The U.S. Securities and Exchange Commission (SEC) has quietly set the stage for a major shake-up in the Bitcoin ETF market. By increasing the limit on options contracts for Bitcoin ETFs tenfold, the SEC has opened the door to much larger institutional strategies and BlackRock’s iShares Bitcoin Trust ETF (IBIT) stands to benefit the most.

This decision could solidify IBIT’s already dominant position, leaving rivals like Fidelity’s Wise Origin Bitcoin Fund (FBTC) struggling to keep up. The move also signals growing confidence in the crypto ETF market, with structural changes that may encourage new capital from risk-aware investors.

SEC Increases Options Contract Limit 10-Fold

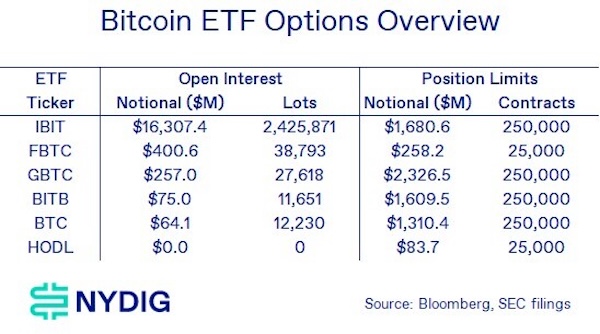

The SEC on Tuesday approved a significant change: raising the number of allowed options contracts for all ETFs with options from 25,000 to 250,000. This includes IBIT, but notably excludes Fidelity’s FBTC, at least for now.

This change allows for much more aggressive options trading strategies particularly ones like covered call selling, which involve holding the asset (Bitcoin, in this case) while selling the right to buy it at a future date. These types of strategies are designed to smooth out risk, reduce volatility, and generate income.

Greg Cipolaro, Global Head of Research at NYDIG, said that the regulatory shift “widens the monstrous lead” BlackRock already enjoys. With $85.5 billion in assets under management (AUM), IBIT’s AUM is four times that of FBTC, which stands at $21.35 billion.

BlackRock’s Strategic Advantage

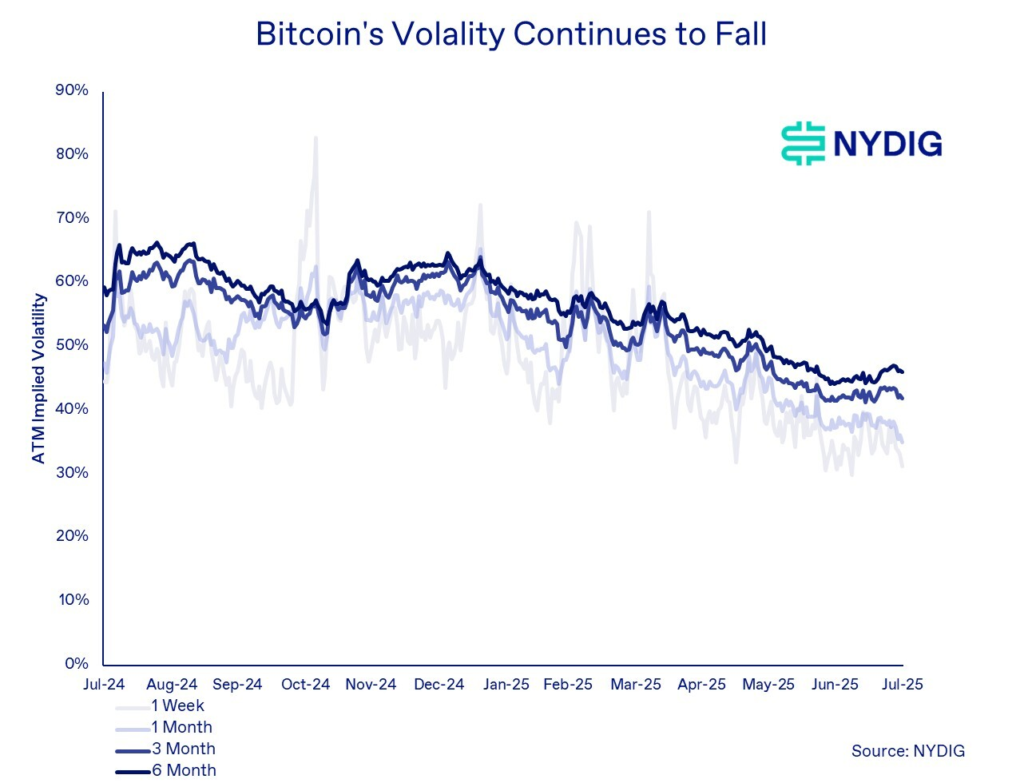

With the increased options limit, IBIT becomes even more attractive to large investors looking for sophisticated hedging strategies. Cipolaro argues that less volatility in Bitcoin prices, caused by such strategies, will make Bitcoin more attractive to institutional investors looking to diversify portfolios in a risk-balanced way.

This could create a positive feedback loop: falling volatility attracts more investors, who in turn create more demand for the spot Bitcoin market, potentially driving up the price further.

As a result, BlackRock’s IBIT is likely to extend its lead, both in terms of AUM and trading volume, reinforcing its status as the go-to ETF for Bitcoin exposure.

Structural Shifts: In-Kind Redemptions Approved

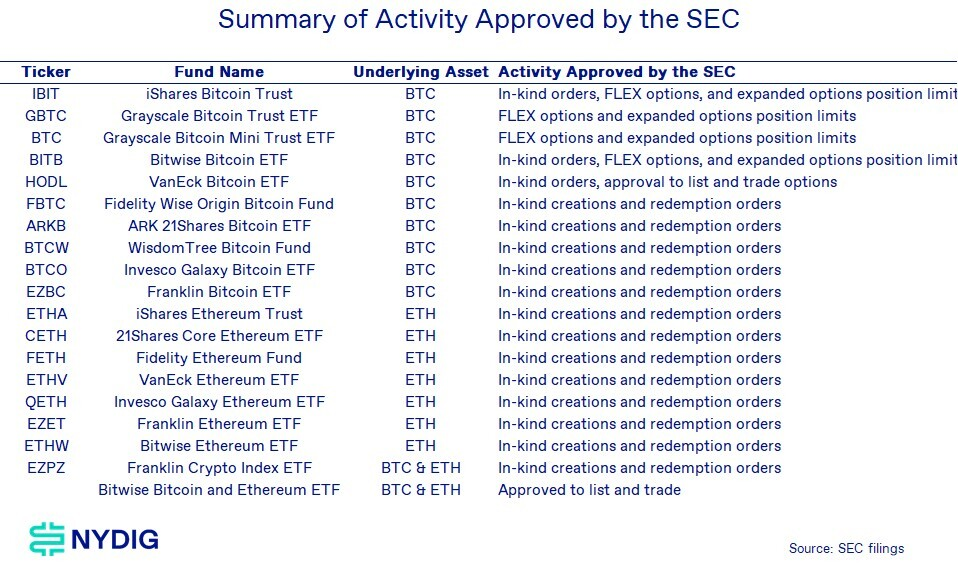

In a related move, the SEC also approved in-kind creation and redemption for crypto ETFs, a feature many issuers had been pushing for since before approval.

This change allows ETF shares to be exchanged directly for the underlying cryptocurrency, instead of cash. In practice, this reduces friction, improves efficiency, and potentially lowers costs for large investors.

Cipolaro emphasised that this change could reshape the ETF market structure, but it will primarily benefit those with established crypto capabilities. Currently, only two authorised participants (APs), Jane Street and Virtu have the ability to trade both the ETF shares and the underlying crypto assets.

Broker-dealers without such capabilities may now need to either partner with or acquire crypto firms to remain competitive. Otherwise, they may struggle to participate in arbitrage opportunities, which help keep ETF prices closely aligned with the underlying asset.

Implications for the Broader Crypto Market

The SEC’s latest moves could have far-reaching implications beyond just IBIT or FBTC. By enabling more options-based strategies and improving ETF mechanics, regulators are making Bitcoin more accessible and manageable for institutions.

In turn, this could attract new waves of capital from investors who had previously avoided Bitcoin due to its extreme price swings. If Bitcoin becomes a more stable and tradable asset, thanks to sophisticated ETFs like IBIT, it may start to look less like a speculative gamble and more like a legitimate component of a modern investment portfolio.

BlackRock, already a financial giant, is now in a position to become the undisputed leader in the crypto ETF space. With regulatory support and first-mover advantage, IBIT may set the standard for how institutional investors engage with digital assets moving forward.

The SEC’s decision to raise options limits and allow in-kind redemptions marks a turning point for Bitcoin ETFs. BlackRock’s IBIT is poised to capitalise on these changes, reinforcing its dominance and attracting more institutional capital. As competitors scramble to adapt, the crypto investment landscape is being reshaped and BlackRock is leading the charge.

Leave a Reply