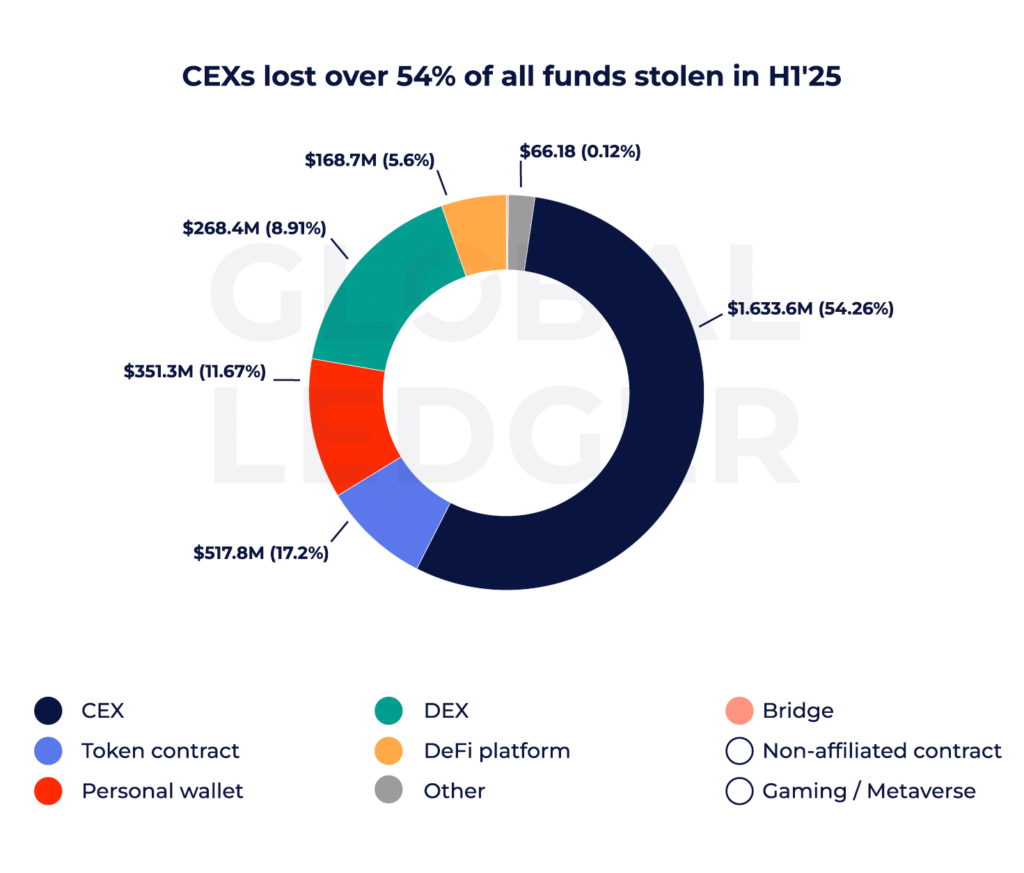

Despite growing awareness, centralised exchanges (CEXs) remain a prime target, accounting for 54.26% of all crypto-related losses this year. They also served as the channel for 15.1% of all laundered funds. According to the report, CEX compliance teams often have just 10 to 15 minutes to identify and freeze suspicious transactions before the assets vanish.

Traditional ticket-based systems used by many exchanges are no longer effective in this environment. The report stresses the need for automated, real-time transaction monitoring and response systems that can stop illicit activity as it happens, not hours or days later.

To address this, new regulations like the US Genius Act, signed into law on July 18 by President Donald Trump, are pushing exchanges and other Virtual Asset Service Providers (VASPs) to tighten their Anti-Money Laundering (AML) protocols and respond faster to suspicious activity.

Tornado Cash Case Puts Developers in Spotlight

The increasing pressure on crypto platforms is also evident in the ongoing trial of Tornado Cash developer Roman Storm. Storm is facing several charges, including conspiracy to commit money laundering, for allegedly allowing his privacy-focused protocol to be used for illicit transactions.

Prosecutors argue that Tornado Cash helped launder over $1 billion, including funds tied to North Korea’s Lazarus Group. They claim that Storm had the ability to implement safeguards but chose not to.

Storm’s defence hinges on the open-source nature of the code and the decentralized nature of the platform. Critics warn that if Storm is convicted, it could set a dangerous precedent that threatens software freedom and innovation, especially for privacy tools in the crypto space. He could face up to 45 years in prison if found guilty.

The crypto industry is facing a major test in 2025. While innovation continues, so do the risks. The gap between the speed of crime and the speed of response is growing wider. Centralised exchanges, regulators, and developers are now under mounting pressure to act, not just after the fact, but in real-time.

The message from this latest Global Ledger report is clear: crypto platforms must match the speed of criminals with equally fast detection and prevention systems. Anything less may leave billions more at risk in the months to come.

Leave a Reply