As artificial intelligence becomes increasingly embedded in crypto workflows, tools like Google Gemini are being used not just to summarise text but to support traders in navigating volatile markets. But can Gemini truly help in planning real crypto trades? We tested it with sample workflows using Render Token (RNDR) as a case study. Here’s what we discovered about its strengths, weaknesses and where it fits in a trader’s toolkit.

Gemini as a Real-Time Research Assistant

Gemini, particularly its Pro version, shines when it comes to narrative tracking and macro sentiment analysis. Thanks to its native access to Google Search, it can scan crypto news in real time, highlight key developments and surface relevant signals from the noise. For example, when prompted to scan news on RNDR, it flagged that the token was frequently mentioned alongside top AI and Web3 projects, gaining visibility through narrative association.

This makes Gemini a powerful tool for identifying catalysts and momentum themes. It summarises sentiment spillover from related tokens and highlights how media coverage, even from previous months, can still drive interest due to broader thematic alignment. However, it does not predict price movements or provide short-term trading signals.

No Real-Time Data or Charting Support

Despite its strengths in context gathering, Gemini lacks native support for charts, price feeds or execution platforms. When asked to simulate a trade setup for RNDR using technical indicators like the 200-day moving average, RSI and MACD, it generated a logical plan. But crucially, the indicators were assumed rather than verified through live data.

Without access to actual charts or real-time market conditions, Gemini’s trade plans remain illustrative. Traders must cross-check such outputs with platforms like TradingView or CoinMarketCap before taking action. It cannot monitor volatility or adapt to fast market shifts, limiting its use to pre-trade planning and learning exercises.

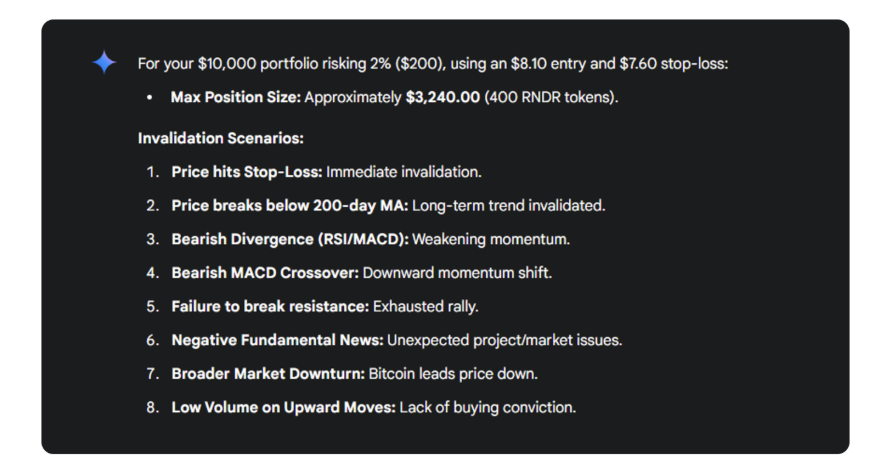

Helps Frame Risk But Needs Human Oversight

In risk management, Gemini can assist with basic calculations. For a simulated $10,000 portfolio, it estimated position size and highlighted conditions that might invalidate the trade, such as macro disruptions or bearish sentiment changes. While helpful in framing logic, the tool does not replace human judgment, especially when it comes to assessing conviction levels or adapting to market shifts.

Traders should use Gemini’s logic as a starting point, not a final decision. Its outputs are built on standard heuristics and may overlook unique token dynamics or technical divergences.

Where Gemini Fails and How to Use It Wisely

Like any AI, Gemini is not immune to errors. It may miss crucial wallet movements, fail to spot short-term catalysts, or misinterpret vague signals. Five common pitfalls include overreliance on outdated news, shallow analysis of complex events, missed onchain triggers, and an inability to adapt to volatility or new listings.

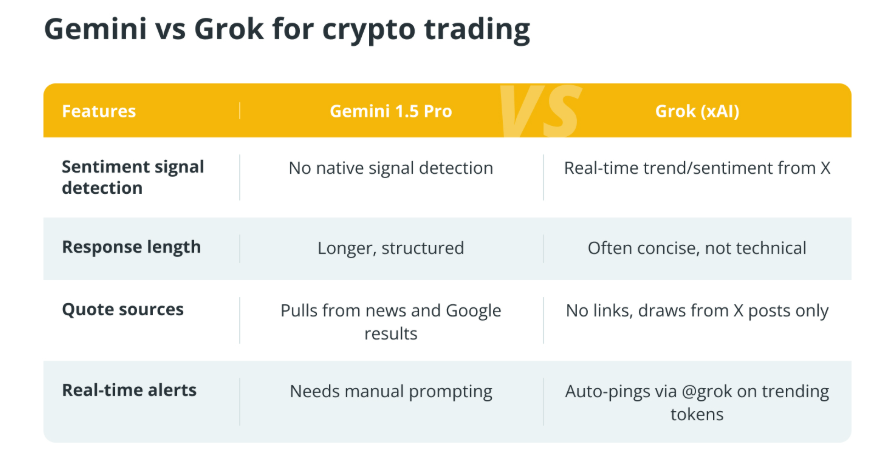

To get the best out of Gemini, traders should treat it as part of a larger toolkit. Combine it with Grok for social sentiment tracking and ChatGPT for coding strategies and trade structuring. Always verify Gemini’s suggestions with external data sources and never act solely based on its outputs.

How Gemini Compares with Other AI Tools

Gemini fits a specific niche in the crypto trader’s toolkit. It excels at surfacing news-driven signals and validating broader narratives. In contrast, ChatGPT is better suited for generating trading strategies, simulations or code-based backtests, while Grok can detect real-time token chatter and community sentiment.

For optimal use, a workflow might involve Grok identifying token hype, Gemini confirming the news context, and ChatGPT generating the actual trade setup. This layered approach balances speed, accuracy and execution logic.

Final Thoughts

Google Gemini is a useful research companion for crypto traders, especially when it comes to identifying trends, analysing sentiment and testing ideas. However, it is not built for live trading, price analysis or execution. Used responsibly, it can help structure trades, simulate risk and cut through the noise. But in a market where seconds matter, the final decision should always rest with a human using verified tools.

Leave a Reply