Ethereum is fast becoming a cornerstone asset for public companies, DAOs, and blockchain-native projects. The Strategic Ethereum Reserve, an aggregated pool of ETH held by major institutional and long-term entities has crossed a massive $10.5 billion in value, marking a dramatic 50x growth in just four months.

This trend signals more than just bullish market sentiment. It reflects a deeper institutional shift toward Ethereum as a long-term strategic asset, driven by its programmability, staking potential, and growing trust in its decentralized ecosystem.

From $200 Million to $10.5 Billion: A Rapid Climb

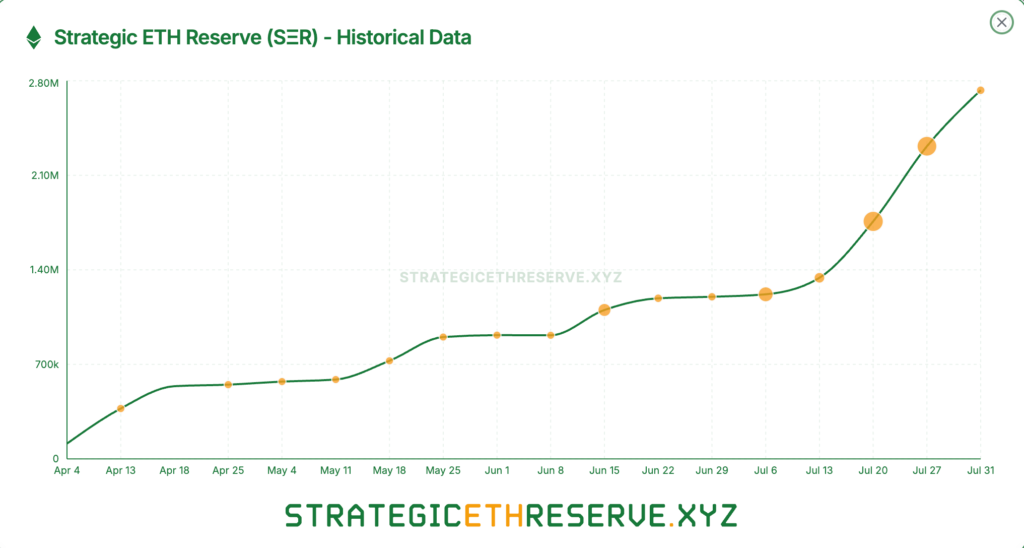

According to updated figures from the Strategic ETH Reserve website, the reserve held only $200 million in ETH at the start of April. By late June, it climbed to $3 billion. But the biggest leap came in July, adding over $7 billion in just one month to cross $10.5 billion.

This explosive growth stems from a wave of institutional Ethereum purchases. Public companies, treasury-backed initiatives, and blockchain-native organisations are now treating ETH as a serious long-term asset. Much like Bitcoin in 2020, Ethereum is gaining the status of a “digital reserve asset” for diversified portfolios.

Major Players Leading the ETH Accumulation

Some of the biggest contributors to this surge are companies like BitMine Immersion Technologies, SharpLink, and the newly formed Ether Machine.

- BitMine Immersion Technologies holds around 625,000 ETH, currently valued at approximately $2.35 billion. The company aims to eventually control 5% of all ETH in existence.

- SharpLink, another key player, has accumulated 438,200 ETH, worth roughly $1.69 billion. The firm has already recorded more than $400 million in unrealised profits from its ETH holdings.

- A newer but significant entry, The Ether Machine, recently acquired 15,000 ETH for $56.9 million. Following this purchase, its total holdings have climbed to 334,757 ETH, making it the third-largest corporate ETH holder.

These companies are not only holding ETH but also adopting staking strategies, aiming to earn passive income from Ethereum’s proof-of-stake consensus mechanism.

More Firms Eye ETH Exposure

The momentum doesn’t stop with current holders. Companies like BTCS Inc. have filed for regulatory approval to raise up to $2 billion for further ETH purchases. Their ambition is to deepen exposure and potentially join the ranks of top ETH corporate holders.

180 Life Sciences Corp. recently announced its plan to raise $425 million to establish a dedicated ETH treasury and rebrand itself as ETHZilla Corporation, showing that even non-crypto firms are now entering the Ethereum ecosystem with significant capital.

Blockchain-native organisations are joining in too. StarHeroes, a multiplayer game, has created an ETH reserve of 410 ETH. Their goal isn’t just financial, it’s also about strengthening their native token ($STAR) and building utility around the Ethereum network.

Why Ethereum is Attracting Institutions

According to Vugar Usi Zade, COO of Bitget, Ethereum offers something beyond Bitcoin: programmability, staking income, and deep integration into Web3. He suggests that institutions are now recognising these features as critical for long-term adoption and portfolio diversity.

Silvina Moschini, founder of Unicoin, supports this view. In an interview with BeInCrypto, she said Ethereum is now being treated much like sovereign bonds in terms of corporate asset allocation. She highlights Ethereum’s strong uptime, decentralised structure, and ability to ensure fair execution as essential elements for gaining institutional trust.

Standard Chartered’s Geoff Kendrick also recently predicted that corporate treasuries could eventually control up to 10% of all ETH, which would be a major leap from the current share held by public companies.

ETH as a New Standard Asset

This trend marks a major shift in how digital assets are being perceived. Ethereum is no longer just a platform for decentralised applications or DeFi protocols. It’s fast becoming a strategic treasury asset.

Institutions are not only buying ETH, they’re integrating it into long-term balance sheets, staking it for yield, and in some cases, using it to underpin ecosystem growth. As the trend continues, Ethereum could very well become a financial standard in both corporate finance and decentralised ecosystems.

With more companies entering the space and the reserve value climbing rapidly, Ethereum’s position as a strategic reserve asset is becoming clearer by the day.

Ethereum’s journey from developer-focused platform to institutional reserve asset has reached a major milestone. Surpassing $10 billion in holdings marks more than just price action, it shows trust, utility, and the beginning of a structural change in corporate crypto adoption.

Leave a Reply