BlackRock’s ETHA Dominates as Total Assets Hit $20.66 Billion

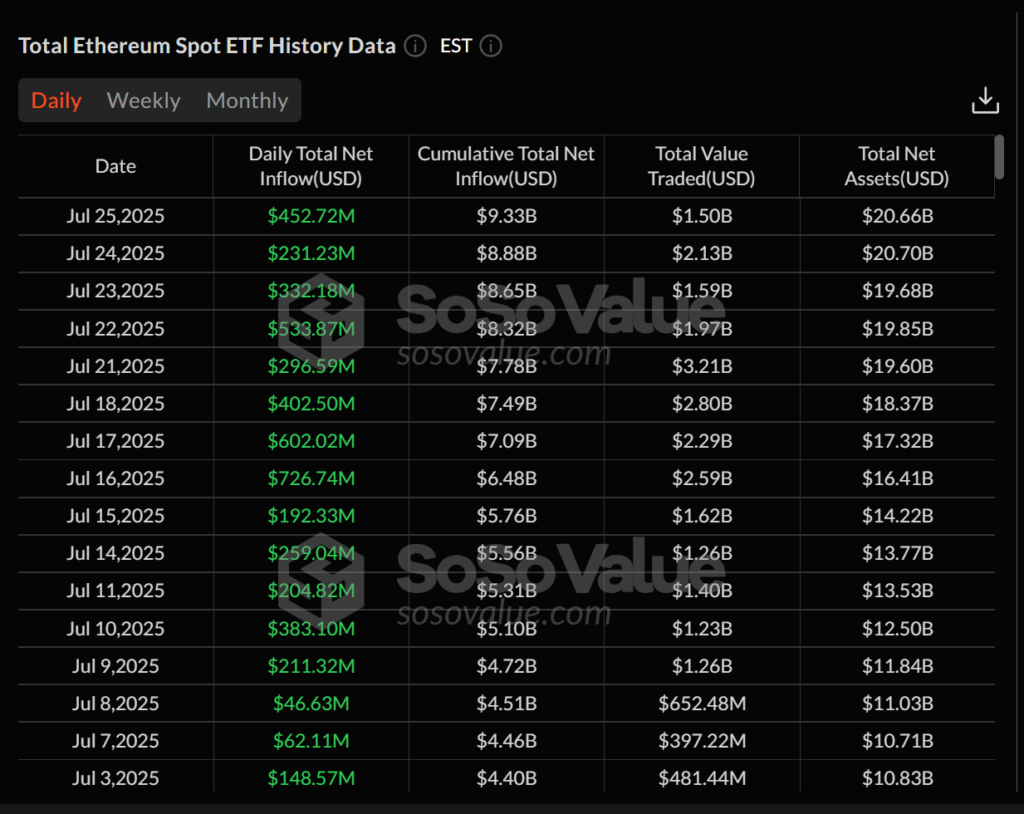

Spot Ethereum ETFs in the US recorded another strong trading day on Friday, drawing in $452.72 million in net inflows and stretching their consecutive daily inflow streak to 16 sessions. The growing interest in Ether-based exchange-traded products has pushed total net assets to $20.66 billion, accounting for approximately 4.64% of Ethereum’s market capitalisation.

BlackRock’s iShares Ethereum Trust (ETHA) once again led the charge, attracting $440.10 million in net inflows for the day. ETHA now holds $10.69 billion in assets, maintaining the largest share among all US-listed Ether ETFs. Bitwise’s ETHW followed distantly with $9.95 million, while Fidelity’s FETH brought in $7.30 million.

In contrast, Grayscale’s ETHE continued its trend of daily redemptions, shedding $23.49 million. The fund’s total net outflows have now reached $4.29 billion, the largest negative balance among Ether ETF offerings.

Inflow Momentum Since Early July

Since the streak began on 2 July, net inflows into US spot Ether ETFs have more than doubled from $4.25 billion to $9.33 billion. The inflow momentum has been consistent, with a peak of $726.74 million on 16 July and several sessions recording over $300 million.

The total value traded on Thursday stood at $1.5 billion, underscoring the growing appetite for Ethereum-related investments. This trend reflects increasing confidence in Ether’s long-term role in decentralised finance, staking, and smart contract infrastructure.

Institutional Interest Drives Demand

According to Matt Hougan, chief investment officer at Bitwise, the rise in inflows is being fuelled by growing interest in stablecoins and tokenisation. In a recent post on X, Hougan projected that combined demand from ETFs and institutions could reach $20 billion in Ether over the next year, equating to roughly 5.33 million ETH at current prices.

Given Ethereum’s estimated issuance of only 0.8 million ETH in the same period, this demand could outstrip supply by nearly seven times, potentially supporting continued price growth and institutional adoption.

Bitcoin ETFs See Modest Recovery

Meanwhile, spot Bitcoin ETFs in the US attracted $130.69 million in net inflows on Friday, marking a rebound after a turbulent start to the week. The funds had previously recorded net outflows of $131.35 million on 21 July, followed by further losses of $67.93 million and $85.96 million on 22 and 23 July.

Despite the volatility, July has been a positive month for Bitcoin ETFs overall, with standout sessions such as $1.18 billion in inflows on 10 July and $1.03 billion on 11 July. The cumulative total for Bitcoin ETF inflows now stands at $54.82 billion, while total net assets reached $151.45 billion.

Growing Confidence in Crypto ETFs

The performance of both Ether and Bitcoin ETFs highlights growing institutional confidence in crypto as a mainstream investment class. While Ether ETFs continue to build momentum with impressive inflow streaks, Bitcoin products also maintain significant investor interest, signalling a broader shift towards digital asset exposure in traditional portfolios.

Leave a Reply