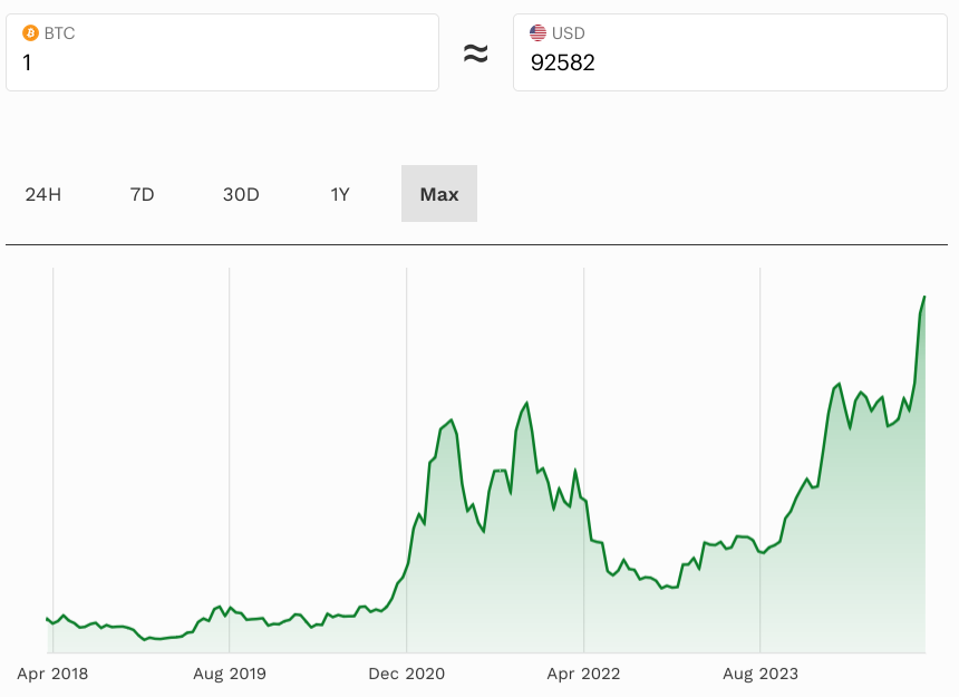

Bitcoin has faced a sharp correction, crashing to $90,000 from its recent high of nearly $100,000. This sudden drop has erased $200 billion from the crypto market’s total value, now standing at $3 trillion. Analysts are pointing to excessive leverage in the system and geopolitical uncertainties as key factors behind the downturn.

Wall Street Leak Sparks Fear

A leaked report has hinted at a significant Wall Street shift that could hit the crypto market in 2025. This has further shaken trader confidence, with concerns that Bitcoin might plunge as low as $80,000. Crypto billionaire Michael Novogratz, CEO of Galaxy Digital, acknowledged the high leverage in the market, warning of further corrections but maintaining optimism for a rebound.

“Inevitable Bounce Back,” Says Novogratz

Novogratz predicted Bitcoin could dip to $80,000 before stabilising but believes it won’t fall lower. He highlighted the pro-crypto stance of Donald Trump‘s new administration, describing it as a “paradigm shift” that could propel Bitcoin beyond the $100,000 mark in the long term. “We’re in price discovery with limited supply,” Novogratz remarked.

Traders Eye Key Support Levels

Market watchers are closely monitoring Bitcoin’s momentum around $91,800. FxPro analyst Alex Kuptsikevich noted that failing to hold this level could push Bitcoin down to $87,000, its next major support. He attributed the current pullback to profit-taking following Bitcoin’s rally earlier in November.

As the crypto market navigates this correction, traders remain cautious. While the long-term outlook appears promising, the short-term volatility underscores the risks of a highly leveraged system. Investors are advised to approach the market with careful risk management amid ongoing uncertainties.

Leave a Reply