Hedera Hashgraph’s native token, HBAR, has suffered a sharp downturn this week, shedding over 17% in value since Sunday. With bearish sentiment gripping the broader crypto market, HBAR has seen intensified selling pressure, sending ripples across its futures market.

In the past 24 hours alone, Hedera’s price has plunged 9%, falling to $0.24 at press time. While the token holds just above the critical $0.22 support level, signs of continued weakness raise concerns over a deeper decline. The current market environment remains fragile, and HBAR bulls are bearing the brunt of it.

Long Liquidations Dominate Futures Market

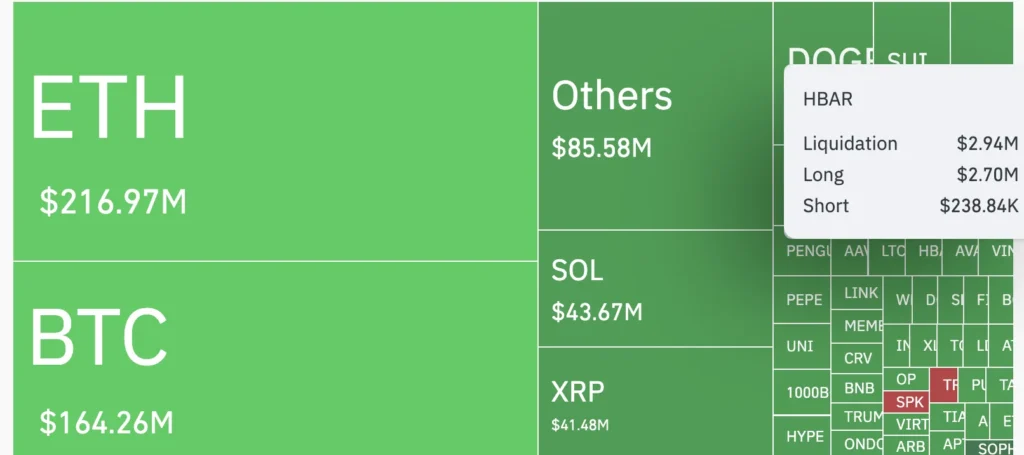

HBAR’s futures market has seen a wave of forced sell-offs, with long liquidations dominating the landscape. According to data from Coinglass, long positions accounted for $2.70 million of the $2.94 million in total Hedera futures liquidations over the past day.

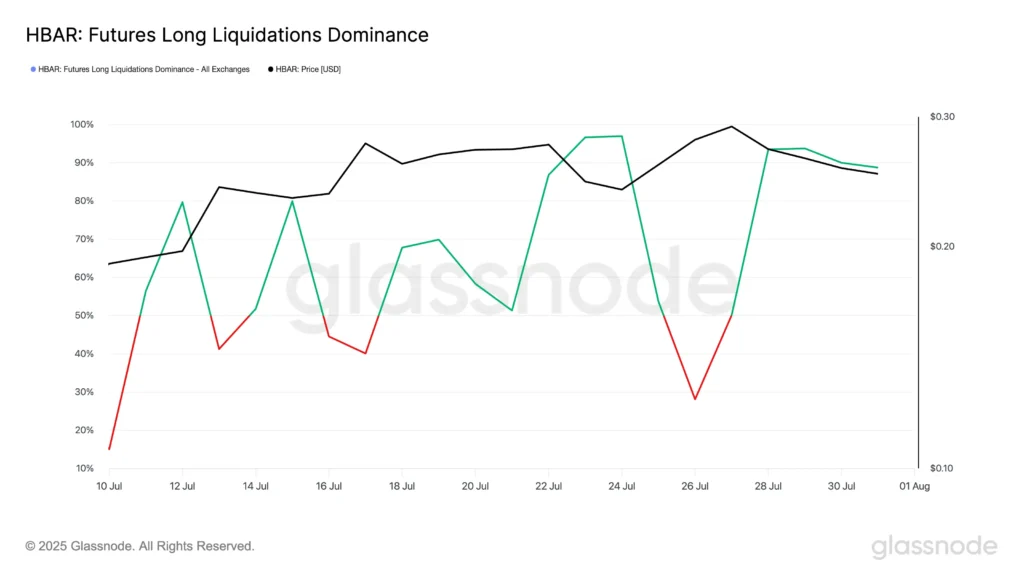

Supporting this, Glassnode’s Futures Long Liquidations Dominance metric soared past 88% on Thursday. This metric highlights the proportion of total futures liquidations originating from long positions and a reading this high underscores the intensity of bearish pressure. In simple terms, traders betting on HBAR’s price increase are being forcefully squeezed out.

Such aggressive liquidation activity typically results in further price pressure, as automatic sell-offs trigger a cascading effect. This scenario is playing out for Hedera, with bullish momentum evaporating and market confidence eroding swiftly.

Smart Money Pulls Back, Signalling Weak Confidence

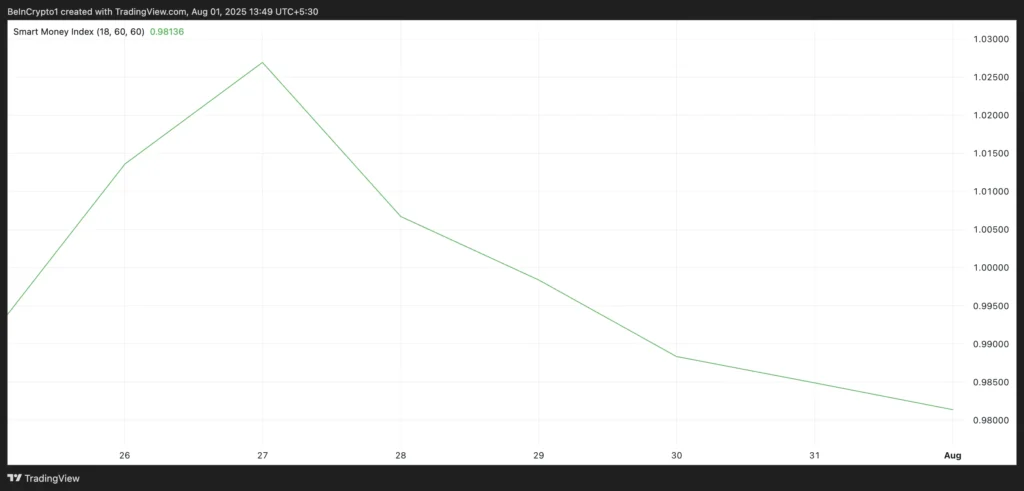

Adding to the negative sentiment is a sharp decline in smart money activity around HBAR. The Smart Money Index (SMI), which gauges the behaviour of institutional and experienced traders, has dropped to 0.98, a clear sign of reduced interest.

The SMI measures the difference between morning (retail-dominated) and afternoon (institutional-dominated) trading behaviour. A declining index points to selling pressure from more experienced traders who typically hold stronger insights into market timing.

This retreat by “smart holders” indicates a lack of short-term confidence in HBAR’s price stability. When institutional players step back, it often acts as a leading indicator for further caution in the market. The trend also highlights the growing disconnect between speculative retail trading and strategic institutional capital.

Crucial Support at $0.22 Under Threat

At $0.24, HBAR hovers dangerously close to its next major support level at $0.22. This floor has held up in recent trading sessions but remains vulnerable to a fresh wave of selling.

If the token breaks below this zone, technical analysis suggests a potential drop towards $0.18, a level not seen in weeks. Such a move would represent a significant retracement, potentially triggering more panic-driven exits in the process.

On the upside, any renewed accumulation or positive macro sentiment could lead to a relief rally. HBAR would then target the $0.26 resistance mark, a psychological barrier it has struggled to surpass amid persistent market turbulence.

Bearish Momentum in Control

With long liquidations mounting, smart money stepping back, and price action skimming key support, HBAR’s short-term outlook remains bearish. The current trading month has begun with heightened volatility, and unless buyer interest revives quickly, further downside appears likely.

For now, all eyes remain on the $0.22 level. Whether HBAR bounces or breaks from this critical support could shape its trajectory in the weeks ahead. Until then, caution is the prevailing sentiment among traders and institutions alike.

Leave a Reply