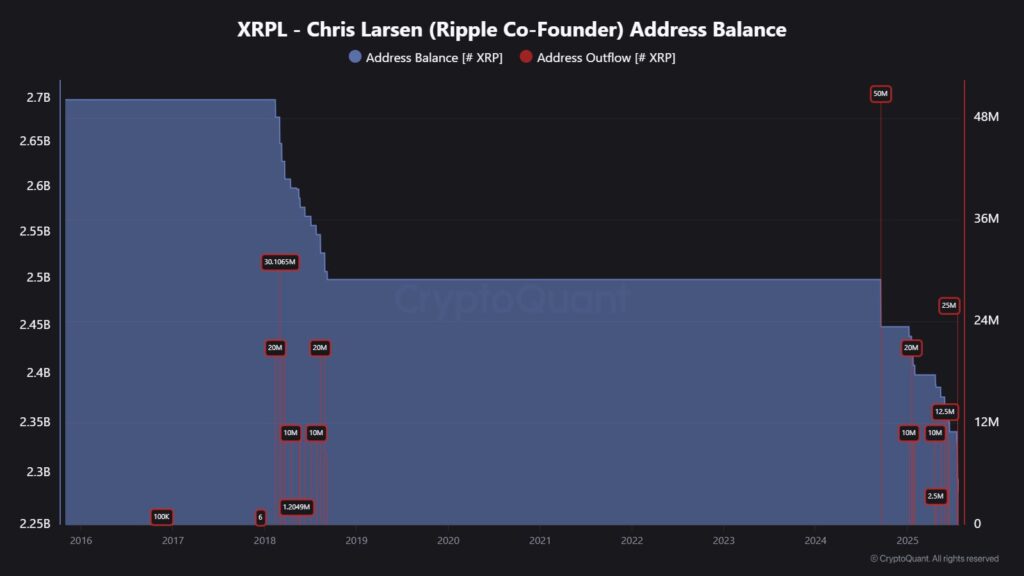

XRP investors are on high alert after Ripple co-founder Chris Larsen reportedly moved 50 million XRP tokens to exchanges, sparking fears that a much larger sell-off could follow. On-chain data tracked by CryptoQuant contributor J. A. Maartunn suggests that the recent transfer could be just the beginning, warning retail holders not to become “exit liquidity.”

The transactions came shortly after XRP touched near all-time highs of $3.60 on July 17. While some investors viewed the sale as profit-taking, others accused Larsen of timing the market peak to offload a small portion of a much larger stash.

Analyst: $200M Was ‘Just the Warm-Up’

Maartunn pointed out that Larsen’s known wallet still holds 2.58 billion XRP, currently valued at approximately $8.83 billion. In comparison, the recent 50 million XRP moved to exchanges accounts for less than 2% of the total holdings.

“If $200M was just the warm-up… what’s next?” Maartunn wrote on X, warning that XRP holders could face intensified selling pressure in the near future. He urged the community, “Don’t get dumped on. Don’t be the exit liquidity. Protect yourself.”

This sentiment was echoed by other analysts and traders, including popular figure ManLy, who also voiced concerns about the potential impact of a full-scale dump by such a high-profile wallet.

XRP Sees 13% Correction Amid Sell-Off Fears

Following the transfers, XRP has seen a sharp pullback, correcting 13% from its recent highs to trade around $3.18, according to Cointelegraph Markets Pro and TradingView data. The move has raised broader concerns about trust and transparency within the XRP ecosystem, especially when major stakeholders liquidate assets during periods of strength.

Despite leading the recent altcoin rally, XRP now faces uncertain short-term prospects as traders weigh the risk of further large-scale offloading. Historical patterns suggest that when whale wallets begin distributing large amounts of tokens, retail investors often bear the brunt of the losses.

BTC Unfazed by 80,000 BTC Whale Dump

Interestingly, the XRP situation unfolded just as Bitcoin absorbed its own whale-driven turbulence. A long-dormant wallet, reportedly from the Satoshi era moved 80,000 BTC, valued in the billions, for the first time in 14 years.

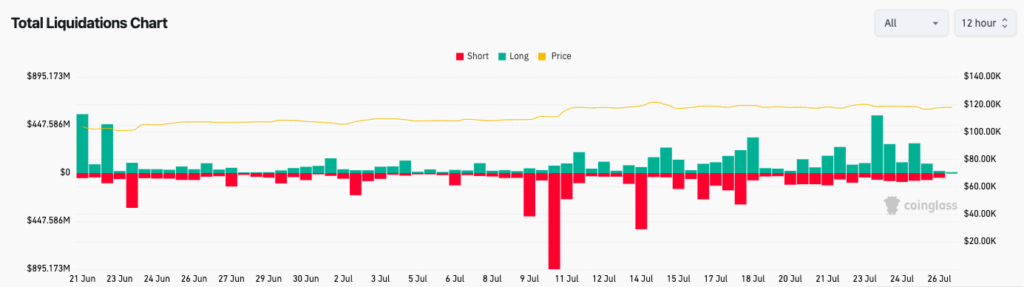

The transaction, facilitated by Galaxy Digital, led to a brief drop in BTC/USD to around $114,500, before the market rebounded swiftly. Still, the event triggered over $500 million in crypto liquidations within 24 hours, according to CoinGlass data.

Bitcoin’s resilience, compared to XRP’s pronounced dip, has further intensified debate among investors about the long-term reliability of XRP and the intentions of its co-founders.

Hold or Fold?

While there’s no confirmation that Larsen intends to sell his remaining $9 billion worth of XRP, the fear of further sell pressure has clearly shaken investor confidence. For now, XRP traders must navigate an environment shaped by whale moves, speculative fear, and volatile price action.

Analysts continue to monitor the wallet’s activity closely, as any further large-scale transfers could catalyse deeper corrections or even trigger panic selling. Until clarity emerges, caution may be the best strategy for XRP holders.

Leave a Reply